Dive Brief:

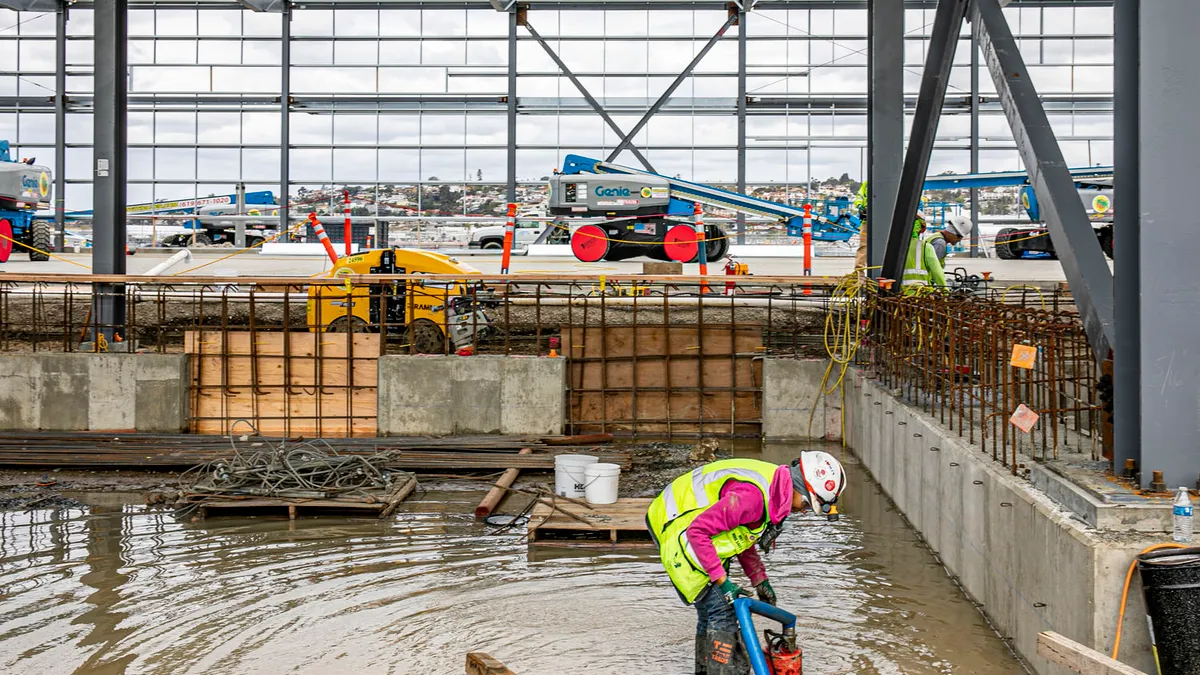

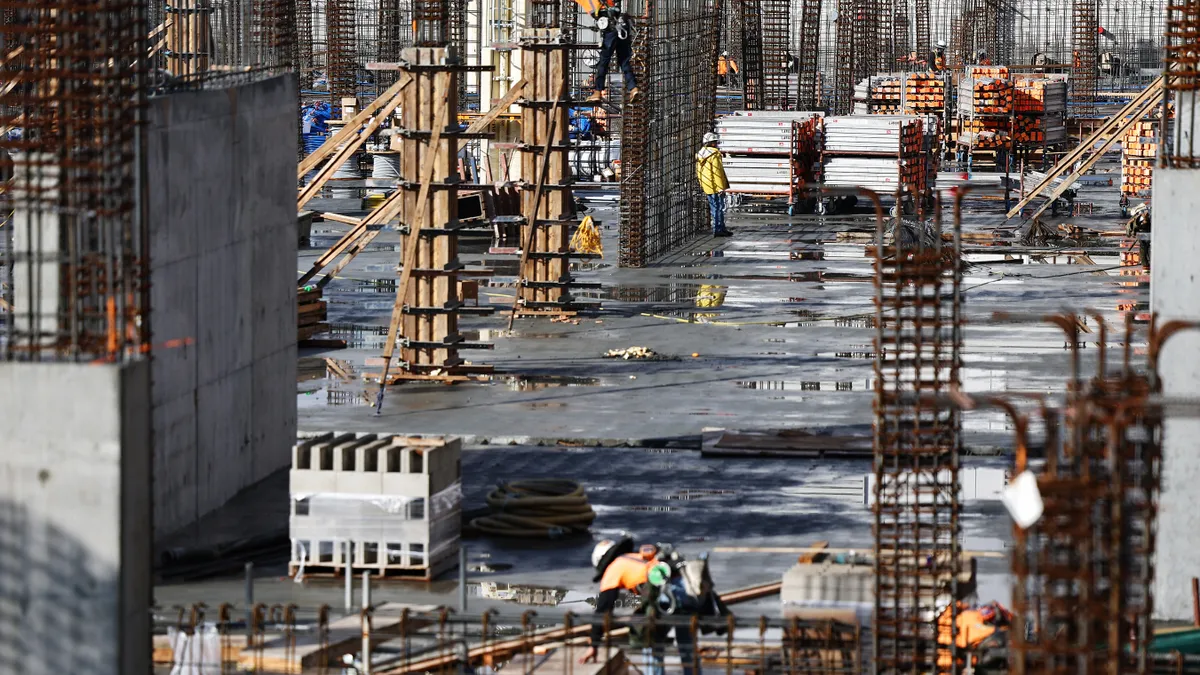

- Construction input prices ticked up 1.5% in August, the first increase in six months, due to a surge in energy costs, according to a new Associated Builders and Contractors’ analysis of U.S. Bureau of Labor Statistics Producer Price Index data released Thursday.

- Overall construction costs remain 0.2% lower than a year ago, while nonresidential input prices inched up 0.2% since last year, according to the report. Although the flattening of costs over the past six months suggested inflation had been cooling, expectations for continued price drops should remain in check, said Anirban Basu, ABC chief economist.

- “Anyone who thought that excess inflation would simply go away later this year has been rudely awakened this week,” said Basu. “Yesterday’s consumer price data and today’s producer price index indicate that price growth continues to be problematic.”

Dive Insight:

An extreme jump in diesel fuel costs in August drove the overall increase in materials prices, according to a separate analysis from the Associated General Contractors of America.

Most other commodity prices remained relatively unchanged, according to AGC officials.

“The steep climb in diesel prices since July is a reminder that construction cost worries have not gone away,” said Ken Simonson, AGC chief economist. “An even greater challenge for most contractors is finding enough qualified workers to complete the many projects available to work on.”

The producer price index for diesel fuel, which covers the selling price at the terminal rack or refinery, ballooned 34.6% in August — the largest one-month jump since 1990 — according to AGC. Simonson added retail diesel prices have continued rising since then and have climbed 77 cents per gallon in the past 10 weeks.

Nevertheless, Basu said while energy prices will likely grab headlines, materials like concrete and switchgear also continued to exhibit inflationary tendencies in August.

“There are many implications for construction contractors, including the fact that persistently elevated inflation will keep interest rates higher for longer,” said Basu. “ABC has been predicting this for months.”

Prices for concrete products increased 0.5% in August, making them 8.7% higher on the year. Meanwhile, prices for switchgear equipment moved up 0.4% in August, and were 6.7% higher than a year ago.

“With labor costs still rising, consumers spending aggressively, oil-producing nations limiting output and global supply chains being reorganized, there is reason to believe that future readings will also demonstrate excess inflation is here to stay,” said Basu.