Dive Brief:

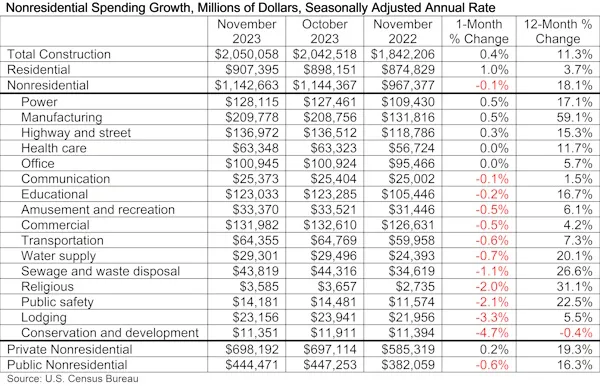

- Nonresidential construction spending dropped 0.1% in November to a seasonally adjusted annual rate of $1.134 trillion, according to Associated Builders and Contractors’ analysis of U.S. Census Bureau data.

- The decline ends a 17-month streak of growth, largely fueled by manufacturing and infrastructure spending. Despite the decrease in November — which Anirban Basu, ABC chief economist, attributed to a drop in public sector activity — several private sectors have seen construction increase significantly in the last year.

- “Nonresidential construction spending dipped in November due to a 0.6% decline in public-sector activity,” said Basu. “Despite the monthly setback, spending is up an impressive 18.1% over the past year, with the gains evenly distributed between the public and private sectors, and currently sits just below the all-time high established in October.”

Dive Insight:

When factoring in the residential sector, total construction spending increased 0.4% in November to a seasonally adjusted annualized basis of $2.05 trillion, according to the Associated General Contractors of America.

“Private construction spending is showing renewed vigor in homebuilding and selected private nonresidential categories, while developer-financed spending languishes,” said Ken Simonson, AGC’s chief economist, in the release. “Unfortunately, public construction spending appears to have stalled.”

Private nonresidential construction rose 0.2% in November, marking the fifth consecutive monthly increase. Public construction spending dropped 2.2% in November, despite a nominal increase in the largest public sector: highway and road construction.

Although spending decreased from October to November in 11 of the 16 nonresidential categories, in the last 12 months only one sector, conservation and development, hasn’t seen positive growth. Spending in that area has decreased 0.4%.

“Manufacturing-related construction continues to surge and now accounts for roughly 45% of the year-over-year increase in nonresidential spending,” said Basu.

Other sectors like education, healthcare and power construction have all increased by double digits in the last 12 months, paired with success in roadwork and waste disposal projects.

“With only 24% of contractors expecting their sales to decline over the next six months, according to ABC’s Construction Confidence Index, the industry appears set to carry momentum into the new year,” Basu said.