Dive Brief:

- Construction’s biggest companies are booking more jobs as federal money accelerates infrastructure work, while firms under $100 million in annual revenues are having a harder time extending their backlog winning streak, according to Associated Builders and Contractors analysis.

- A 24.4% upswing in infrastructure backlog in August kept the overall backlog level 5.7% higher than in August 2022, according to ABC. That elevated level persists despite tightening credit, high financing costs and lingering recession fears, said Anirban Basu, ABC chief economist.

- “Backlog continues to be at the upper end of historic levels, with the infrastructure category registering substantial gains in backlog in August,” said Basu. “That suggests that a growing number of public works projects is poised to break ground.”

Dive Insight:

Backlog fell on a monthly basis for companies with revenues of less than $100 million a year. That mirrors the slight downturn in monthly numbers from July to August as overall industry backlog, including private development, dipped 1.1% lower.

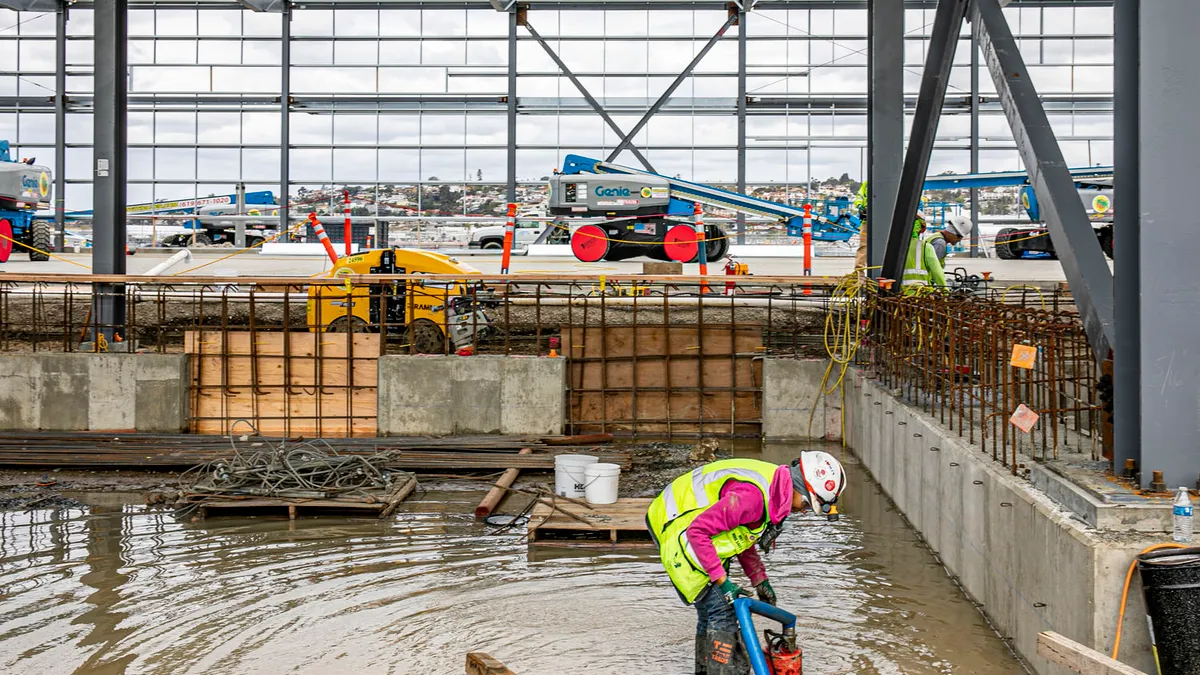

But it surged more than 30% for the biggest contractors — those with sales of $100 million or more — that are most likely to bid on billion-dollar, large-scale infrastructure projects. That swing has contractors more upbeat about the construction outlook, despite the fact that demand for their services already hovers around historic highs.

Given that environment, even the slightest upward movement in backlog in the short-term “is remarkable” given the issues facing the wider economy, such as tight credit, financing costs and recession fears, said Basu.

“There’s no sign of a construction recession in the near term,” he said. “If anything, contractors are more upbeat, as policy and technology shifts, along with economic transformation, are creating substantial demand for improvements and growth in America’s built environment.”

ABC’s Construction Confidence Index reading for sales, profit margins and staffing levels all moved higher in August, the first time all three categories improved over the month since February. The three readings all sit above the threshold of 50, indicating expectations of more growth over the next six months.

Only the West region posted a lower backlog from a year ago, while the South remains the region with the highest level of backlog, according to the analysis.

ABC’s backlog reading measures the work contractors have booked, but have not yet begun. The association releases the benchmark each month along with the Construction Confidence Index, which polls construction executives about their outlook on sales, profit margins and staffing over the next six months.