Dive Brief:

- Prefab builder Katerra has announced plans to expand and open six manufacturing plants by March 2019, Building Design + Construction reported.

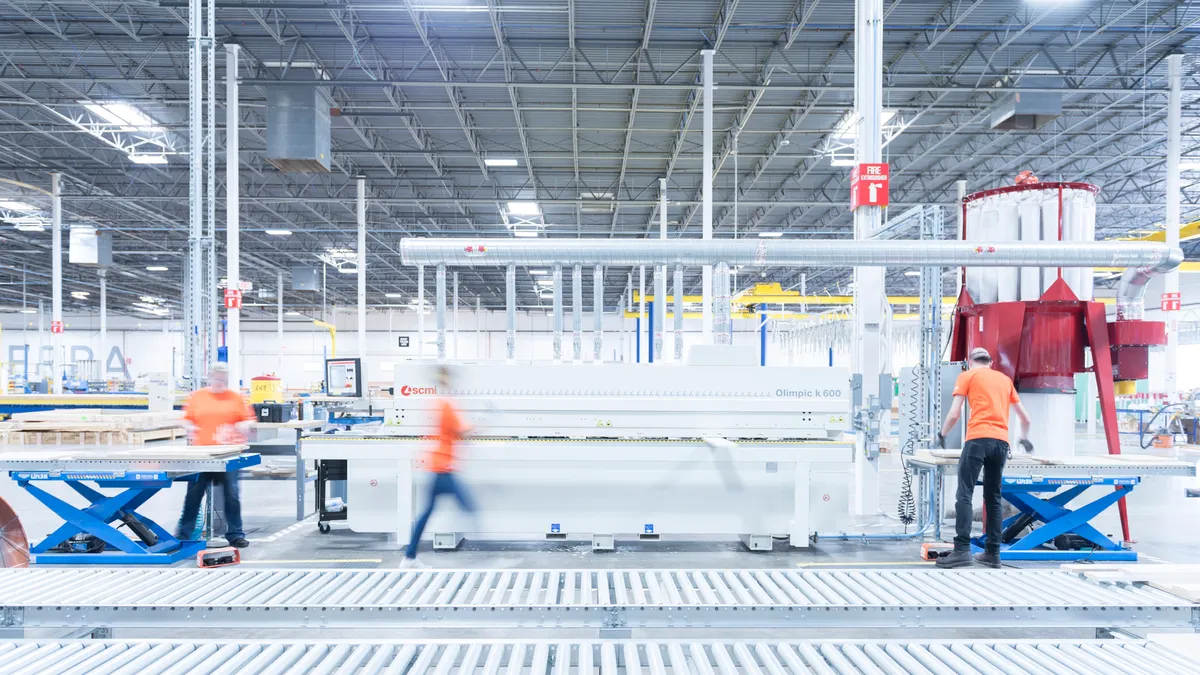

- One of those factories includes the general contractor's 250,000-square-foot mass timber plant being built in Spokane, Wash. When complete, the plant is expected to produce 4.6 million cubic feet of cross-laminated timber (CLT) each year, making it comparable to similar European CLT plants.

- Katerra's other buildouts this year will be conventional wood panel and truss plants. The company also has potential plans to build its next mass timber factory in the Southeast.

Dive Insight:

Katerra's shift to mass-timber manufacturing follows the company's plans to jumpstart North American CLT production.

"If you look at the actual supply chains for the market that we're addressing, there is need for strategic placement of this manufacturing and also operations related to the actual source of the fiber," Todd Beyreuther, senior director of advanced building materials at Katerra, told Construction Dive last year. "The site selection of Spokane is strategic on the market side but also very strategic on the resource side."

For Trevor Schick, who leads Katerra's materials organization, material demand is only expected to rise among developers and contractors.

There are still challenges to CLT adoption in the mainstream market, but scheduled changes to the International Building Code and an uncertain future surrounding steel and concrete tariffs could help the building material gain popularity in the U.S. And while CLT's popularity grows, Katerra is positioning itself to be at the forefront of its production. The company is reportedly testing CLT panels for resistance to fires, earthquakes and wind sheer.

Katerra has emerged as a darling among investors in its short three-year lifespan. The company snapped up $865 million in a Series D funding round led by the SoftBank Vision Fund earlier this year, marking Katerra's largest single-funding round since April 2017 when it raised $130 million. And, as promised, Katerra's latest funding round does appear to be helping finance the expansion of the builder's manufacturing operations.

Katerra and other similarly positioned construction technology-focused companies are likely to see more of such mega-investments in the coming months as investors turn their attention to those working to solve construction's productivity problem. From 2012 to mid-2017, Katerra alone snagged a 15.5% share of the top 20 construction technology deals. The company has since surpassed $2.5 billion in valuation, and with plans to ramp up its manufacturing operations and expand into the hotel construction sector, it seems Katerra will be on a growth curve for the foreseeable future.