UPDATE, Dec. 22 — President Donald Trump signed the tax bill into law Friday morning in a "last-minute" ceremony at the Oval Office, The New York Times reported. Here's what construction companies can expect under the new legislation.

Construction companies should brace for change.

The 30-plus-year drought since the last tax code overhaul is now over as Congress sets out to vote on and place a now-finalized tax bill on President Donald Trump's desk. The bill slashes slashes the corporate tax rate from 35% to 21%, and also includes massive changes to how income earned or kept offshore is treated. Every industry could see effects — including higher education. Here's a 60-second overview of what the bill could change for the construction industry, and where other industries that impact construction stand on it:

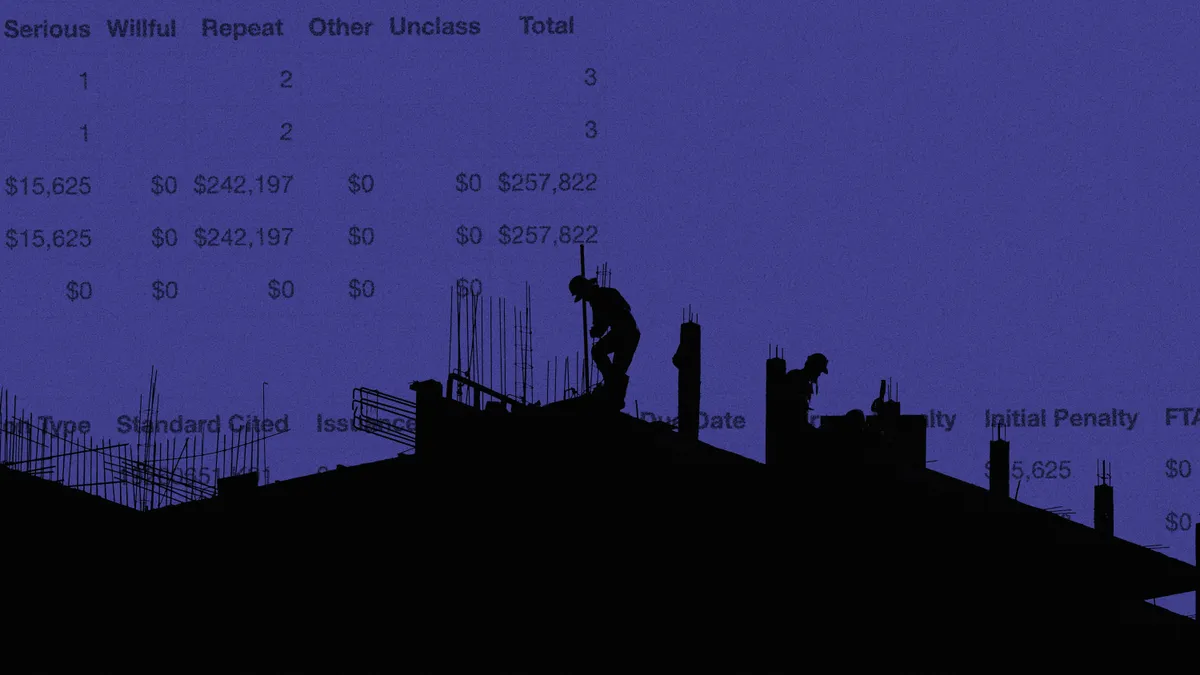

IMPACT: The public construction sector will benefit from the uninterrupted flow of private-activity bond financing, and both the contractors who are structured as pass-through entities and C Corporations will see significant tax relief.

POSITION: The retention of tax-free status for PABs, as well as favorable treatment of energy-related exploration and tax credits have some segments of the industry breathing a sigh of relief, but potential PAB use limits and the locking out of design professionals from being able to take advantage of the new, lower pass-through tax rate could result in some pushback.

ANALYSIS: The House GOP tax bill, passed early in November, took aim at PABs – a financing scheme that allows private entities developing public projects to borrow at the same tax-free rate as government agencies do – and eliminated them altogether. The Senate's version restored PABs, possibly driven by the expectation that they will play a big role in financing the president's $1 trillion infrastructure plan, but both chambers call for a termination of another popular funding vehicle, tax-exempt stadium bonds. Some states and municipalities rely on tax-free bonds for their contributions to the new construction and renovation of sports venues – often a condition of being able to snag a professional team – but, according to the Brookings Institution, the federal government loses out to the tunes of billions when projects that are financed this way.

The latest version of the reconciled bill also sets a new 21% tax rate for corporations, a break for everyone except those low-earners that currently pay 15%. But many construction companies are pass-through entities, a structure that allows owners to include business profits on their personal tax returns. The new tax reform measure gives those individuals a 20% break on that income, a bigger break that the House bill's rate of 25%. However, some in the industry were frustrated by a provision that professional service and consulting firms like architects and engineers to take that deduction.

The energy sector got better news when it was revealed that the Senate bill would reinstate the wind sector's production tax credit that the House bill eliminated. While the industry awaits the final version of the joint bill, word is that that credit, as well as one for the purchase of electric vehicles, will stay put. The measure also green-lights exploration in Alaska's Arctic National Wildlife Refuge.

Kim Slowey / Construction Dive

THE BIGGER PICTURE

Here's how the bill may alter other industries that impact construction.

HUMAN RESOURCES

IMPACT: Tax reform is expected to impact several areas of interest to HR: paid leave, fringe benefits, automation and offshoring.

POSITION: The tax proposal could, on balance, be good for companies and in turn good for HR professionals. The industry has not taken a specific stance on the issue to date.

ANALYSIS: Tax reform is expected to impact several areas of interest to HR including some core issues such as paid leave, fringe benefits, automation and offshoring.

One proposal would give employers a tax credit equal to 25% of an employee's salary if it paid them during FMLA leave. There are several proposals to scrap deductions for benefits employers often are involved in, like transportation and relocation expenses.

Some thought the bill might create new tax incentives to encourage employers to create jobs. (That's what the Trump administration promised, after all.) Instead, it proposes to allow employers to write off the full value of machines right away, perhaps encouraging automation without an accompanying incentive for hiring humans.

The bill proposes to exempt some income from U.S. companies with operations outside the country. This encourages business to send work overseas, some experts have said.

HR will probably like the paid leave proposal, as it gets at an existing problem without a mandate. Instead, it's an incentive to do something many are already doing anyway. On the flip side, the fringe benefit exclusions do the opposite, creating a disincentive for employers to offer those benefits.

The automation and offshoring items are, on their face, good news for companies. Some, however, say they're not as useful without an incentive to hire people, too. After all, machines can't be up-skilled when needs shift.

Kate Tornone / HR Dive

TECHNOLOGY

IMPACT: Tech companies with large overseas cash holdings will benefit from cuts to corporate tax rates, but SMBs and companies with larger domestic holdings may not be as lucky.

POSITION: Big tech lobbied hard for a cut to the corporate tax rate, but the loss of R&D tax breaks and new income tax applications on grad students may undercut the win.

ANALYSIS: The corporate tax rate currently sits at 35%, but the tech sector on average pays much lower than that. For example, the average tax rate is about 16% for computer services companies and about 25% for internet software companies, according to Aswath Damodaran, professor at the Stern School of Business professor. Moving the overall rate down to 21% may not benefit tech as much as other sectors since the industry already has lower rates.

The lowered, one-time repatriation tax, however, will have a greater effect. Tech tops the list of U.S. companies with the largest overseas cash holdings. More than $564 billion is held abroad between Apple, Microsoft, Cisco, Alphabet and Oracle — $246 billion of which belongs to Apple alone.

The tax levied on overseas cash will drop from the current 35% corporate rate to 15.5% under tax reform. Less liquid assets will be taxed at 8%. For companies without large overseas cash holdings, the benefits are less substantial.

Alex Hickey / CIO Dive

SMART CITIES

IMPACT: Overall, tax reform proposes various threats to city governments, primarily in the areas of infrastructure, key tax credits and the development of economically sustainable communities.

POSITION: Most city leaders, including those of the U.S. Conference of Mayors and the National League of Cities (NLC), opposed primary versions of the bill — and are still wary in light of the conference report.

ANALYSIS: The final conference bill is seen as one that "protects the tax exemptions for most bonds, preserves many key credits and partially protects the deduction for state and local taxes (SALT)," according to a statement from NLC President Mark Stodola. However the bill could still eliminate a few key resources for cities, which could in turn cause cities to fall short of economic and development goals.

One key elimination is the tax exemption of advance refunding bonds, which are defined as "any bond used to pay principal, interest, or redemption price on a prior bond issue (the refunded bond) ...A current refunding occurs when the refunded bond is redeemed within 90 days of issuance of the refunding bonds. Conversely, a bond is classified as an advance refunding if it is issued more than 90 days before the redemption of the refunded bond." Cities currently use these bonds to refund existing debt in response to economic downturns.![]()

Kristin Musulin / Smart Cities Dive