Dive Brief:

- Lendlease lost $264 million in the first half of its fiscal 2022, ended Dec. 31, compared to a $196 million profit in the year-ago period, as the builder absorbed higher than expected restructuring charges and lingering impacts from COVID-19 on its development business.

- Core operating profit after tax, a key figure watched by investors, totaled $28 million, or 4 cents a share, falling far short of the 24 cents a share stock analysts expected. In the first half of fiscal 2021, Lendlease’s core profit after tax was $205 million.

- The company signed $6 billion in investment partnerships during the six-month period, but development completions were at a historical low. Lendlease's pipeline declined to $111.8 billion, and public projects in the Australian region accounted for 75%.

Dive Insight:

Sydney-based Lendlease has American Depository Receipts that trade on the New York Stock Exchange, however the company has yet to file its financial results with the Securities and Exchange Commission. Financial results reported Feb. 20 do not necessarily conform to Generally Accepted Accounting Principles (GAAP).

"Challenging operating conditions continue to impact the business, in particular the development segment," CFO Simon Dixon told investors on a conference call. Dixon joined the company last October to help guide its restructuring, and he added, "We expect this to be the low point in profitability, which is set to recover in the second half of fiscal 2022."

The company's $16.1 billion worth of work in progress is the highest in five years, said CEO Tony Lombardo, who took the helm a year ago. The company expects $2 billion in completions in the second half of its fiscal year, climbing to $5 billion in fiscal 2023 and $7 billion in 2024. That makes 2022 a "reset year" Lombardo said.

Lendlease spent the past six months executing on a five-year reorganization strategy, shuttering or selling non-core businesses, with expected annual savings of $160 million. The restructuring included cutting 264 jobs and abandoning 24,000-square-meters of office space. The company will lay off another 100 people by the end of June.

The company's cash and liquid assets totaled about $3 billion at the end of December, down from $5 billion at the end of fiscal 2021. Dixon said he is keeping an eye on the company's credit rating and used some untapped credit facilities to save money.

"We believe this still places the group in a strong liquidity position," Dixon said.

Projects in Lendlease's pipeline include:

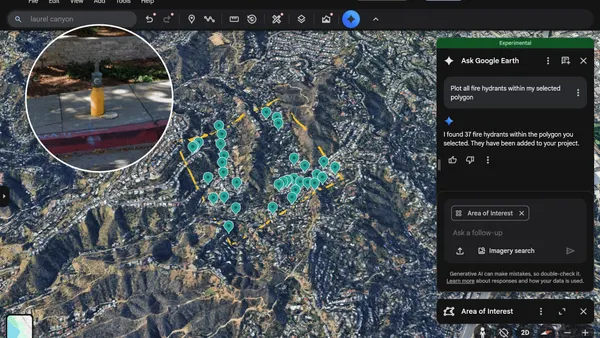

- Collaborations with Google on mixed-use developments in California (pictured above).

- Development of the Milan Innovation District.

- Apartment and office developments in Chicago.

- The International Quarter in London.

Alexander Prineas, equity analyst for Morningstar, said Friday he didn't expect an impressive earnings announcement, largely due to the lack of Lendlease projects close to hitting profit milestones. Nevertheless, long-term, international projects around the world pose hope for Lendlease reaching its goals – which include $5.8 billion per annum in development production and 10-13% return invested capital by 2024.

That's ambitious, Prineas said, given development production of $2.7 billion in fiscal year 2021, but is buoyed by $82 billion in production and Lendlease's track record for delivery.

COVID-19 certainly hit Lendlease hard in 2021, Prinease said, harder than its domestic competitors due to its international projects.

“However, that disadvantage should become an advantage over rival Australian domestically focused REITs, as other markets reopen for business sooner than Australia," Prineas said. "Furthermore, having been more impacted by COVID restrictions and virus cases than Australia, some of Lendlease's offshore markets [have] greater scope for recovery."