Dive Brief:

- A development joint venture has secured $325 million to complete construction on a 41-story, mixed-use apartment building in Seattle, according to REBusiness Online

- The Molasky Group and Chinese investor Binjiang Group have arranged $225 million of financing and investment for the former Potala Tower and have obtained a $100 million construction loan that will convert into a permanent loan once construction is finished. PCL Construction will serve as general contractor on the project.

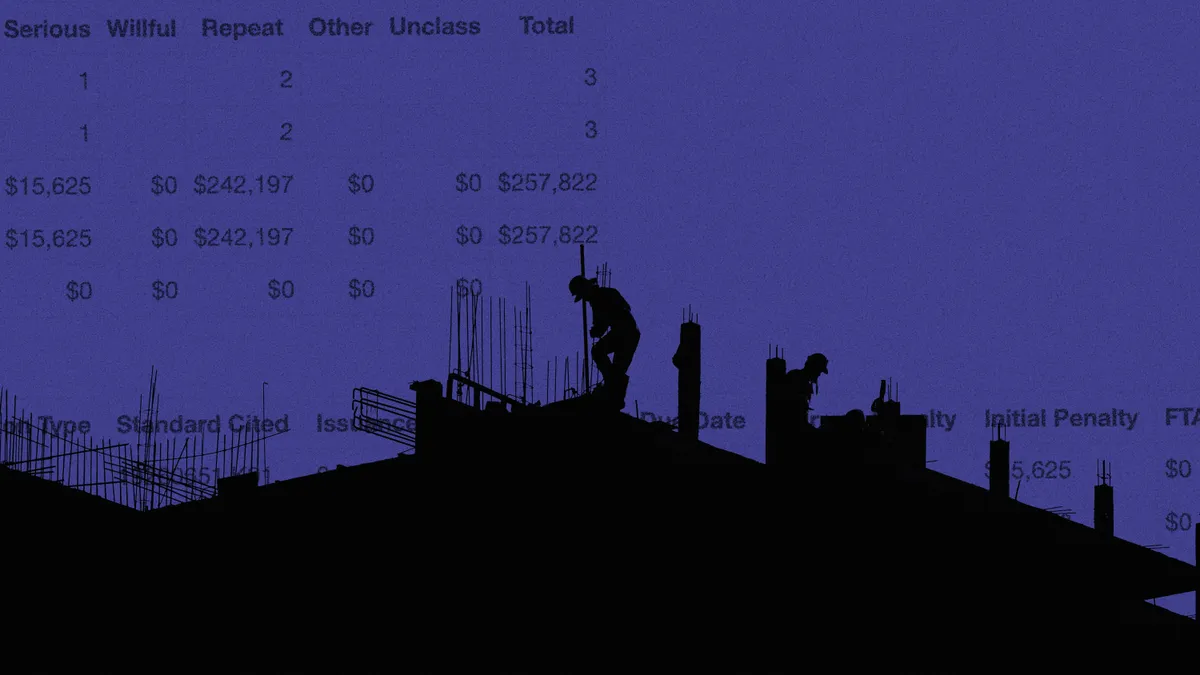

- Progress on the project was held up in court after developer Lobsang Dargey was charged with — and later pleaded guilty to — securities fraud for using EB-5 visa program funds for personal use.

Dive Insight:

EB-5 visa applicants, who can earn a trip to the front of the line of the green card process in exchange for a $500,000 to $1 million investment in a qualifying project, reportedly invested a total of $83 million in Potala Tower before Dargey was arrested.

The program has been under scrutiny by lawmakers who want to increase the investment level and put tighter controls on the program. Dargey's arrest got some legislators talking about doing away with the EB-5 option completely, but it has been a significant financing vehicle for many U.S. projects, including Manhattan's Hudson Yards, which reportedly attracted $600 million in program funds.

Rogelio "Roy" J. Carrasquillo, partner at Fox Rothschild in New York City, told Construction Dive last month that the immigration aspect of the EB-5 program was subject to constant monitoring but that attention to the construction and development side had been lacking. He added that not only does the government need to make sure the program is operating as intended, but that investors also need to be protected from scams like Dargey's.

Of course, not all foreign investment is tied to a green card. Since 2015, foreign companies — mostly from China and other Asian countries — have snapped up approximately $4 billion worth of real estate in the Seattle commercial market. The city had seen significant foreign investment in its residential sector, but that has shifted to interest in apartment developments, office buildings, condominiums and warehouses as well. While pricier coastal metros like New York, Los Angeles and San Francisco see plenty of foreign investment, more affordable markets like Seattle are now beginning to see increased commercial interest.