While the broader technology sector has struggled with layoffs and flagging demand, the contech market is plugging along. Companies that specialize in drones, AI and procurements completed successful investor rounds recently, and plan to expand as the year continues. Read more about startups that got investor funding below.

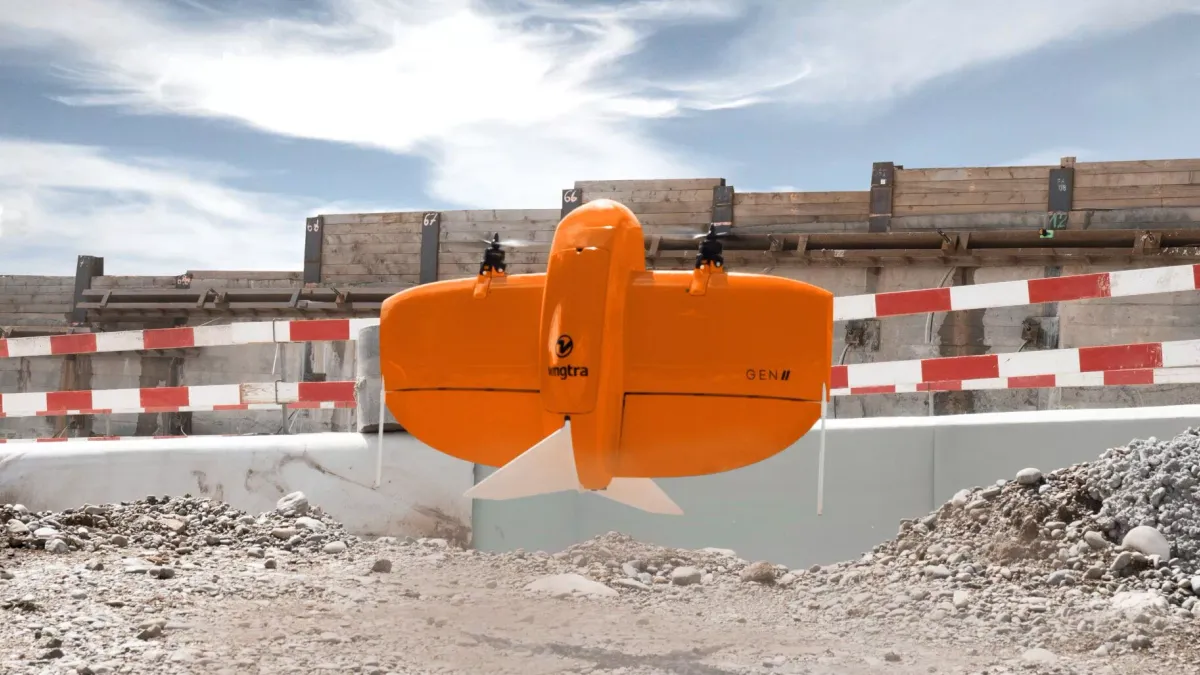

Wingtra

Zurich-based commercial drone manufacturer Wingtra raised $22 million in a series B funding round, the company announced on March 21. The funding round included DiamondStream Partners, EquityPitcher Ventures and others, according to the company.

Wingtra builds professional survey drones that can be piloted manually, develops software that makes drones autonomous and operates the WingtraPilot app, which pairs with the drone to collect and process aerial survey data, according to the company.

With the funding, Wingtra will grow its operations, according to the release. The company also hired more executives to push its plans forward.

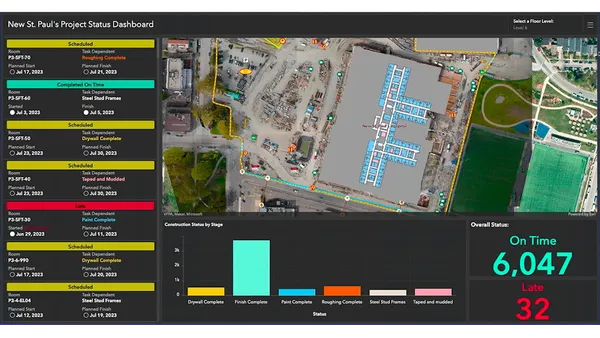

Togal.AI

Miami, Florida-based software firm Togal.AI announced that it raised $5 million in a pre-Series A SAFE round with a $50 million valuation cap, according to a March 21 press release shared with Construction Dive. A SAFE round of funding means that the investing party can turn that investment into equity at a later date, such as at the next equity financing round or liquidation event.

The round was led by Florida Funders, based in Tampa, along with a roster of new and existing investors, including executives from Facebook parent Meta and Goldman Sachs.

Togal.AI claims to be the first and only estimating software that uses deep machine learning to help contractors with the bidding process. The software detects and measures project spaces in seconds with 97% accuracy, the company claimed in the release, which reduces an otherwise laborious and time-consuming process.

Field Materials

San Jose, California-based software firm Field Materials announced it raised $4.65 million in a seed funding round on April 6. The round was led by San Francisco-based venture capital firm Blumberg Capital, and joined by Zacua Ventures.

The startup’s product is an AI-driven program built to streamline materials procurement for contractors. It can perform tasks that were historically done in Excel, Word and on paper, according to the company. The software is compatible with existing estimating and accounting programs and uses AI-powered systems to monitor delivery slips and invoices to catch errors and minimize delays.

Mercator AI

Calgary, Alberta-based project procurement firm Mercator.AI raised $3.75 million and successfully oversubscribed its seed round, according to a March 21 press release shared with Construction Dive. Freestyle Ventures and Builders VC co-led the financing.

The program provides a variety of functions from the beginning to the end of the construction process, the company said. It surfaces new projects while notifying users about jobs that are a good fit for their firms, keeps project information in one place and provides up-to-date information on project awards to competitors, according to the company’s website.

With the influx of funding, the company plans to continue its expansion in the U.S. and Canada, broaden the services it provides and grow its team.

StructShare

Austin, Texas-based procurement automation firm StructShare raised an additional $8 million in funding, the company announced on March 21. The type of funding was a seed round, according to CrunchBase.

The round was led by Kompas VC, a venture capital firm focused on the built environment and construction digitization, according to the company. Cemex Ventures also participated in the funding round.

StructShare said its contractor-focused software automates all procurement processes in the field, office and warehouse. This reduces costs and material waste, prevents purchasing mistakes and enables full control over spend and inventory, according to the company.

With the funding, the company plans to launch new products that aid subcontractor procurement processes, enhance materials management capabilities and make the best buying decisions.