The construction industry had a challenging but positive year in 2021, and the growth of construction technology has been one of the bright spots. With the pandemic forcing faster adoption of technological tools, experts and investors are recognizing the sector's increasing importance. The federal government is also providing an assist, with $100 million designated for contech in the recently signed infrastructure act.

"[Construction technology] is not a 'want' anymore. It's a 'need,'" said Matt Abeles, vice president of construction technology and innovation at Associated Builders and Contractors.

So what can contractors expect in the construction technology space in the coming year? Here are five trends that construction pros should be keeping an eye on in 2022.

A focus on good data

The experts who spoke to Construction Dive all agreed — gathering data is one thing, but the way contractors actually utilize and share it across their companies is what will affect their success.

"I've always said data is only as good as the action you can take with it," Meirav Oren, the co-founder and CEO of construction technology firm Versatile, told Construction Dive. "Anything that has to do with machine learning or AI starts with the ability to have data that allows you to teach the machine."

A big part of the problem is "bad" data, or information that is in some way inaccurate or misleading. According to an Autodesk report from the fall, bad data cost contractors globally $1.8 trillion in losses in 2020. The study also revealed that bad data was responsible for 14% of avoidable rework, which amounts to $88 billion in costs.

"I'll say, at this point, insurers should start paying attention to and rethink the risk models, as well as how they assess and reward GCs that employ technologies the right way," Oren said.

Dan McCarthy, the CEO of Dodge Construction Network, is also a big advocate for employing data on the jobsite. McCarthy said that construction projects are like mini supply chains that need to get materials from one place to another — and heavily rely on accurate data to do so.

"Increasingly, what you need is data, the valuable data to be able to move around the supply chain in such a way that helps benefit all the participants, helps them make more money and helps reduce the risk in any project," McCarthy said.

Digital visualization

At the top of Oren's list of future trends is the ability for contractors to visualize their projects and data, and use that information to get ahead and improve their work.

"The ability to see in a very visual industry probably comes first," Oren said.

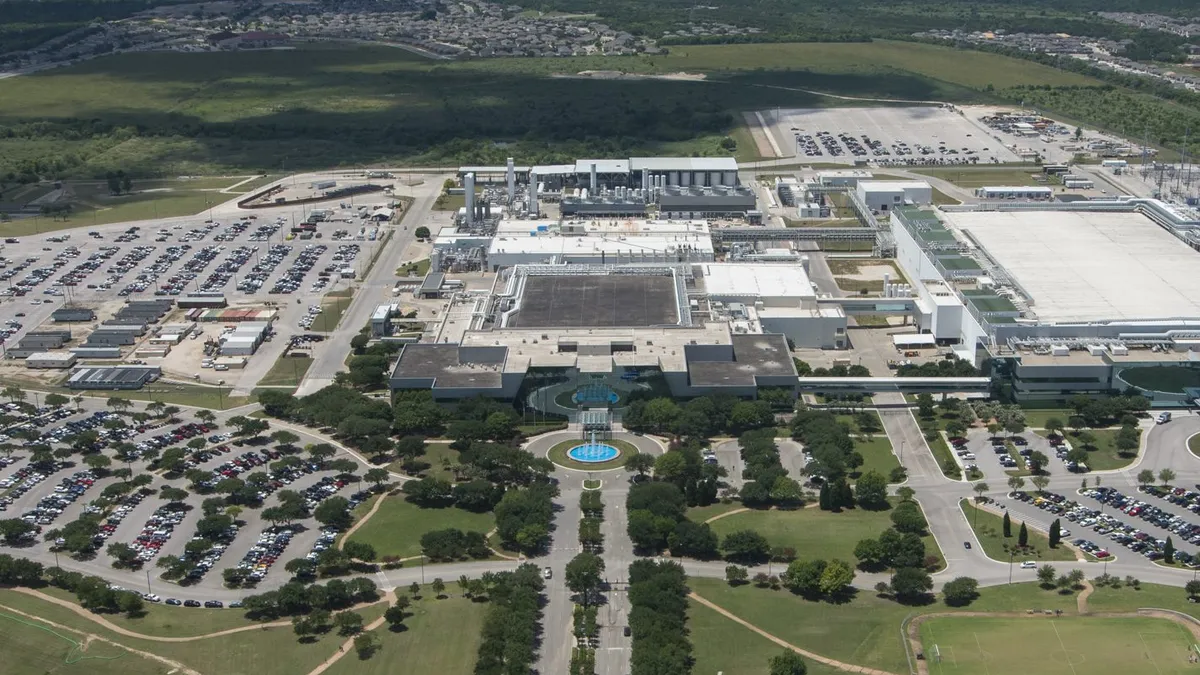

Contractors are speeding along work with technology like Building Information Modeling (BIM) and robots that allow them to get visual data without spending extensive amounts of time collecting it. For example, general contractor Hensel Phelps used time-saving and precise drones to help construct the Kalahari Resort in Round Rock, Texas.

"As you're covering a really massive area, like 350 acres, that would take an enormous amount of time, if you were trying to cover the whole thing in that type of grid," said John Frost, the vice president of business development at Propeller, a construction technology firm that worked on the Kalahari Resort project. "But with a drone, you can, in an hour, achieve a much greater level of coverage, because you don't get a point every 25 feet, you get points every centimeter or two or every couple inches."

Oren believes that better visualizations and robotics won't take jobs from workers, but will instead enable them to do their work better.

"I'm a huge fan of industrial robotics on the layout side, when it comes to getting those smart people off their hands and knees and utilizing those incredible skills in other domains, while the robot does what they should no longer be doing, and these people scale up," Oren said.

Big bucks in contech

Notably, this past year has seen rapid technological advancements on jobsites, in part due to necessity. Contractors were faced with various COVID-19 challenges that accelerated their adoption of new tech.

"I think one of the silver linings of the pandemic is, it did push people to use technology out of necessity a little bit quicker," Abeles said.

This focus is reflected in the growing wave of contech firms that have recently had successful investor rounds.

"Our take on what happened was that basically two or three years' worth of construction tech adoption got squeezed into the nine months post-pandemic because everyone was shifting to being offsite, socially distancing and virtual tools," Henry D'Esposito, construction research lead at JLL, a global commercial real estate services company, told Construction Dive. "So, there was a huge demand for adoption. If you see rising adoption numbers, new customers, more profitability, then that gives investors a good reason to want to invest in a sector."

A report by Cemex Ventures, the corporate venture capital arm of Mexico-based construction materials company Cemex, revealed that a significant subset of winners in the space and on its top 50 list of contech startups were focused on streamlining work and enhancing productivity.

"Four or five years ago, contractors were not investing, they were testing concepts. Today, you can see contractors are really investing in venture capital as well. And that, as a result, has been a huge increase in the amount of money flowing into this," Gonzalo Galindo, the president of Cemex Ventures, told Construction Dive.

3D printing

A handful of commercial construction companies are exploring 3D printing as an alternative to traditional building components, particularly in areas where using traditional materials can lead to logistical problems.

A Skanska JV, for example, is planning to use 3D-printed concrete blocks, fabricated on site, to help with the construction of the HS1 rail project in the U.K. The machine that prints the blocks is also capable of going into tight spaces that would otherwise be hard to access. The technology, called "Printfrastructure," has proof-of-concept trials coming up this spring.

In addition, construction technology firm Icon is partnering with the U.S. government to see if 3D printing has applications for lunar construction, and the company's proprietary Vulcan technology created a 3,800-square-foot military barrack, fresh on the heels of a strong $200 million Series B funding round this past August.

With this focus has come additional funding. This past September, the University of Idaho announced that it received a $4 million award from the National Science Foundation's EPSCoR Research Infrastructure Improvement Program to study recycled materials that can be used in 3D printing. It seeks to reuse refuse from construction — in particular wood — to create a material to 3D print modular floor, wall and roof panels.

It will be important for contractors to keep an eye on this technology, as the potential applications for 3D printed construction are vast.

Green techniques

Environmental issues are a concern for all businesses, and as contractors try to figure out how to generate less waste on site and in the supply chain, there's incentive to do so from not only a virtuous perspective, but also a financial one.

"In environmental issues, valuations are different and companies in carbon capture, for example, get valued very high, very quickly," Galindo said of startups which focused on environmental methods.

On Cemex's list of the top 50 construction technology startups, 14 of the featured companies focused on environmental areas.

"Environmental pressure will continue and will start increasing, especially on the building materials production side," said Galindo. "We will see much more efforts trying to reduce the carbon footprint and testing new technologies from carbon capture and research."

More established construction companies are also focusing on waste reduction goals. Earlier this past fall, contractor Webcor diverted 90% of a California office project's waste from landfills and incinerators for a year in order to meet TRUE certification requirements.

Alternative construction methods and materials, such as 3D printing and cross-laminated timber (CLT), can also enable cleaner building. Recently, Shawmut built a 75-foot-tall tower using CLT wood technology, which generates almost zero waste on site.

"You're not talking about shipping something from around the world. It's done through sustainable forests," Greg Skalaski, the executive vice president of the West for Shawmut, told Construction Dive about the material's lighter carbon footprint.

As the effects of climate change grow in intensity and priority, contractors have a growing range of technological tools to help them not only adapt, but also address the root causes of the issue and build greener from the get-go. For contractors, the message is catch up, or get left behind.

"The future has already begun. We don't have 18 months to pilot," Oren said.