Dive Brief:

- Fluor announced Friday it earned $66 million, or $0.38 per diluted share, in the second quarter of 2022, compared to a loss of $115 million in the same period last year.

- The Irving, Texas-based company reported its revenue dropped to $3.3 billion from $3.7 billion a year ago, about an 11% decrease. Revenues declined due to the completion of a mining project in Australia, a metals project in Canada and data center jobs in Europe and the closure of the LOGCAP project in Afghanistan, according to the report.

- Revenue missed the $3.5 billion consensus, while the adjusted, non-GAAP EPS of $0.13 fell short of the $0.30 consensus, according to stock analysis site Seeking Alpha. The miss was in part due to issues with the Gordie Howe infrastructure project such as $32 million in project charges for additional inflation and cost growth, said Andrew Wittmann, senior research analyst at Milwaukee-based financial services company Baird, in a research note. Fluor adjusted its EPS guidance now to $1.15-$1.35, down $0.05 at the high end.

Dive Insight:

Fluor’s backlog fell to $19.52 billion from $20.8 billion, about a 6% drop, due to declines from its Energy and Mission Solutions segments. The firm's Urban Solutions unit increased backlog to $7.71 billion, up 9.4% from $7.05 billion.

New awards in the Urban Solutions segment increased this quarter to $1.94 billion, around a 214% jump from $617 million, due to large awards for a mining project in Australia, a $547 million highway project in Texas and Intel semiconductor facilities in Arizona and Malaysia, according to the earnings report.

David Constable, CEO of Fluor, said he expects that the company will benefit from the recently passed CHIPS Act, as more companies look to bring their manufacturing facilities back to the U.S. He said he expects millions of dollars of awards in the short term, and a couple billion in the first quarter of next year due to CHIPS.

“We’re seeing other governments outside of the U.S. following our lead with incentives,” said Constable during a Friday call with investors. “Think about Germany and Italy, countries like that, where we’ll see semiconductor manufacturing picking up. We’re bullish on it.”

New awards in the Missions Solutions segment decreased due to extensions on two Department of Energy contracts booked in the 2021 period and the cancellation of the Pantex Y-12 project, a national security complex. Backlog also included $76 million and $445 million of unfunded government contracts.

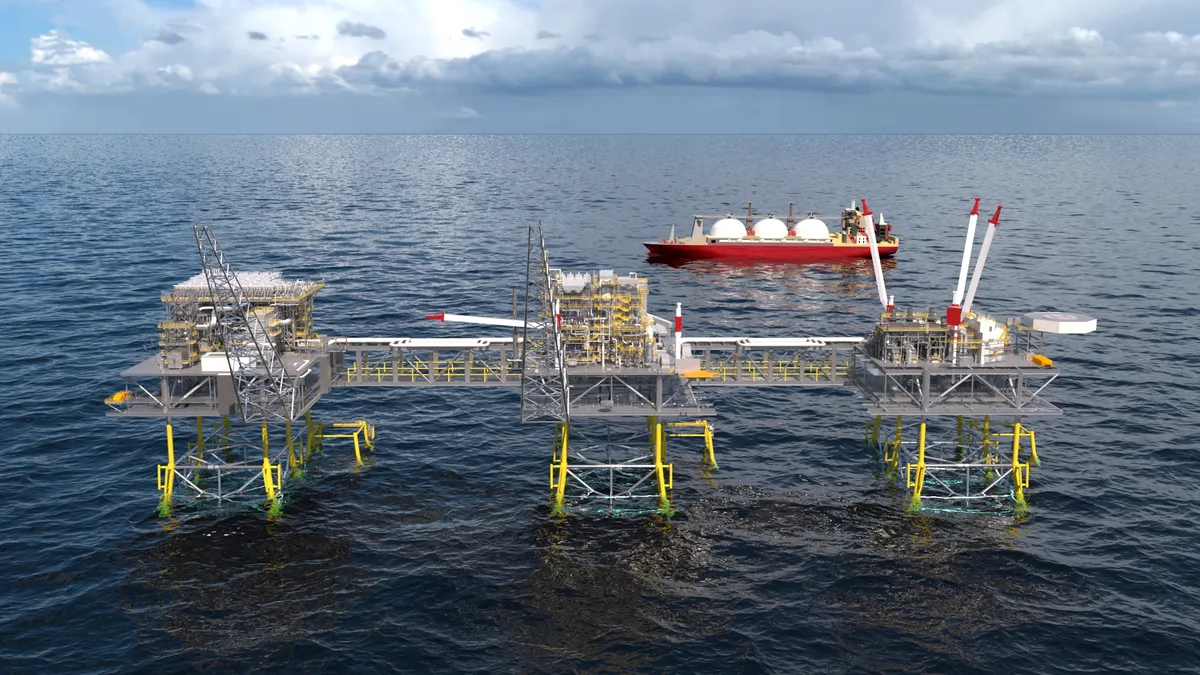

Its Energy Solutions backlog decreased during the 2022 period “due to a lack of significant new awards,” according to the report. A few recent awards in the segment include a lithium chemicals project in China, a refinery project in Mexico and the Fortress Energy FAST LNG 2 project (pictured above.)

“We’re really pleased with the pace and timing of new awards in a challenging inflationary environment,” said Constable. “I believe that we remain on track to deliver our expectations for 2022 and on our key strategic priorities for 2024.”

Takeaways from earnings

Wittmann said in a research note the earnings miss did little to change his position on the company’s long-term outlook.

“Fluor specializes in large-scale, multi-billion dollar ‘mega projects’ which we believe differentiates the company from peers,” said Wittmann in the note. “[Fluor is] one of only a handful of companies capable of executing the largest and most technically complex engineering and construction projects located throughout the world.”

But demand for Fluor’s services in private sector markets is largely determined by macroeconomic conditions and fluctuations in commodity prices. Wittmann said the company faces risk from raw material cost fluctuations, such as aluminum, copper, nickel and iron ore, particularly on fixed-price and guaranteed maximum contracts, which may not contain commodity pricing safeguards in some cases.

He added Fluor’s concentration in large projects also poses risks.

“While Fluor’s average contract size is roughly $20 million to $30 million, and the firm benefits from a diverse portfolio of project work, much of Fluor’s business is driven by large project awards,” said Wittmann. “Large projects result in lumpier bookings and can result in larger project charges, should project execution deteriorate.”