Dive Brief:

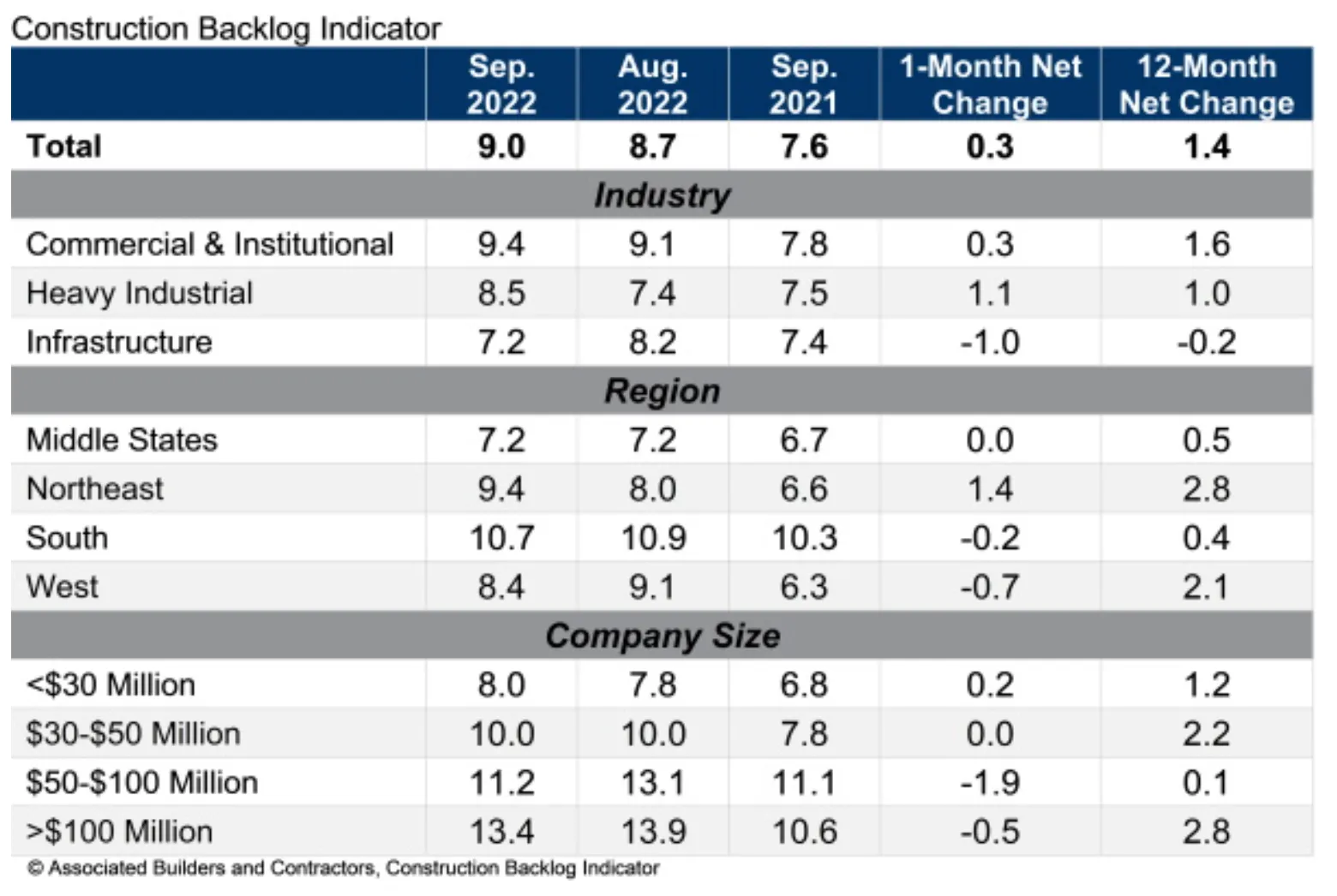

- Further defying expectations of a looming recession, nonresidential contractors added more to their backlogs in September and surpassed the level of upcoming projects they had before the pandemic, according to Associated Builders and Contractors.

- ABC’s Construction Backlog Indicator grew to 9.0 months in September, its highest reading since May 2022 and slightly above the 8.9 reading seen in February 2020, immediately before the pandemic. The indicator measures the number of jobs contractors have signed, but haven’t started working on yet.

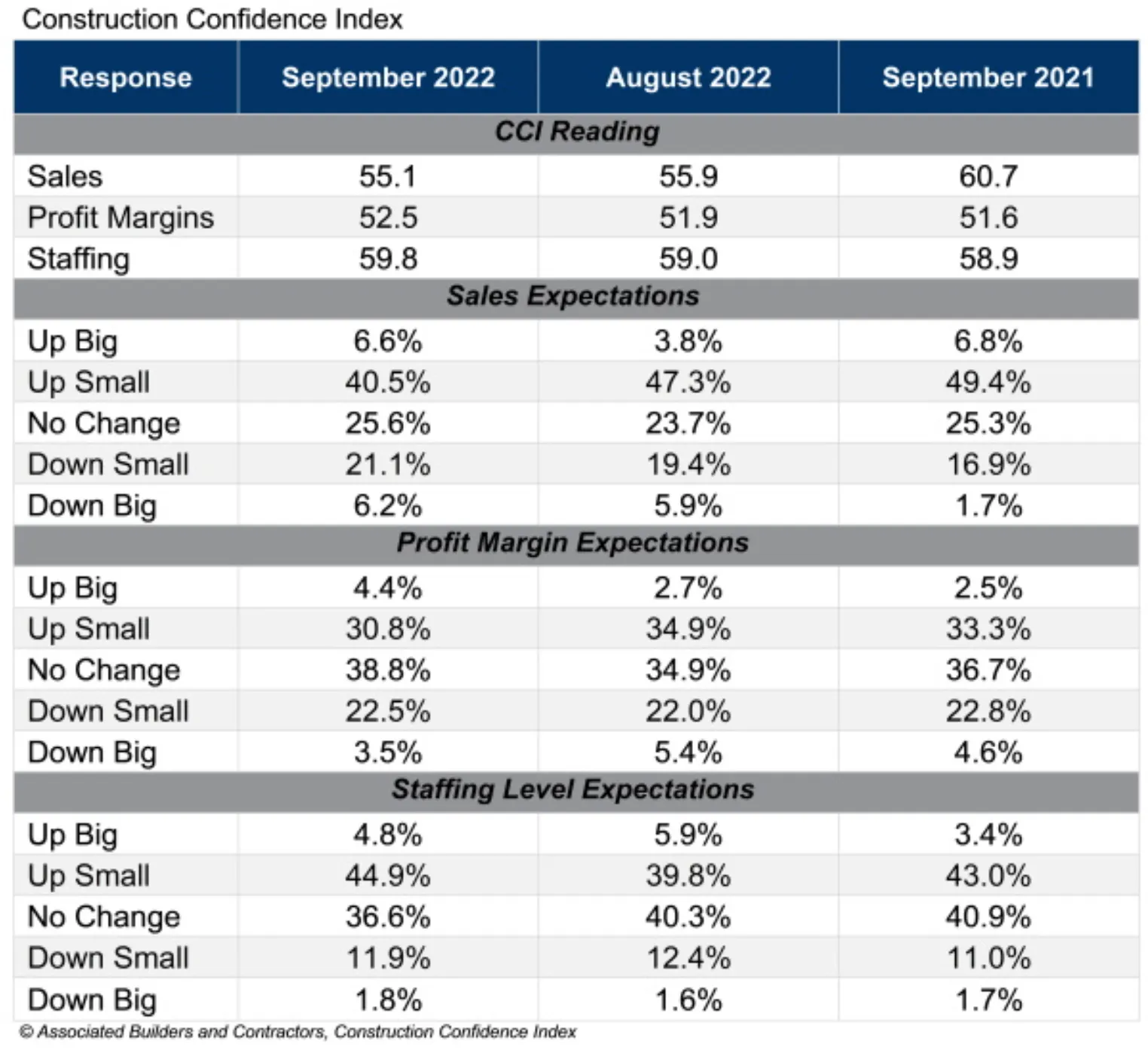

- The influx in new jobs further bolstered contractors’ positive outlook for both staffing levels and profit margins over the next six months, though the overall expectation for sales faltered slightly.

Dive Insight:

Backlog in heavy industrial increased sizably in September, spurred by a 21.5% year-over-year increase in manufacturing-related construction spending.

The booking of new projects, plus an even more optimistic outlook on profits and hiring, defies predictions of a recession taking the air out of commercial construction’s recovery.

Recent readings of the Architectural Billings Index, as well as the latest quarterly market forecast from Newton, Massachusetts-based AEC consultant PSMJ Resources indicated that economic storm clouds could be gathering over the sector.

Contractors shrugging off those concerns also flies in the face of the Federal Reserve’s interest rate hiking campaign, which has unleashed five increases on the market already this year in an effort to tame historic inflation.

“One would think the recent surge in interest rates would be enough to dampen contractor confidence,” said Anirban Basu, ABC’s chief economist, in a statement. “Instead, project owners continue to move forward with a significant number of projects. Faced with high demand for their services, contractors continue to show pricing power, helping to offset rising compensation and other construction delivery costs.”