David D’Hondt has seen for himself the ups and down of Seattle’s construction market.

The executive vice president of Associated General Contractors of Washington and a 30-year veteran of the industry, D’Hondt said that construction activity there currently is following the flow of public money. Where private development was once king, infrastructure is now on the rise.

“We've had just a long period of growth in the Puget Sound region. That's sustained construction really well,” D’Hondt told Construction Dive.

The Emerald City, located in Washington’s King County, is an interesting area for construction. The metro’s stringent focus on sustainability sets it apart from others, according to a report from Cumming Group.

For instance, in 2021, the city banned natural gas in new buildings, KUOW reported. It also plans to be carbon neutral in 30 years and incentivizes green building with services that include faster permit review for sustainable projects, additional development capacity for milestone-meeting projects and a committee that reviews new energy-efficient proposals not currently covered in the building code.

This has led to high-profile green projects like Climate Pledge Arena, the home of the NHL’s Seattle Kraken, which it claims is the first functional zero-carbon sports arena ever built through the International Living Future Institute’s Zero Carbon Certification. This means that more than 90% of waste generated on site is diverted from a landfill.

Future development

Of course, Seattle is also known for the tech firms that have set up shop there — Microsoft and Amazon, for example, have their headquarters in the metro area. Those companies started a boom decades ago, said Bryan Maggio, the director of business development in Minneapolis-based Mortenson’s Seattle office.

And like in many areas of the country, the infrastructure and manufacturing sectors are hot. According to Cumming Group construction volume for these sectors is predicted to grow 10.4% and 8.3% year-over-year, respectively. Money is flowing into public works like the $10 billion Sound Transit Light Rail project. Other infrastructure jobs include the Seattle Tacoma International Airport’s $1.5 billion concourse renovation.

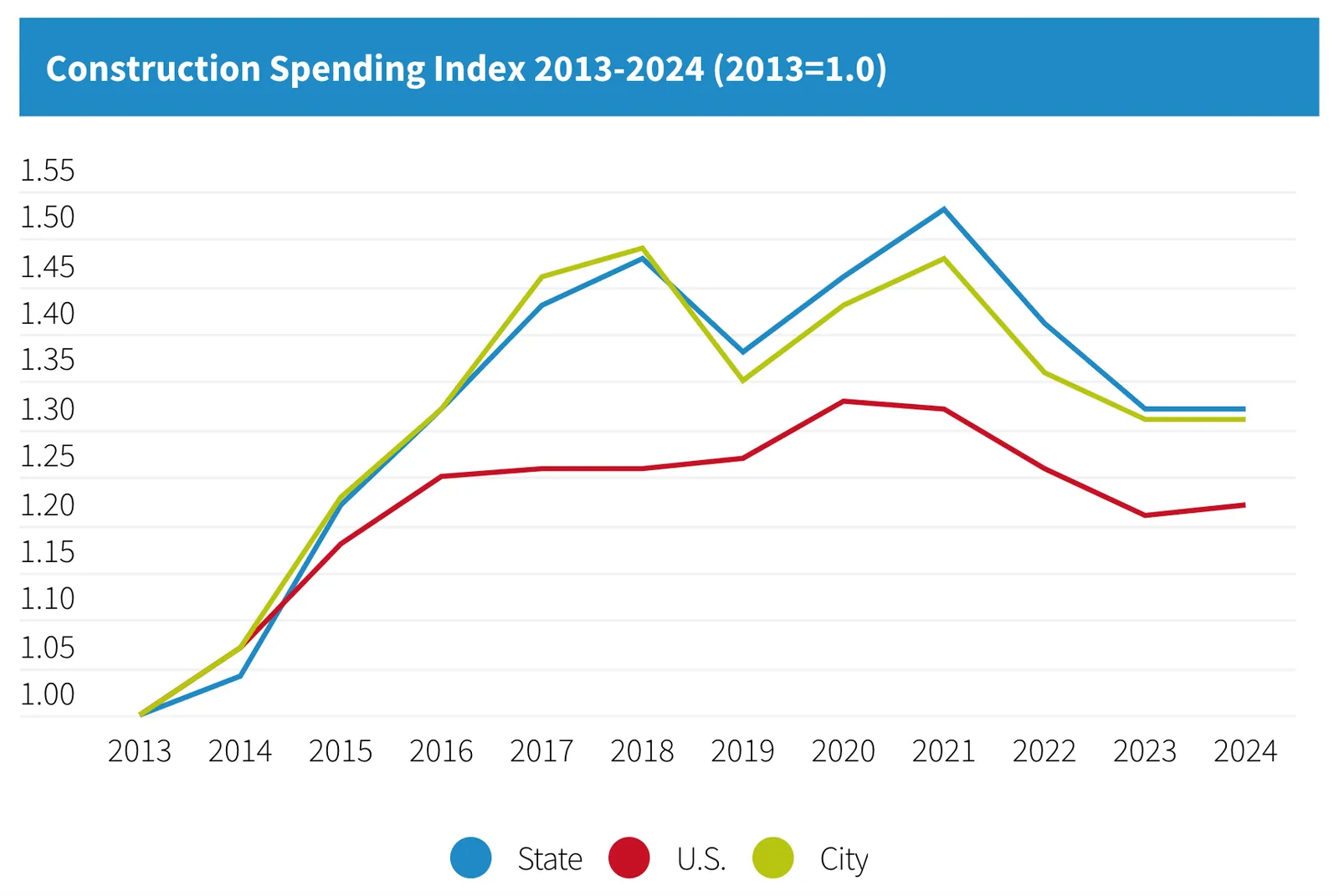

Seattle, Washington state stay ahead of US in construction spending

Seattle is also the king of cranes, according to Rider Levett Bucknall, which tracks the equipment on a city’s skyline. It reported a 21% growth in the structures year-over-year, adding nine total in the third quarter of 2023.

The 1,000-foot view

Overall, Seattle is an attractive place to build, Maggio said.

“I think we've been in a strong, probably decades-long cycle of a boom in the region, driven primarily from net migration to the area,” Maggio said. The city has grown from a population of around 563,000 in 2000 to around 737,000 in 2020, according to the Seattle government’s website.

Top construction projects in Seattle

| Project | General Contractor | Cost |

|---|---|---|

| Sound Transit Expansion Project | Kiewit & Hoffman JV | $10 billion |

| Seattle Tacoma International Airport South Concourse Evolution Project | Hensel Phelps | $1.5 billion |

| Harborview Medical Center New Medical Tower | TBD | $925 million |

| Kaiser Permanente Special Care Facility | Mortenson | $500 million |

However, these strengths may not be able to offset a dip in activity — Seattle’s total construction volume is expected to shrink 3.6% in 2023, according to Cumming Group, bogged down mostly by the residential segment, which is predicted to tumble 7.7%.

“In the years that I've been working in the construction industry, we've seen ups and downs. Currently, we are in a down cycle,” said Michael Harder, the vice president of Minneapolis-based Mortenson’s Seattle office. Harder cited office and development projects that require external capital as the ones that have taken the hardest hits.

Experts blame rising interest rates and material price increases, which also have hurt contractors in other metros across the country. Maggio said that he estimated the peak for Seattle’s construction industry was about a year or two behind them.

“I think we're still the U.S. leader of cranes in the air, but you're going to see that those cranes are going to come down, and I think our prediction is that you're not going to see that many go back up in the next year,” Maggio said.

D’Hondt provided his own form of anecdotal evidence for the construction dip.

“It wasn't too long ago that I could sit in my office on Lake Union, and I could look at 55 tower cranes that were building new office buildings for Amazon, Google and Facebook,” D’Hondt said. “And that's all come to an end.”

However, that doesn’t mean that tech construction is dead, or even in danger. While infrastructure is the story right now, Harder predicted that it would come rushing back, but not necessarily in office work, in another instance of the cycle repeating itself.

Harder told Construction Dive he expected a rise in construction associated with supporting the development of artificial intelligence systems, including offices, labs and test facilities.

“I think that tech's gonna swing up pretty pretty strongly here shortly. I don't know if that will result in us building more office buildings, because I think we'll still see a lot of those team members working from remote locations,” Harder said.