Preserve cash, build backlog and target federal contracts in case a recession sinks the U.S. economy.

That's the winning game plan for construction pros during these uncertain economic times, sources told Construction Dive.

Whether a recession is here now or is waiting in the wings, industry experts suggested now is the time for construction companies to start shoring up their businesses, just in case. Here are some of their top tips for getting recession ready:

Build what you know. In the face of a recession, contractors should aim for more than 12 months in backlog and to “stick to your knitting,” said Joe Natarelli, construction services leader at Marcum, a national accounting and advisory services firm.

“Now is not the time to go and try different trades,” said Natarelli. “If you’re a mechanical contractor or you’re a general contractor, stick to the jobs you have a track record with [and] where you’ve done well."

Monitor financials. Nick Grandy, construction and real estate senior analyst at RSM US, a Chicago-based accounting firm, said the most important thing a contractor can do during a potential slowdown is to maintain a businesslike approach.

That means continually monitoring the financial health of the company and projects to ensure profitability, communicating regularly with customers, subcontractors and employees and keeping a focus on the firm's specialties.

“The construction industry will likely feel the pain in managing the risk of potential insolvency,” said Grandy. “The separation of winners and losers really comes down to who does a good job finding profitable projects and managing through those projects to get back to economic growth.”

Remember that cash is king. A recession would cause profit margins to squeeze as “contractors would find themselves having to compete more aggressively for work,” said Anirban Basu, chief economist at Associated Builders and Contractors.

“If contractor leadership is convinced that a downturn is coming, the primary goals are to preserve cash and to shore up financial relationships,” said Basu. “This represents a time to determine whether the firm can cut costs and whether it makes sense to attempt to negotiate larger lines of credit.”

Hold off on large expenses. Defer on large expenditures in order to keep cash on hand, said Natarelli.

“Make sure you manage what we call the work-in-progress schedule. That’s the schedule of the jobs and how the jobs are progressing,” said Natarelli. “Make sure you’re making money on the job and if you’re having problems, make sure you make the necessary adjustments to make the jobs profitable.”

Think twice before shedding workers. While many U.S. businesses look to layoffs during an economic downturn, that may prove to be a costly decision for construction firms, said Richard Branch, chief economist at Dodge Data & Analytics, who told Construction Dive earlier this summer that he expects a potential recession to be fairly short.

“The gut reaction during a slowdown is to shed workers,” said Branch. “This is a huge risk.”

That’s because the current lack of available labor means contractors may not be able to rehire quickly when the economy improves.

“In the past, contractors have been willing to carry extra team members even during downturns, with the understanding that rehiring talent can be extraordinarily difficult,” said Basu. “Contractors would likely respond to a downturn by trimming their least productive personnel but would strive to keep their most talented team members."

Keep hiring. Indeed, experts say a downturn can sometimes improve contractors’ ability to hire and retain workers. Branch noted successful construction firms will continue to hire, for when the economy does turn around.

“Companies with a growth mindset will be on the lookout to snap up any available labor even if they may not necessarily have the work for them over the short term,” said Branch. “What tends to separate the winners from the losers during the downturn is that success is determined by maintaining a growth mindset.”

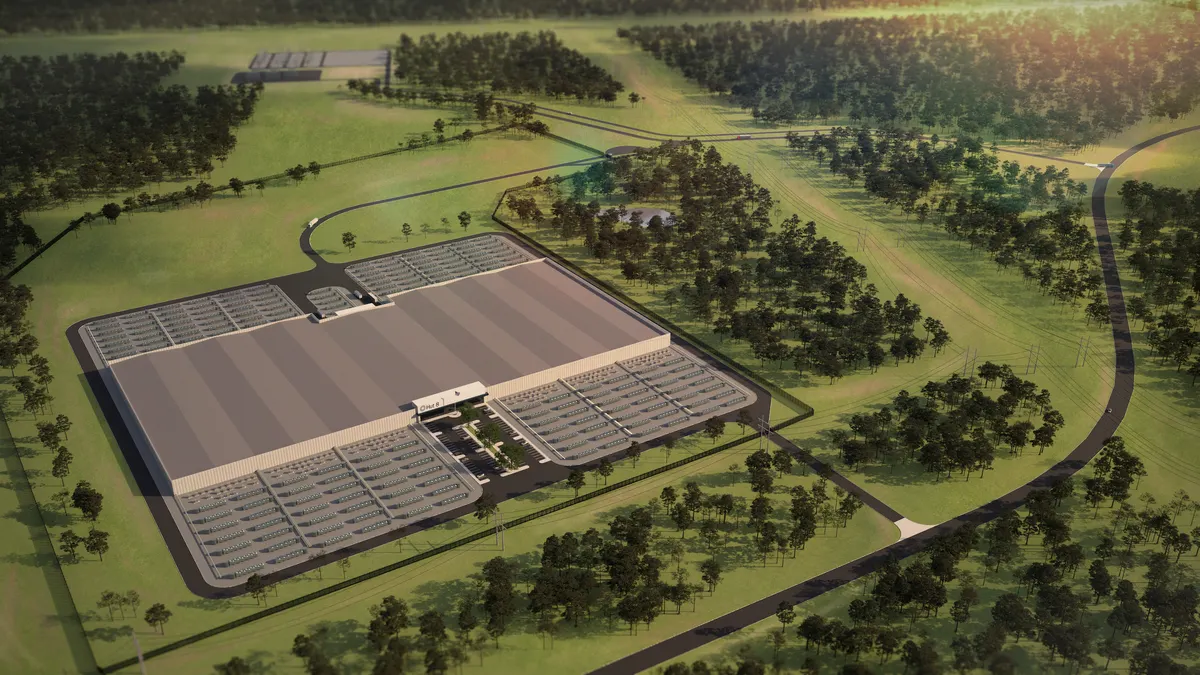

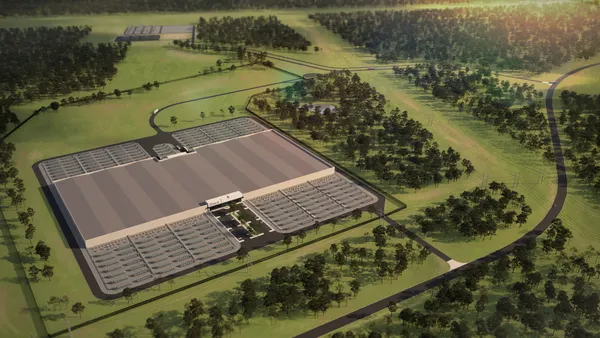

Beef up civil work. Grandy noted that work related to federally funded infrastructure projects will be a bright spot in construction no matter what happens with the economy.

“The infrastructure bill should help to sustain continued employment opportunities in the industry,” said Grandy. “Other nonresidential construction opportunities will likely see offsetting declines as demand for services would likely slow in a recession.”

Be on the lookout for M&A deals. A tougher economy produces fewer mergers and acquisitions because such deals require confidence among dealmakers and the availability of financing tends to be truncated during moments of economic stress, said Basu.

However, once economic recovery begins, “dealmaking generally takes off” because many firms find themselves weaker after the downturn and therefore are more willing to be acquired, added Basu.

Indeed, experts say there’s a tendency to buy new work on the upswing, which should translate to an acceleration of mergers and acquisitions.

Thus, a positive of a downturn could be the right opportunity to gain market share through acquisition.

“Capital tends to dry up during a downturn and with rates rising, the cost of lending is more dear,” said Branch. “That shouldn’t scare companies away from looking to acquire companies that fit in with your strategic growth plans.”