A high-tech takeover is underway in construction, and it's changing what we build and how we build it. One area in which the trend is particularly apparent is in the growing list of cloud-based workflow management software that lets teams access project information anytime, anywhere.

Turning workflows digital has helped teams collect data, and lots of it, according to Pat Keaney, product management director at Autodesk. The software developer is currently piloting a new program, Project IQ, that analyzes project data to help contractors identify and manage risk on the job site.

“Out in the field on any given day, you may have thousands of open issues on a project, you may have hundreds of subcontractors,” Keaney said. “The reality of how people work on a job site is they are getting inundated by data, and, at the same time, there are more data-capture options than there ever have been.”

Tracking job sites in real time

Autodesk is not alone in their effort to bring cloud-based, mobile workflow technology to the job site — though they’re a bit ahead of the pack with IQ. Construction tech startup PlanGrid, for example, last month announced new functionality for its building plans app that lets crews file and update custom job-site reports from their mobile devices. PlanGrid said it will offer ways to analyze the data — such as tracking labor hours or site conditions — in the coming months.

“Back when I was a superintendent [in the early 2000s], we didn’t have a lot of these tools,” said Dustin Hartsuiker, manager of technology solutions at Swinerton Builders. “It used to be a bunch of checklists, a bunch of field notebooks, a bunch of lists of problems that we would get from the architects and engineers.”

Swinerton is one of 12 companies in Autodesk’s Project IQ pilot.

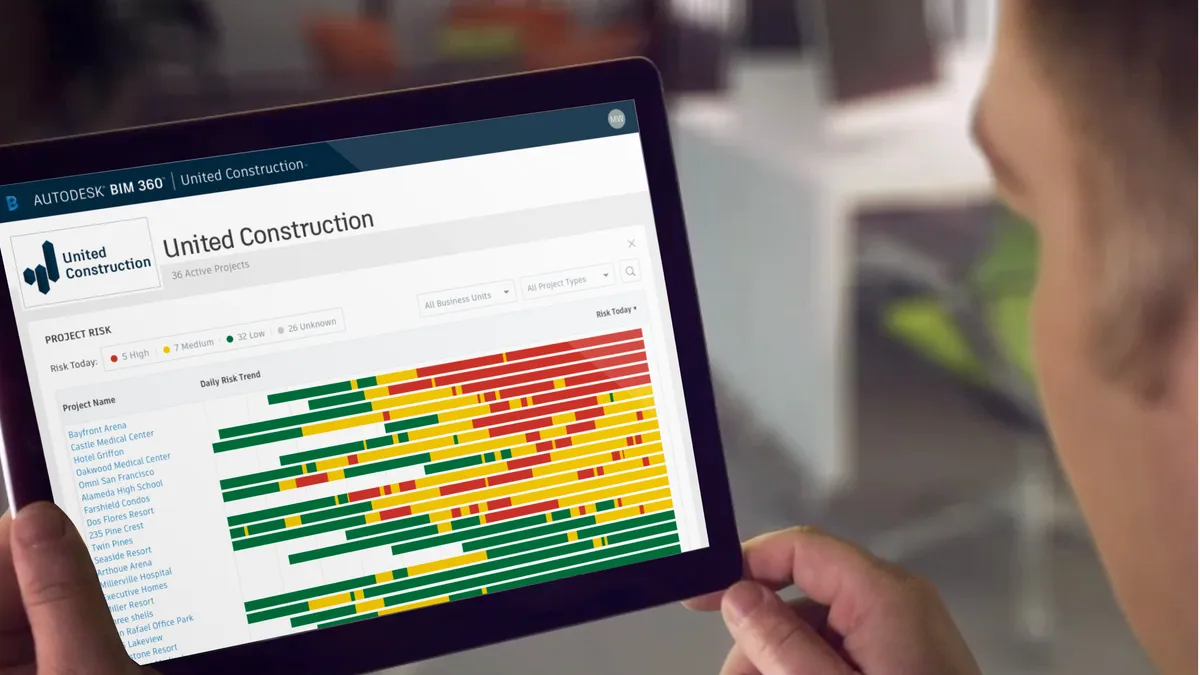

IQ is part of Autodesk’s BIM 360 construction project management software platform. Currently, it pulls in data uploaded by Autodesk customers to Field, a component of BIM 360. Keaney expects that, over time, IQ will pull from other BIM 360 products as well as external data sources.

IQ was borne from the presence of ample Field data, along with the uptick in mobile use industry-wide, growth in data-capture technology and the volume of data that can be gathered on a job site (such as drones, digital fabrication and even wearables), Keaney said. All that encouraged Autodesk to consider what would happen if it mined its customers' Field data and applied a little machine learning.

“We think of [IQ] like … a super-bright PE who's on top of everything and can grab you at the start of the day and say, ‘Hey, today these are the top 50 things we need to focus on to make sure nothing falls through the cracks, and then these are the five subcontractors that I'm going to go work with because they're trending risky today,’” she said.

Autodesk uses code names for internal projects before they’re formally released, so when it does roll out IQ to all BIM 360 users, the program will likely have a different name, Keaney said. For now, it’s helping those construction companies manage risk on the job. And, in turn, those companies are teaching the technology a thing or two about how construction works.

Machine learning on the job

Swinerton is using IQ to monitor subcontractor performance with an eye toward improving project schedules and job-site safety.

“What we can understand is not only did [a sub] have a rough job but that they've had five rough jobs over the last three years,” Hartsuiker said. “So now we understand that trade partner is beginning to impact our ability to have successful projects.”

That information can be looked at by project, by division and even company-wide, helping contractors to decide whether to dedicate more, different or fewer resources to an issue.

For Layton Construction, another company piloting IQ, machine-learning technology has helped them evaluate risk factors more efficiently.

“In the old days, we would have to call those subcontractors in and say, ‘Hey we've kind of been noticing things are falling off, you don't have enough manpower here,’” said Rich Holbrook, director of construction operations at Layton. “We still have to do those things, but this AI helps us recognize more easily what some of those problems are ahead of time so that we can act on them sooner.”

The trick, Hartsuiker and Holbrook said, is making sure their crews — subs included — are using the software properly. Machine-learning technology responds to data inputs, meaning that it learns from the behavior of its users.

“We have to make sure we're closing the issues timely and noting that information accurately in the program so the risk severity gets minimized,” Holbrook said. “It's helping us focus on doing a better job with our data entry.”

Layton knows it can’t manage subcontractors as effectively as those subs can manage themselves, so the company relies on each of them to help make sure the inputs are accurate.

"The machine needs to learn that and feed that back into the database so a month from now the contractor isn’t teaching it the same thing."

Dustin Hartsuiker

Manager of technology solutions, Swinerton Builders

Context matters, too. Hartsuiker cited a theoretical example of a waterproofing subcontractor being labeled as high-risk. Seeing that, the contractor opens IQ and drills down into the data to see why the sub is flagged. There, the contractor sees that the software has identified the words “roof” and “penetration” multiple times in the specs. The contractor knows the waterproofer is not there to patch holes — something that would cause the task to earn higher priority in the system due to the potential for water damage — but rather to complete scheduled work. The contractor then manually downgrades risk assigned to the sub and the related task.

“The machine needs to learn that and feed that back into the database so a month from now the contractor isn’t teaching it the same thing,” Hartsuiker said.

Autodesk is working on how the software can provide that level of granularity. “We are now looking at how do we look for repeat patterns and how do we show where you're not seeing the kind of progress we hope to see either at the project level or the subcontractor level,” Keaney said.

The future of AI for construction

IQ pilot users are large building construction companies in the U.S. and Europe with lots of data to parse, Keaney said, though Autodesk is also exploring horizontal construction applications as well as use by smaller firms.

Down the line, IQ could expand into other forms of predictive analysis. “It's not difficult to imagine us being able to leverage some of the … design patterns that we see in the virtual construction phase and to be able to ultimately correlate which designs are more likely to lead to schedule delays, water risk, cost overruns, etc.,” she said.

Layton piloted IQ on eight projects that represent the company’s business units. It focused on training existing team members to champion the technology throughout the company and educate other users, Holbrook said. Today, IQ is available to the company’s roughly 200 active construction projects, though uptake varies.

At Swinerton, the software is available company-wide, but Hartsuiker and his team are leaving it up to individual project teams to decide how to use it. He said the company has been “pushing IQ the most” on a 30-story apartment high-rise in Denver.

“As an industry, we're beginning to develop an understanding that all of this data makes a big difference, and we're beginning to start to work with the tools that can help us analyze that data to become more efficient,” Hartsuiker said.