Dive Brief:

-

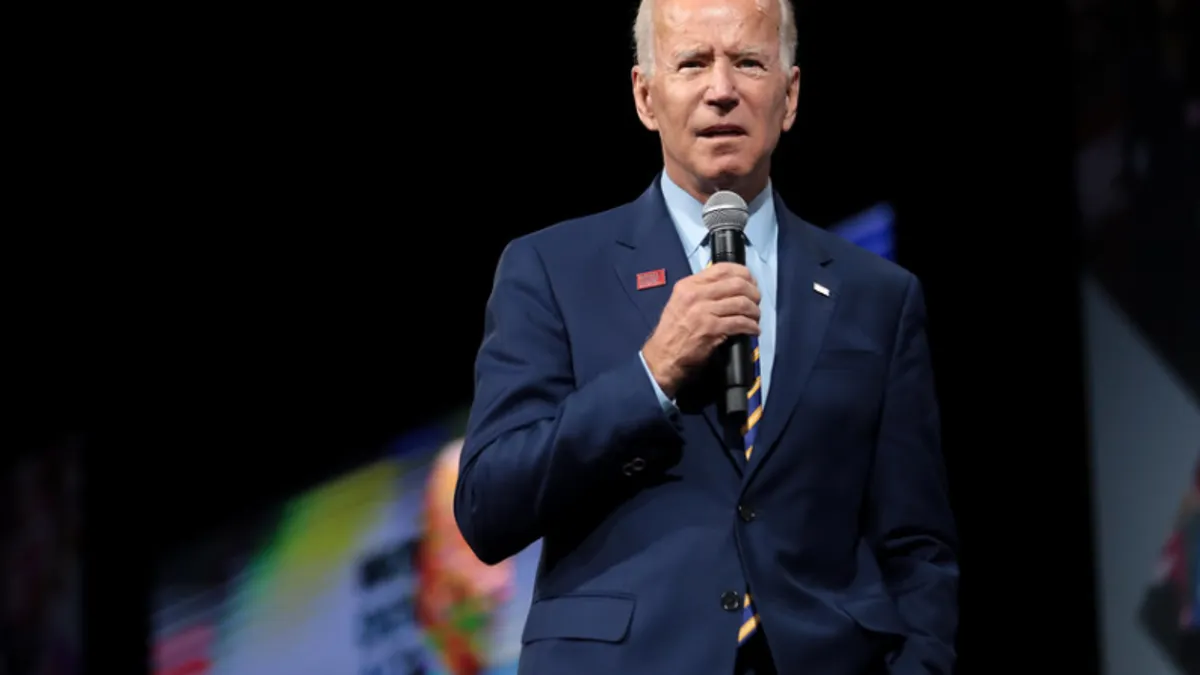

The Small Business Administration, for two weeks beginning Wednesday, will only accept Paycheck Protection Program loan applications from businesses with fewer than 20 employees, White House officials announced Monday.

-

The Biden administration announced several other revisions to the SBA's program, including changes to the way loans are calculated for businesses without employees, such as sole proprietors, independent contractors and the self-employed.

-

These efforts "will extend much-needed resources to help small businesses survive, reopen, and rebuild," the White House said in a statement.

Dive Insight:

The administration said the SBA will now calculate the loan amount for applicants without employees by using gross income instead of payroll.

Businesses without employees were structurally excluded from the program or were approved for as little as $1 because of how their PPP loans were calculated, the administration said. establish a $1 billion set-aside for businesses without employees located in low- and moderate-income communities.

The SBA will also eliminate two exclusionary restrictions that have prevented some business owners from obtaining PPP loans. Applicants with prior nonfraud felony convictions and small-business owners who are delinquent on their federal student loans will no longer be excluded from participating in the program.

The Biden administration also clarified that noncitizen small-business owners who are lawful U.S. residents may use Individual Taxpayer Identification Numbers to apply for relief. A lack of guidance from the SBA has created inconsistency in access for ITIN holders like green card holders or those in the U.S. on a visa, according to the administration.

The SBA will issue guidance in the coming days stating that otherwise eligible applicants cannot be denied access to the PPP because they use ITINs to pay their taxes, officials said.

White House officials said they hope the new changes to the PPP will address some of the shortcomings that plagued the program's initial rollout.

The program provided $525 billion in forgivable loans to small businesses during its first iteration between April and August. After reports of borrower favoritism that led to smaller businesses missing out, the SBA instituted several changes to the program's $284 billion reboot last month.

The SBA gave community-based lenders — such as community development financial institutions, minority depository institutions and certified development companies — exclusive access to the PPP for the first two days.

The SBA also set aside $15 billion for lenders with less than $1 billion in assets and another $15 billion for those with less than $10 billion in assets. Also, the current round of PPP loans narrowed eligibility to smaller businesses — those with up to 300 employees, compared with the first round's 500-person cap — and lowered the maximum threshold for new loans to $2 million from $10 million.

The SBA added an optional demographic reporting section to the PPP, which asks about race, ethnicity, gender and veteran status, in the hopes that lenders will encourage borrowers to fill it out and bolster "efforts to reach underserved, minority-owned, veteran-owned and women-owned businesses."

However, the majority of borrowers in the newest round, which remains open through March 31, haven't answered the questions, according to The Wall Street Journal.

The SBA recently moved the demographic questions to the first page of the PPP application, from the last page, in an effort to increase response rates, the Journal reported.

The SBA approved $134 billion in loans, through Feb. 18, since the program's relaunch, according to SBA data.

Businesses in LMI areas received 25% of the rebooted program's loans, a Biden administration official said.