Dive Brief:

- Jacobs Engineering Group reported $88.8 million in profits for its second fiscal quarter Tuesday, or $0.68 per share, up from $11 million a year ago. Revenue increased to $3.84 billion, up 8% from $3.55 billion 12 months earlier, as the company won key projects from the U.S. government.

- But for the six months ended April 1, profits lagged, down nearly 17% from $268 million a year earlier to $223 million now. The Dallas-based technical, professional and construction services firm took a charge of $74.6 million during the first six months of fiscal 2022 as it abandoned leases on several of its office buildings.

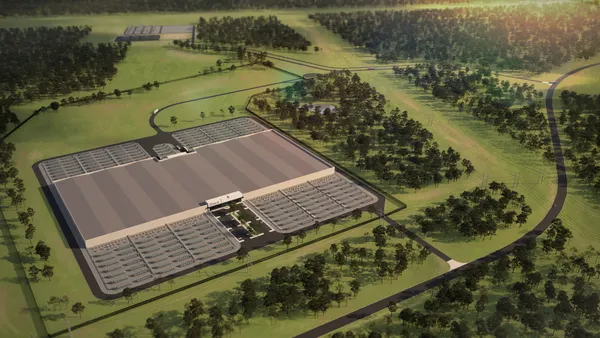

- The company, currently working on projects such as the NASA Artemis 1 program (pictured above) and the EDF Energy nuclear plant in the United Kingdom, maintained its midpoint financial guidance for fiscal 2022, but narrowed its projected adjusted earnings per share range to $6.95-$7.35 from $6.85-$7.45.

Dive Insight:

The large year-over-year jump in profits was partly due to the company's lower numbers last year at this time, when it still felt the full effects of the coronavirus pandemic on its operations.

“For fiscal 2022 we are tightening the outlook and maintaining the midpoint guidance,” said Jacobs CEO Steven Demetriou during a May 3 investor call. “Looking past fiscal 2022, backlog performance and an increasing sales pipeline provide us with continued conviction in achieving the multiyear growth targets we provided during our March strategy launch.”

Jacobs’ backlog rose about 8.7% to nearly $27.8 billion, up from $25.6 billion a year ago. Its critical mission solutions (CMS) and people and places solutions (P&PS) segments added close to $1 billion and $1.4 billion to their respective backlogs. But its PA Consulting segment's backlog fell 4% to $269 million, compared to $280 million a year ago.

The increase in backlog in CMS was primarily due to success in closing on key opportunities in the U.S. government space, such as contracts with the U.S. Army Intelligence and Security Command Support at Fort Meade, Maryland, and the Department of Defense Artificial Intelligence Centers in Arizona, Florida and Texas, as well as its BlackLynx acquisition in November.

The acquisition of Rockville, Maryland-based BlackLynx, a provider of high-performance software, will support Jacobs’ work in government services, as well as critical infrastructure sectors of transportation, water and smart cities, the firm said.

The increase in backlog in P&PS was primarily due to new business awards in the advanced facilities business, specifically in life sciences and U.S. infrastructure, and the StreetLight Data acquisition from February. Industry sources project life sciences construction to climb even higher this year.

San Francisco-based StreetLight Data tracks mobility analytics to support infrastructure planning, investment and policy decisions.

Top takeaways

Jacobs is well positioned to take advantage of opportunities in sophisticated facility construction, such as semiconductor manufacturing, life sciences and infrastructure projects, especially as IIJA funding takes off, said Matt Arnold, an industrial analyst with Edward Jones.

“Results were modestly above expectations, not any real significant amount though,” Arnold said. “There’s plenty of evidence that the business is strengthening and likely to continue to grow over the next couple of years.”

But the company cited concern around currency fluctuations as a near term headwind. Arnold pointed to the U.S. dollar's increased volatility since Russia invaded Ukraine in late February.

A surge in COVID-19 cases could also cause a delay in the completion of projects, though that concern is significantly less than at the beginning of the pandemic, said Arnold.

“Even though they’ve got a backlog of strong demand for their services, those backlogs just have to get burned through and things like COVID flareups might cause some delay in the completion of projects,” Arnold said. “That’s been a lot less meaningful of a challenge over the last several quarters than it was a year or two ago.”

On the call, Demetriou also stressed that potential delays are less worrisome now than last year, but tempered those remarks by highlighting new potential impacts from world events.

“What’s on our mind is… with all this political activity, geopolitical activity, just how health projects and programs are going to get across the finish line and get awarded,” said Demetriou. “We’re confident that there’s no concern about anything getting canceled. It’s really more around just the timing of how things unfold in the second half."