Dive Brief:

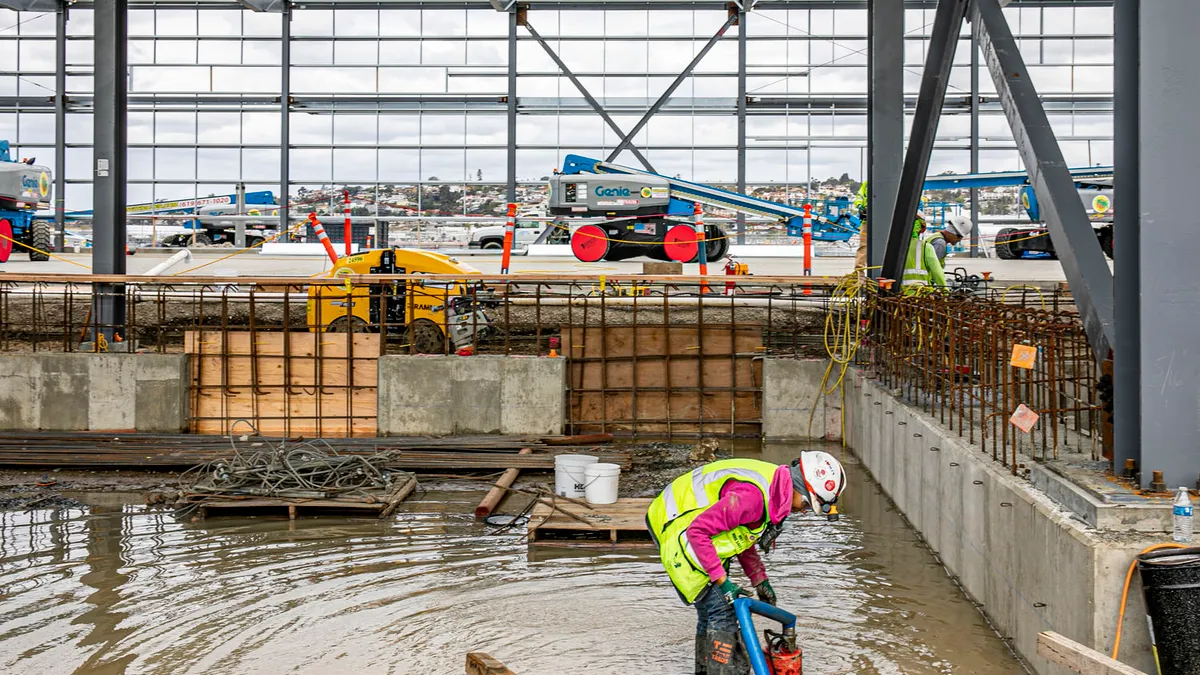

- National nonresidential construction spending ticked up a meager 0.1% in June to a seasonally adjusted annualized basis of $1.07 trillion, according to an Associated Builders and Contractors analysis.

- The minimal uptick in June follows a 0.2% slip in May, the first drop after 11 months of growth, according to ABC. Over the past 12 months, nonresidential construction spending remains up 18.1%.

- “Nonresidential construction spending growth downshifted over the past two months,” said Anirban Basu, ABC chief economist. “While stakeholders can expect ongoing spending growth in public nonresidential construction segments as more Infrastructure Investment and Jobs Act monies flow into the economy, private developer-driven activity appears to be drying up in the context of higher costs of capital and tighter credit conditions.”

Dive Insight:

Despite that positive outlook for public infrastructure jobs, others still see hurdles in that area.

For example, a report from the Associated General Contractors of America warned some of the regulatory requirements associated with federal construction funding, such as incomplete guidance on new Buy America rules, delayed many construction projects where funding has been announced, but construction has yet to start.

“Confusion about some of the strings that come with the new federal construction funds is limiting the economic impact of these investments for now,” said Stephen Sandherr, AGC’s CEO. “The sooner the administration clarifies questions around Buy America and the rules around clean energy investments, the sooner construction can begin on many infrastructure and power projects across the country.”

Commercial construction spending, such as warehouse and retail projects, inched up 0.1% in June compared to a month ago, noted the AGC report. Highway and street construction, on the other hand, ticked down 0.1% in June, while power construction also dropped 1.3%.

Total construction spending, which includes housing, increased 0.5% in June, according to the AGC report.

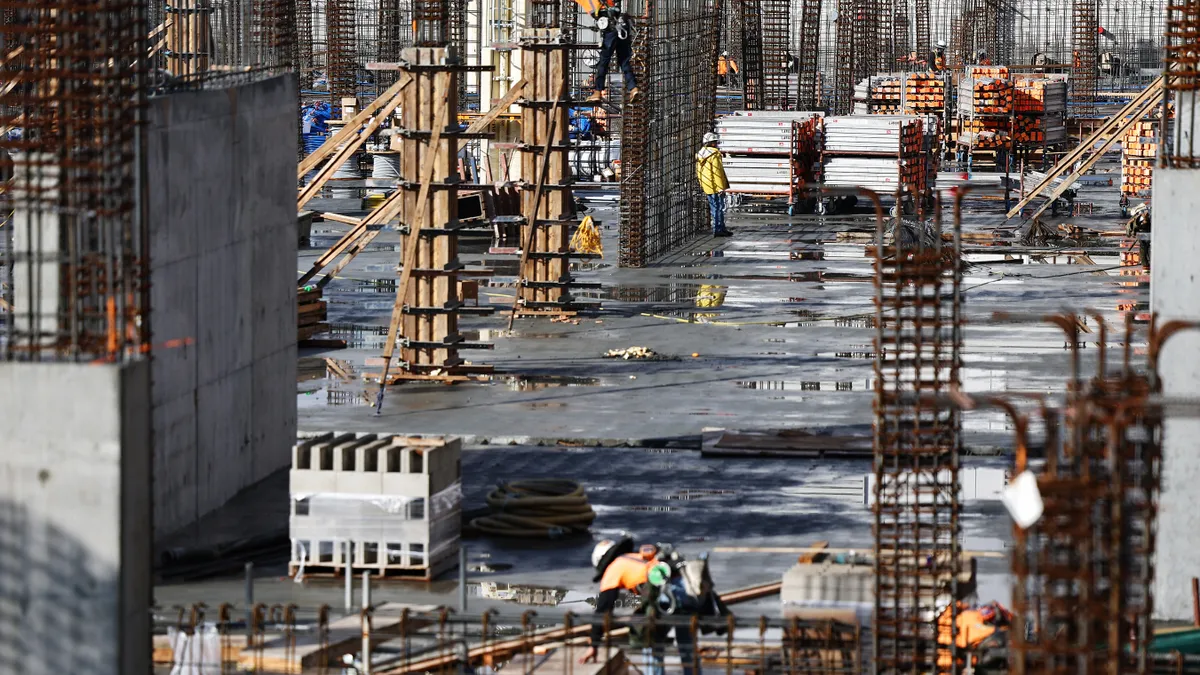

Meanwhile, Basu pointed to high capital costs and tighter credit conditions as potential factors for a looming slowdown, particularly in certain construction segments.

“While those that focus on public work stand to remain busy for years to come, those who specialize in meeting the needs of developers of office buildings, hotels and shopping centers are likely to struggle to support backlog going forward,” said Basu. “The good news is that there remain private construction segments associated with rosier prospects, including manufacturing, data centers and health care.”

Spending increased on a monthly basis in 12 of the 16 nonresidential subcategories, led by a 3.7% growth in religious-related construction, followed by conservation and development projects, according to ABC. Private nonresidential spending remained virtually unchanged, while public nonresidential construction spending ticked up 0.3% in June.