Dive Brief:

-

A bankrupt Texas toll road, built and operated under a public-private partnership, has new management and new financing after going through Chapter 11 bankruptcy reorganization, according to Engineering News-Record.

-

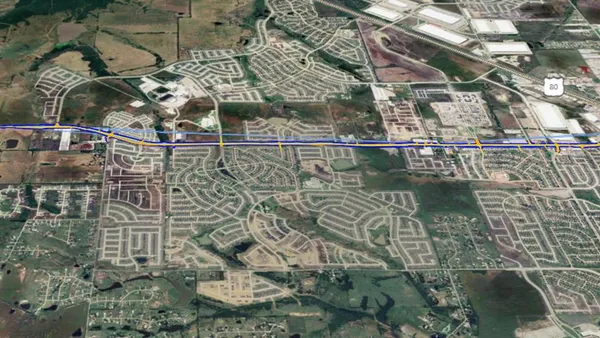

SH 130 Concession Co. operated and maintained a 41-mile stretch of Texas State Highway 130, but it experienced irreparable financial losses when tolls failed to meet original, pre-recession projections.

-

Strategic Value Partners and Louis Berger Services will take over management of the concession and the toll road from Cintra and Zachary American Infrastructure. SH 130 has secured a $260 million loan to help the company exit the bankruptcy process. There has been no increase in tolls as a result of the process.

Dive Insight:

More public entities are becoming comfortable with P3s. The project structure allows them to hand over the chores of financing, design, construction and operations to the private sector, and to leverage limited government funds across more capital programs. P3s are central to President Donald Trump's plans to transform $200 billion of federal investment into a $1 trillion infrastructure initiative.

As part of the enthusiasm for P3s and the benefits they provide, however, their potential for failure may be overlooked.

Indiana, for example, is a big proponent of P3s, and has had considerable success using the structure on public projects. But in June, the Indiana Finance Authority announced that it was taking over an Interstate 69 highway P3 project after I-69 Development Partners allegedly fell behind schedule and was late in paying subcontractors. The IFA also said there was $236 million in work on the highway yet to be performed but only $72 million in funding left.

Keith Poliakoff, partner in the Fort Lauderdale, FL, office of Arnstein & Lehr, told Construction Dive last month that public entities sometimes choose a P3 partner without fully vetting them or go with the bidder with the rock-bottom price — both of which would be mistakes, he said. The lowest bidder is not always able to perform sufficiently at that number. And many state laws force public agencies to automatically choose the bidder with the lowest estimate.

The potential for P3s to fall off track is one reason public entities typically favor industry giants when selecting winning bids, Poliakoff said. That could prevent smaller companies from participating and, ultimately, limit broader uptake of the P3 method.