The good news is that President Joe Biden has signed the long-awaited, $1.2 trillion infrastructure spending package into law. The Infrastructure Investment and Jobs Act (IIJA) represents the largest federal spending in roads and bridges in 70 years.

The bad news — or at very least, the downside to the welcome influx of civil work — is that the bill's passage comes at a time when the industry is already in desperate need of workers.

Supply for skilled construction workers has not met demand for decades, and now, that demand is going to increase. Among other issues, this will mean that contractors will have to pay their onsite workers more, experts told Construction Dive.

Wage changes

The supply and demand issue will be exacerbated by the influx of infrastructure projects, Joe Natarelli, national leader of Marcum's Construction Services practice, told Construction Dive, and he predicts wages will go up "significantly." Natarelli said he has already spoken to clients who are trying to secure labor to work on their existing projects and to prepare for the deluge of work that's on the horizon.

A report from Marcum shared with Construction Dive shows a breakdown of current hourly wages of carpenters, electricians and heavy equipment operators across 24 states. The highest earners, according to the report, include:

- Carpenters in Wisconsin, who earn $30.31 per hour, on average.

- Electricians in Massachusetts, who earn $35.18 per hour, on average.

- Heavy equipment operators in California, who earn $38.11 per hour, on average.

With the infrastructure spending package, those skilled workers will only become more valuable. Natarelli said current wage rates will be even higher three months from now, as a direct result of the infrastructure bill.

Tatenda Tazarurwa, director for Turner and Townsend, indicated that wages are changing, but will also be spread out — often skilled workers move to where the work is. Even beyond the infrastructure spending, workers may head to burgeoning markets like Nashville, Tenn. or Austin, Texas.

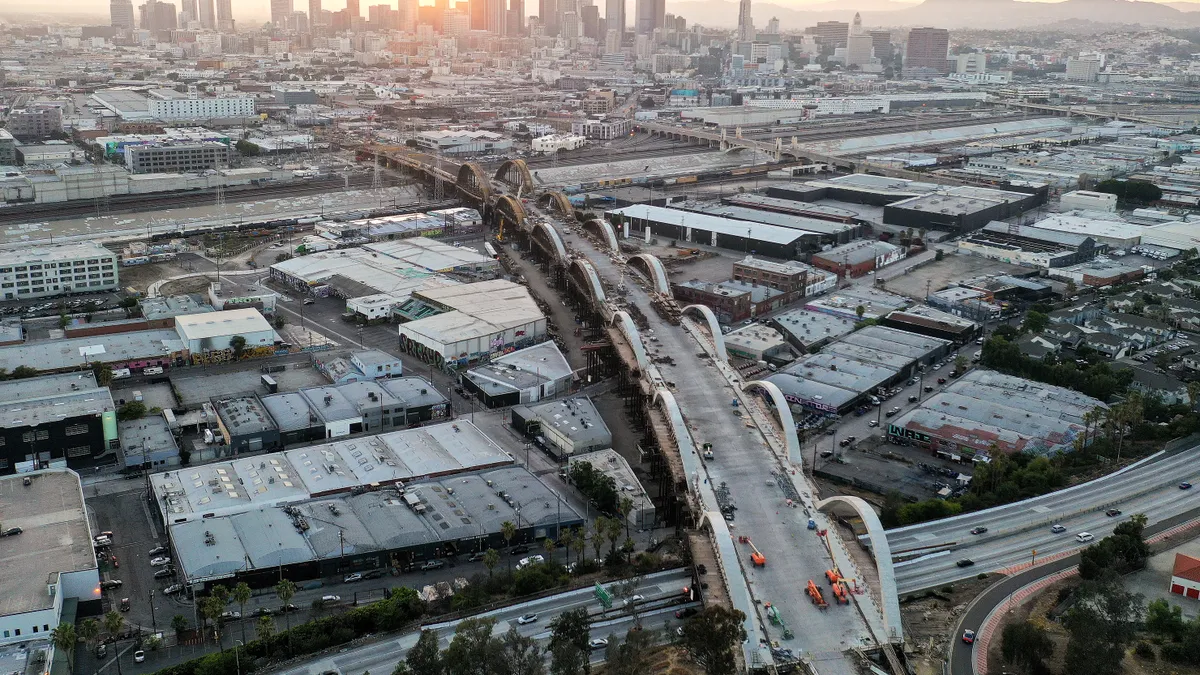

A major goal of the infrastructure package, which will infuse roughly $550 billion into roads, bridges and other forms of transit, is to create jobs that don't require a college education, Michelle Meisels, a principal in Deloitte Consulting's technology practice, told Construction Dive.

"It is expected to create increased demand for predominantly low-wage construction jobs and therefore drive up wages," Meisels said.

The infrastructure plan will likely increase earnings and conditions for workers in two ways, said Meisels: first, the bill will likely tighten the labor markets in which contractors operate, and second, there will likely be direct government wage mandates embedded in the bills.

"Contractors need to be cognizant of the fact that the new bill requires the vast majority of construction projects to pay prevailing wages based on an average of the pay scale for local construction work," Meisels said.

The bill also includes stringent provisions that require all federal infrastructure projects to use construction materials largely manufactured in the U.S., which will increase the number of other types of jobs, and therefore, wages, Meisels said.

Wages to increase 'significantly'

The Great Resignation, partially brought on by the pandemic, has only made things more difficult. The mean workforce age in construction has climbed into the 40s as the industry struggles to recruit younger workers, Tazarurwa told Construction Dive.

Additionally, the pandemic limited the number of migrant workers, as traveling became harder for some and impossible for others.

On the one hand, Tazarurwa said, the shortage could take some time to get over, but on the other, there has been a skilled shortage for decades, and employees are seeing their power increase.

"No time in the past generation or past ages have employees had more power," Tazarurwa said.

An uphill battle

Contractors may have to get creative to secure labor. Natarelli said he's already spoken to clients who are interested in creating joint ventures to secure work. Some companies can secure financing and bonding, but struggle with the labor. Two contractors joining forces can mitigate that, Natarelli told Construction Dive.

Nevertheless, there's a lot of work to be done. The Department of Labor estimates the industry will need to add 747,000 workers by 2026. The key to filling out those jobs? Continuing to elevate recruiting efforts.

"I see the industry really trying to reinvest back into this and reaching out to folks in high school to let them know there are careers here that are really good careers," Natarelli said.