Dive Brief:

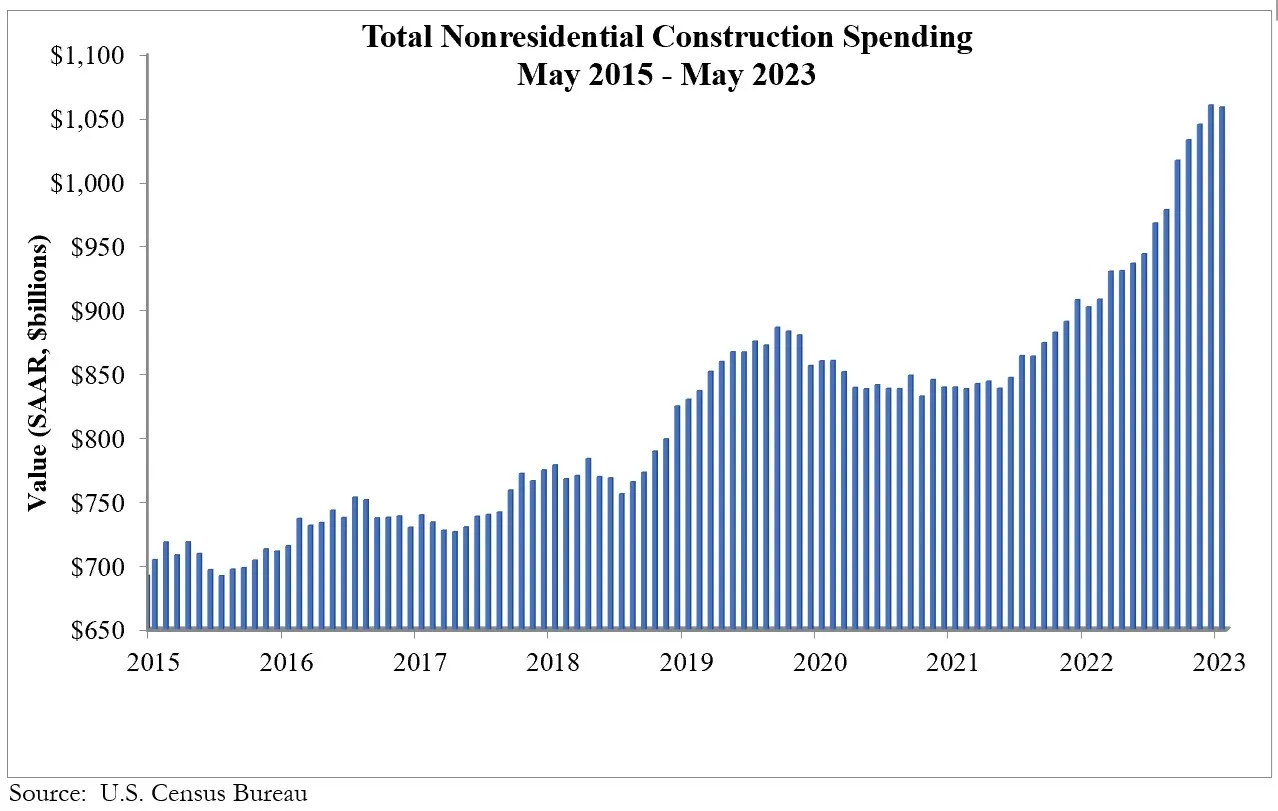

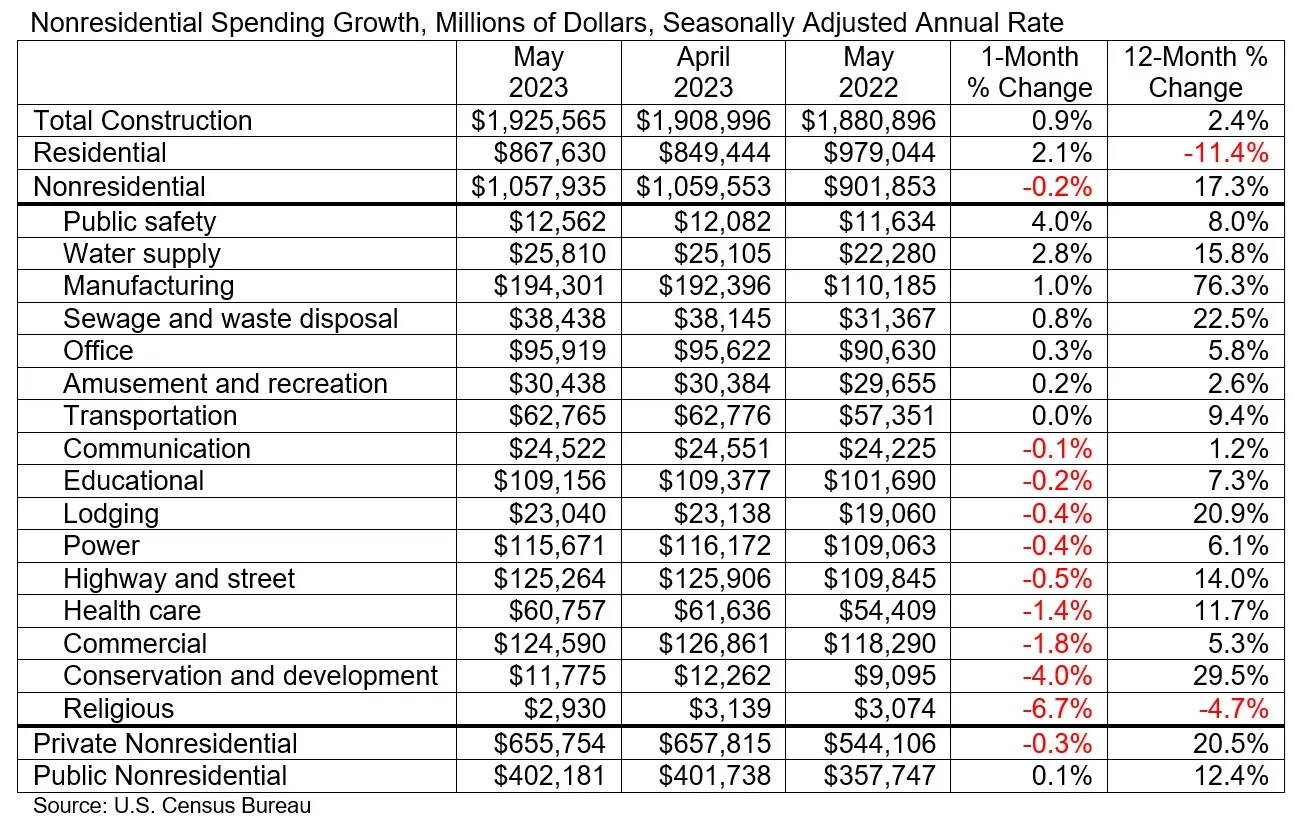

- National nonresidential construction spending inched down 0.2% in May to a seasonally adjusted annualized basis of $1.06 trillion, according to new Associated Builders and Contractors analysis.

- The slight drop this month follows an 11-month streak of nonresidential spending increases, largely driven by strong activity in manufacturing construction.

- “While spending is up more than 17% over that [11-month] span, manufacturing-related construction accounted for the majority of that increase,” said Anirban Basu, ABC chief economist. “Excluding the manufacturing segment, nonresidential construction spending is barely outpacing inflation, up just 6% over the past year.”

Dive Insight:

Spending in the manufacturing sector ticked up 1% in May, and remains up more than 76% year over year. Meanwhile, office construction, which includes the booming data center sector, inched up close to 1% in May and remains up 6.7% year over year.

But despite the increases in these two types of private nonresidential spending, most other categories lag behind, said Ken Simonson, Associated General Contractors of America chief economist.

For example, public construction spending posted mixed results, as the largest infrastructure categories declined for the month and education spending flattened, according to an AGC analysis of federal data. Highway and street construction dipped 0.4% from April and public spending on transportation facilities, such as airports, transit and passenger rail, ticked down 0.8%.

Meanwhile, commercial construction spending, such as warehouse and retail, also dropped 1.8% in May.

“The data for May show there has been no letup in the feverish pace of manufacturing construction but a very mixed picture for other project types,” said Simonson. “There have been strong year-over-year increases in most categories, but it remains to be seen if the market is now cooling.”

Basu agreed that aside from manufacturing construction, spending in other categories largely slumped during the month. Nine of the 16 nonresidential categories posted drops in spending, according to ABC analysis.

That slowdown could stick around for the remainder of the year, he said.

“Unfortunately, conditions may prove challenging in other segments over the next few quarters,” said Basu. “Interest rates remain elevated and are likely to rise at least once more over the second half of 2023, exacerbating already tight credit conditions and ultimately limiting construction activity.”