The coronavirus outbreak in China could add another layer of unpredictability to the many uncertainties facing commercial building in the U.S. From labor shortages and tariffs to an upcoming presidential election, the industry entered 2020 facing many unknowns, and experts say the fallout from the COVID-19 illness, caused by the new coronavirus, is one more factor poised to affect construction firms.

The outbreak that has sickened nearly 75,000 and killed more than 2,000, mainly in China, could have ramifications even for U.S. builders with no presence in the region. Government containment efforts and quarantines have slowed or shut down factories in dozens of cities and provinces, leading to forecasts of a sharp falloff in production of everything from cars to smartphones, according to the New York Times.

Richard Branch, chief economist for Dodge Data & Analytics, said that the American construction industry will not be immune to the coronavirus’ impact. For commercial builders that rely on Chinese-made goods or materials, this could mean higher material costs and potentially slower project completions.

By Branch’s estimate, building product imports from China account for nearly 30% of all U.S. building product imports, making China the largest single supplier to the U.S.

“With China’s manufacturing output declining as factories are temporarily sidelined," he said, "it’s likely that U.S. building product supply chains will be affected, with costs potentially moving higher."

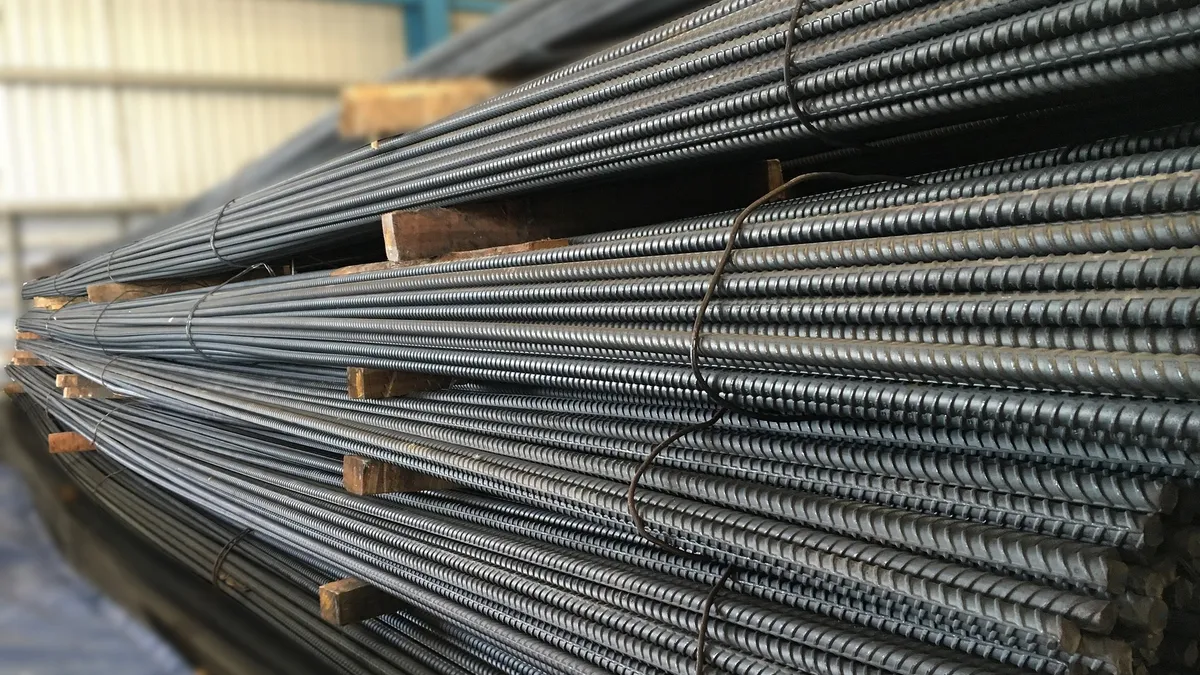

U.S. builders look to China for everything from steel and other building materials to cabinets and fixtures, according to Daniel Pomfrett, vice president of forecasting and analytics at construction cost consultant Cummings. The virus has led to a slowdown of supply to the market that is expected to cause price increases across many of these commodities.

“Items such as copper, aluminum and casework look to be some of the key products affected and already we are seeing price increases,” he told Construction Dive.

Steel is a bit trickier to forecast, he said, because its price was expected to rise this year after prices bottomed out due to oversupplies from both China and U.S. makers. A reduction in Chinese supply due to the outbreak could help to even out supply and demand, he said, driving prices up faster than was expected. On the other hand, reduced Chinese demand caused by the outbreak may counteract most of the upward push.

Either way, U.S. producers of structural steel will help keep price fluctuations to a minimum, he said.

Short-term uncertainty

The downturn has affected U.S.-based companies like Trimble, Apple, General Motors, Ford and Nissan. Leaders of global construction firms AECOM, Fluor and Lendlease have both noted little to no impact as of yet in recent earnings calls.

"We'll continue to evaluate that guidance as we start to see things hopefully return to normal,” AECOM CEO Michael S. Burke told investors. "At this point we don't expect it to have any impact on our business."

Peggy Marker, president of Ft. Lauderdale-based Marker Construction Group, said she has been keeping an eye on the situation, most notably on how the slowdown in manufacturing could affect imports of structural steel from China, which her company uses on some of its healthcare, hospitality, multifamily and other commercial projects.

While she realizes it may cause a short-term bump in steel prices, the worst part is not knowing how long the crisis will continue, she said.

“Nobody has any kind of handle on how long this is going to be going on or exactly how it’s going to impact everything,” she said. “From what I understand they think the virus is starting to plateau, so hopefully things will return to normal shortly.”

As the spread of the virus begins to slow, some Chinese workers are starting to return to their jobs. But even as factories reopen, they are unlikely to be fully staffed, according to the American Chamber of Commerce in Shanghai.

When production does pick up again, it will take time to ramp up while facilities work through a backlog of orders and transportation networks come back online after regional quarantines lift, according to Supply Chain Dive.

All of these factors will come into play in determining whether construction materials prices will rise in the U.S.

“The exact extent to which they increase will be determined by how quickly the virus can be contained and how much product can be substituted from other countries,” Branch told Construction Dive.

Business as usual

Because the virus is just one more potential risk among several others already on contractors' radar, firms like Marker's can fall back on time-tested strategies for protecting themselves.

She said her company’s first line of defense against volatile costs is to have a variety of sources and suppliers on hand for when prices start to get out of control. She said when Chinese granite was in short supply a few years ago, for example, her company worked to find more local vendors.

In addition, most of her suppliers' bids are locked in for between 30 and 90 days, which provides a buffer from unexpected price hikes.

“Aside from that,” she’ll keep on with business as usual, she said, “trying to negotiate good deals with subs and suppliers."