Dive Brief:

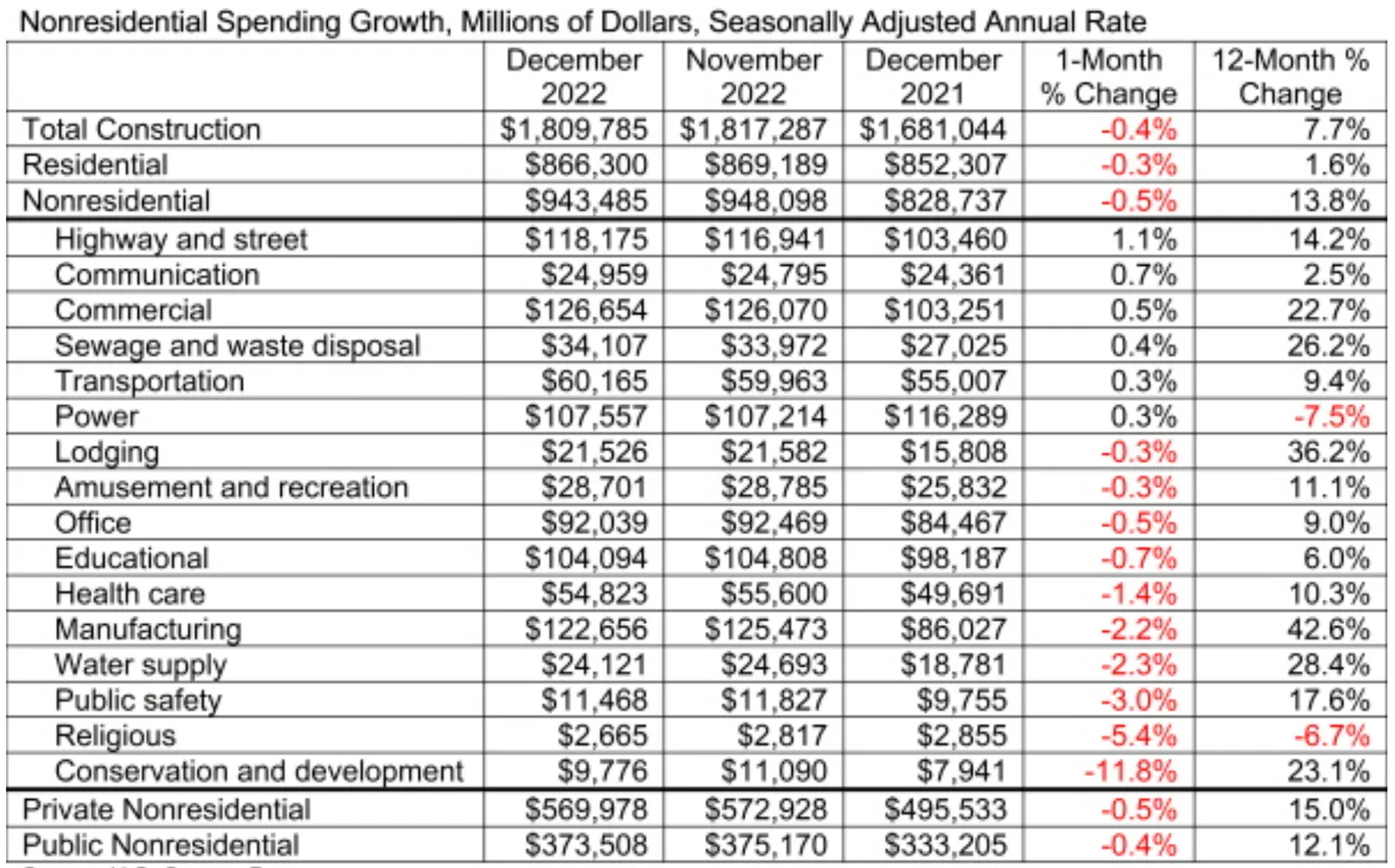

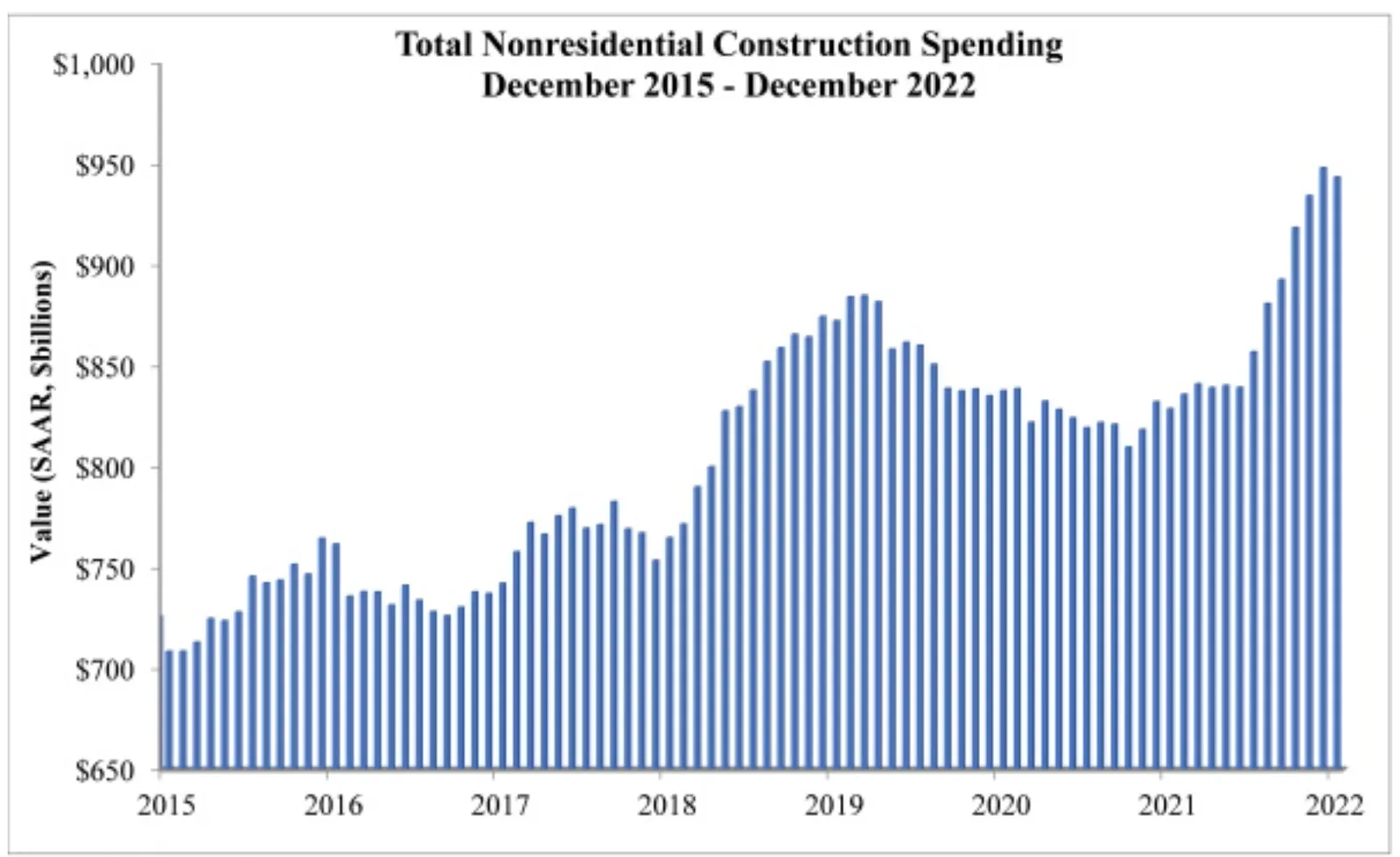

- Nonresidential construction spending ended on a down note in 2022, falling 0.5% in December, to a seasonally adjusted annualized basis of $943.5 billion, according to Associated Builders and Contractors. The drop ended a six-month period of increases.

- The dip came as spending fell in 10 of 16 nonresidential spending categories. Broadly, privately funded nonresidential spending was also down 0.5%, while public spending pulled back 0.4%.

- “While contractors remain reasonably confident, there is reason for caution,” said Anirban Basu, ABC’s chief economist, in a release. “Worker shortages remain a challenge for contractors, and elevated interest rates have increased borrowing costs, making certain projects unfeasible at the margins while also driving the economy toward a potential recession this year.”

Dive Insight:

The dip came even as overall building starts ended the year with the first positive gain in December since 2017.

December’s dip wasn’t all bad news, however.

Basu noted that for the year, 2022 nonresidential construction spending increased 13.8%, a rate that was higher than both overall inflation (6.4%) and materials price inflation (7.6%).

More than half of the increase in nonresidential construction over the past year is due to heightened activity in two segments: manufacturing, as megaprojects begin across the nation, and commercial, a category that includes warehouse- and distribution-related construction.

Still, the latest numbers also provide more evidence that the economy could slow in 2023, and that nonresidential construction wouldn’t be immune to a contraction.

Indeed, a recession in the housing market is already underway. National Association of Home Builders Chief Economist Rob Dietz said this week at the International Builders’ Show in Las Vegas he expects the sector’s malaise to spread to the rest of the economy.

“We’ve never had a period where home prices have declined and there has not been a recession,” he said. “I think the rest of the economy will feel it in 2023 via slowing economic output and rising job losses.”