Dive Brief:

- Maryland Gov. Larry Hogan has announced his intention to sell hundreds of millions in private-activity bonds (PABs) before a potential new tax reform bill prevents their use, according to The Baltimore Sun.

- PABs attract private investment because they allow developers to borrow money to help finance public projects at the same tax-free rate offered to state and local governments. As part of the public-private partnership funding of the 16-mile, $5.6 billion Purple Line light-rail project in the Bethesda-area, Maryland issued $313 million in PABs.

- The Senate tax reform measure, which passed Dec. 2, does not eliminate the use of PABs like the House bill, but Maryland officials want to secure a year's worth of the tax-free funding in case it is lost in the process of reconciling the two bills. PABs have been used in Maryland to build and renovate affordable housing, construct new infrastructure and back student loans.

Dive Insight:

Some House GOP members have pushed back against a version of the bill that would eliminate the use of PABs by penning a letter to the leaders of both the House and Senate. In that document, representatives note that such a restriction would harm the president's $1 trillion infrastructure agenda, particularly because — as of the administration's 2018 budget request — private activity had been slated to play a big role in the execution of important rail, bridge, highway and other projects.

House Republicans have argued that eliminating PABs would save almost $40 billion in lost federal tax revenue.

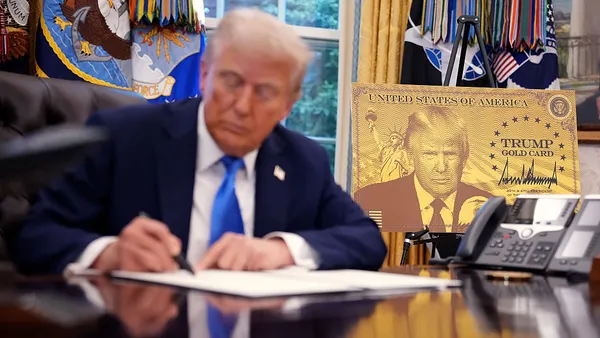

Although President Donald Trump recently walked back his commitment to partnering with the private sector on his massive infrastructure program, his earlier budget request advocated for lifting the cap on how much PAB financing private companies could tap.

There are, however, certain areas where the Senate and House agree on PAB use, including their role in refinancing debt. Today, that option involves reducing the cost of borrowing by allowing issuers of municipal bonds to refinance the resulting debt with tax-free issues. Both the Senate and House would eliminate that option outside of a 90-day window before the call date. The potential for such change, according to The Bond Buyer, has caused a rush on the market.