Recession watch: Why the next one will be different

Almost all economists and contractors expect some sort of an economic slowdown this year.

Some have even baked a recession into their current forecasts. But the unanswered question on many observers' minds remains how this downturn will be different.

“Our early signs, like most contractors, is that a slowdown of some sort is coming as our projects are pushing to later time frames,” said George Pfeffer, member of the management committee team at DPR, a Redwood, California-based commercial general contractor. “We’ve been through several of these cycles and what we can say is there’s always something different.”

Pfeffer points to workforce shortages and volatility in commodities markets. Material costs’ trajectories play an important role in procurement strategies, he said.

For example, electrical manufacturers and distributors told DPR there is currently a $1.5 billion order backlog of switchgear, components required to provide electrical power and distribution on a projects. As a result, DPR expects shortages in metal sockets and bus plugs due to this high demand, said Pfeffer.

“In terms of new work opportunities, we expect a more challenging market,” said Pfeffer. “There is a lot in the mix, and we expect that to be sorted out in 2023, which may mean fewer customers moving forward on projects until there is more certainty.”

Past as prologue

Looking at data from past downturns can help put the current environment in context.

Nonresidential construction employment growth averaged 3.3% in the months leading up to the Great Recession, according to the Associated General Contractors of America. This time around, that number was about 6.3% in the last seven months of 2022.

“Nonresidential construction has been growing more strongly in the second half of 2022 than in the second half of 2007,” said Ken Simonson, AGC chief economist. “At that time, both single and multifamily residential construction were tumbling, which probably pulled down demand for related retail, street, school and public safety construction, and demand for other types of nonresidential construction was slowing.”

The national unemployment rate sits much healthier now too than in the months leading up to the Great Recession. It hovered at around 4.6% in the summer of 2007, whereas it was around just 3.5% last month, according to the Bureau of Labor Statistics.

The construction backlog in November also reached its highest level since the second quarter of 2019, according to Associated Builders and Contractors, indicating new projects are still coming online now.

“It’s hard to imagine a significant spike in unemployment that we saw during the Great Recession,” said Jeff Hansen, CEO of Adolfson & Peterson Construction, a Minneapolis-based general contractor. “We have a shortage today and jobs are still being created. I don’t see a significant correction taking place.”

Given those differences, a recession in 2023 will have its own unique markers this time around compared to past economic downturns, said John Fish, CEO of Suffolk, a Boston-based construction contracting company.

“Despite rising interest rates and high inflation, the fundamentals of our economy are still strong,” said Fish. “We have seen upward trends in our GDP, consumer confidence is still high, Americans still have money to spend, and we have seen strong jobs reports with low unemployment rates.”

Interest rates take a toll

At the same time, interest rate hikes remain a concern for the construction industry, said Fish. The Federal Reserve boosted its benchmark rate in December to a range of 4.25% to 4.5%, up from 0% to 0.25% at the beginning of 2022. Meanwhile, two Federal Reserve officials recently said this month additional hikes could push rates above 5%, reports Bloomberg.

“I often describe our economy as a sick patient and the Fed’s interest rate hikes as medication for that patient," said Fish. “Based on the impact interest rates are having on the housing market, real estate development and consumer demand, we are seeing signs the medication is working. But we must be careful we do not overprescribe.”

Raising interest rates too much means fewer construction starts, said Barry Wurzel, president of Wurzel Builders, an Austin, Texas-based general contractor.

“Interest rates will likely continue to go up and there may be some thunderstorms in the near future over the next six months or more,” said Wurzel. “Inflation affects everyone in the chain.”

The amount of debt in the commercial real estate industry that will be maturing over the next two years, given the increase in rates, remains a top concern as well, said Hansen.

“The real impact is going to be the erosion on the returns for the investors,” said Hansen.“The likelihood of real estate seeing a significantly lower return than current interest rates will create negative leverage and affect the appetite for investors to hold.”

On a similar note, the availability of new debt in the capital markets also will be a top issue for commercial development, said Turner Burton, president at Hoar Construction, a Birmingham, Alabama-based construction company.

That makes financing commercial real estate projects more challenging, said Anirban Basu, ABC chief economist.

Plan for more supply chain shortages, prices hikes

Analysts expect continued material price escalation over the next couple of years, said Michael Hardman, vice president of Turner & Townsend, a U.K.-based global real estate and infrastructure consultancy. Nonresidential input prices remain 11.5% higher than a year ago, and are up 40% from February 2020, according to an ABC analysis.

“What we’re seeing today is the continued impact of the last couple years of inflation and it’s starting to catch up on the marketplace,” said Derek Cunz, executive vice president at Mortenson, a Minneapolis-based construction company. “The last couple of years have seen significant cost increase, that’s starting to make it tougher to get some deals done.”

Inflation rates in 2007 averaged around 2.8%, according to the Bureau of Labor Statistics. In 2022, inflation rates averaged 8%, though the rate has been falling in recent months.

That also leads to higher price tags and uncertainty around accurate budgets, said Burton. For example, Madison Square Garden Entertainment increased the price tag for the MSG Sphere project in Las Vegas to close to $2.18 billion, up from its prior estimate of $2 billion.

At the same time, nonresidential construction input prices slightly ticked down in November compared to the previous month, according to the ABC analysis.

That’s a good sign for supply chain recovery, said Bert Brandt, managing director of construction for the Americas division at Australian contractor and developer Lendlease. Still, the supply chain market shows signs of going into different directions for different materials, said Richard Kennedy, president and CEO of Skanska USA.

“We have seen a combination of some improvement in the supply chain with architectural and structural product lines improving, while critical mechanical and electrical equipment lead times remain at unprecedented levels,” said Kennedy. “Pricing levels across the board remain escalated with many leading construction indices reporting flattening in the fourth quarter, which would be welcome relief to the industry.”

Lessons learned from past recessions

The key to staying ahead of slowdown in 2023 is diversification, contractors said.

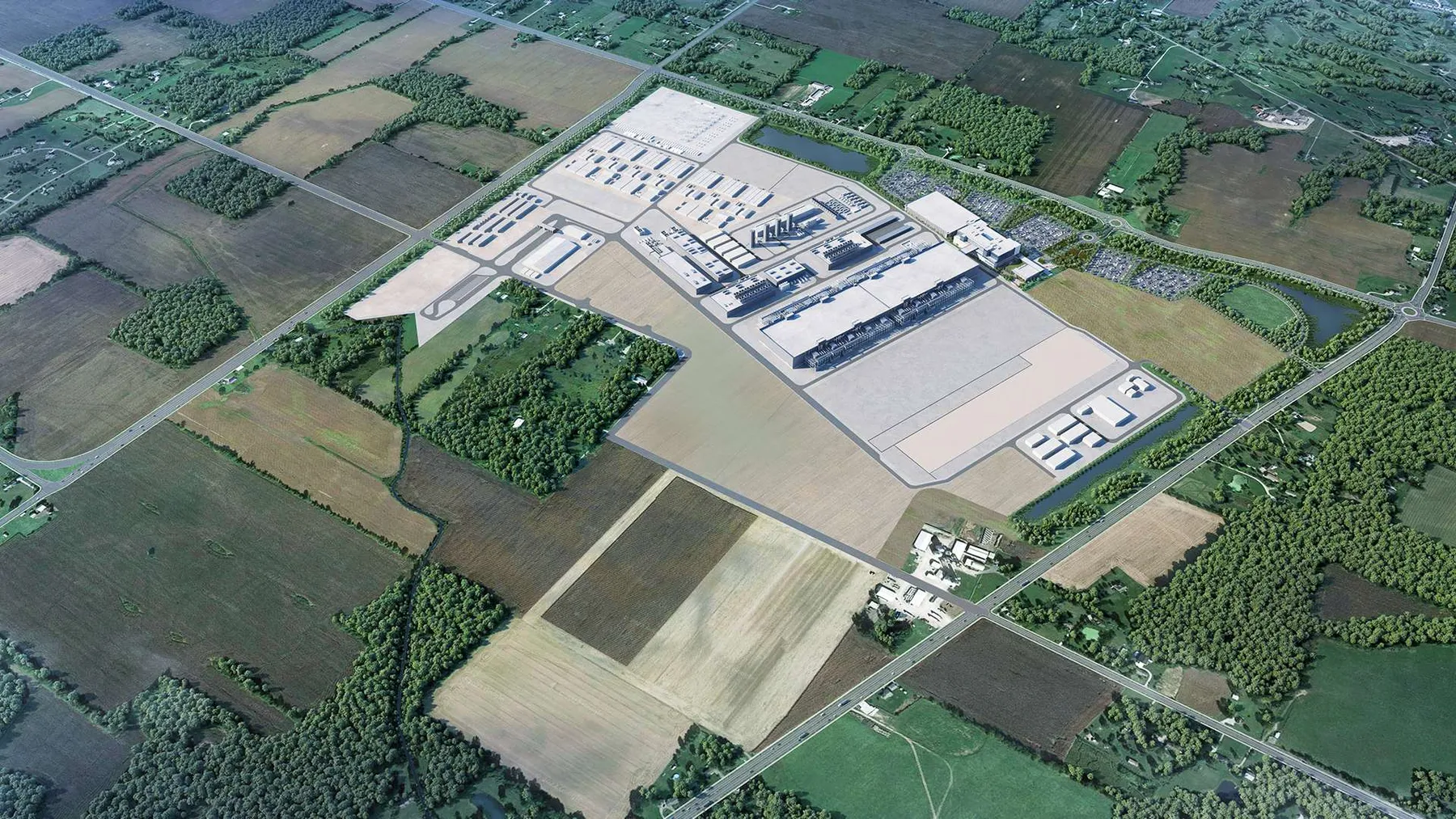

Though some commercial sectors, such as retail and hospitality, will feel the impact of recession more quickly, that still leaves plenty of resources for more institutional projects to help keep things in balance, said Burton. Pfeffer agrees, and named the healthcare, life sciences and manufacturing sectors as potential safe havens.

“We need to pursue work that allows us the best opportunity to overcome shortages in skilled workforce as well as the volatility in commodities markets that affect procurement,” said Pfeffer. “We’re looking at the things that have helped us weather previous storms.”

Other sectors slated to do well in 2023 include life sciences, data centers and manufacturing projects, said Fish. Brandt agrees the life sciences sector should remain resilient against an economic slowdown over the next 12 months. Kennedy also added infrastructure projects tend to be executed in an economic slowdown.

“Recessions are a great reminder to remain committed to your business strategy and focus on securing work that is core to your geographies and markets,” said Kennedy. “Otherwise, you may find yourself taking on projects that are not financially right for the business or do not match your organization’s risk profile.”