Dive Brief:

- Construction’s tale of two markets continued in May, as public projects garnered increased dollars while private jobs struggled to find funding, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data.

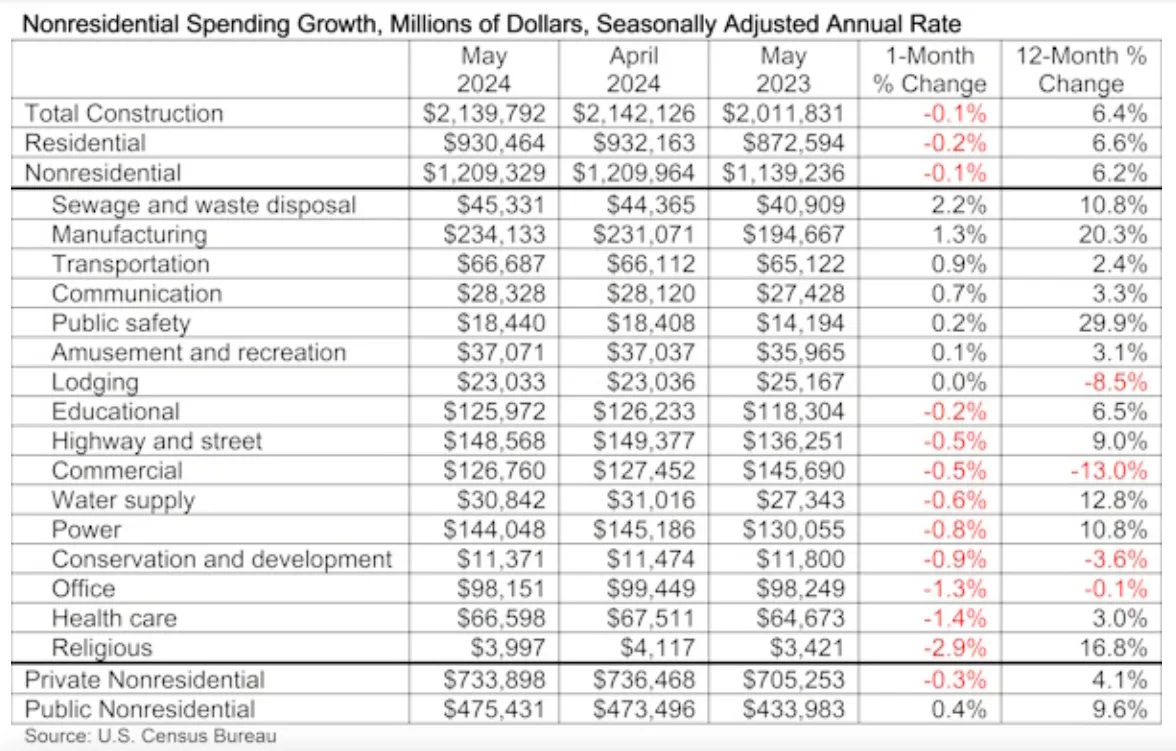

- Overall, national nonresidential spending was flat in May, ticking down 0.1% to a seasonally adjusted annualized rate of $1.21 trillion. But private nonresidential spending fell further, by 0.3%, as public projects gained 0.4%. That momentum on the public side kept the broader nonresidential sector up for the year with a 6.2% gain.

- “Nonresidential construction spending has fallen for two consecutive months yet remains just 0.2% below the all-time high achieved in March 2024,” said ABC Chief Economist Anirban Basu in a news release. “Much of that progress is attributable to ongoing infrastructure investments, which spurred a sizable 0.4% increase in publicly funded nonresidential spending in May.”

Dive Insight:

As has been the case for the last 24 months, public dollars flowing from the $1.2 trillion Infrastructructure Investment and Jobs Act, as well as follow-on legislation such as the $52 billion CHIPS and Science Act, are propping up the sector as a whole.

Indeed, spending on public projects was up a whopping 9.6% for the year, while private spending grew at less than half that rate.

“Private nonresidential spending has lagged and, after falling 0.3% in May, is up just 4.1% year over year,” said Basu. “That weakness can be tied to interest rate-sensitive segments like office and commercial, both of which have also been hampered by altered demand dynamics in the wake of the pandemic.”

Still, while those numbers show a growing gulf between the public and private markets in nonresidential construction, total construction spending, which includes residential buildings, is up 6.4% for the year. That widely outpaces the seasonally adjusted annual growth rate of 1.7% the Federal Reserve estimated for the broader economy on July 1.

Spending declined on a monthly basis in 9 of the 16 nonresidential subcategories. Religious buildings saw the biggest drop, at 2.9%, while educational projects pulled back by just 0.2%. Amusement and recreation construction was flat.

Over the last 12 months, the biggest winner has been public safety, which has seen a 29.9% increase in spending. The sector with the largest drop is commercial construction, the heart of the private nonresidential category, down 13% on the year.

Despite those category pullbacks, and perhaps buoyed by the continued strength of public spending on construction, ABC said its members have a positive outlook for the future, with a majority of contractors expecting their sales to increase over the next six months.

One area of private projects continues to standout, however. According to the Associated General Contractors of America, data center construction has jumped 69% in the last 12 months. The AGC had been advocating for the Census Bureau to break data centers out of the overall office sector, which the agency did.

“The Census Bureau today responded to requests by the association and others to show data centers separately from the overall private office category,” said Ken Simonson, the association’s chief economist, in a news release. “While the overall category slipped just 1.7% in the latest 12 months, that total hides a 69% jump in data center construction, which nearly offset an 18.5% plunge in spending on actual private offices.”