Dive Brief:

- Nonresidential construction input prices dipped for a second consecutive month in August, providing more evidence that construction material costs peaked in June and supporting newfound optimism in the sector.

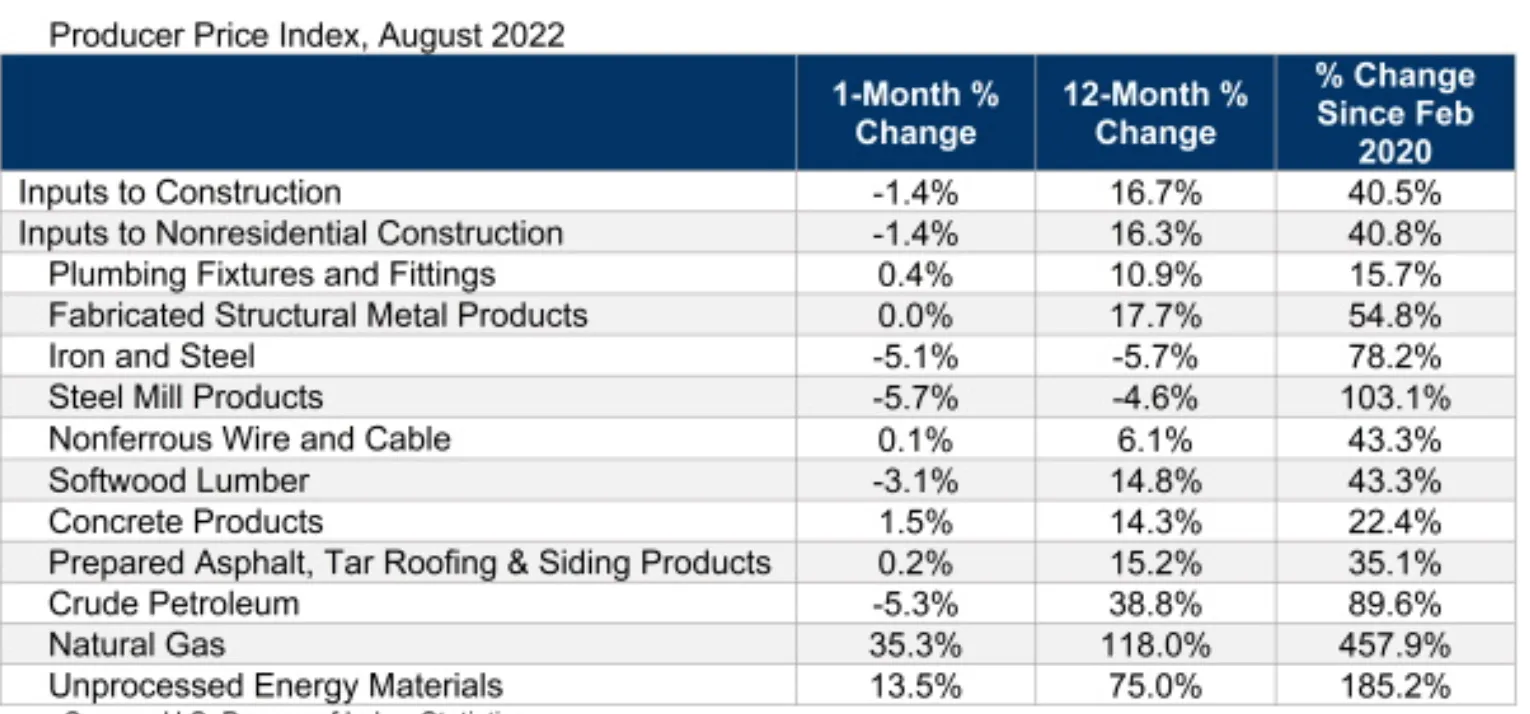

- Prices for steel mill products, crude petroleum and softwood lumber were down 5.7%, 5.3% and 3.1%, respectively, for the month, while cost for all nonresidential supplies moderated 1.4%, according to an Associated Builders and Contractors analysis of Bureau of Labor Statistics producer price index data.

- That builds on momentum from July, when nonresidential input prices fell 1.8% after rising by the same amount in June. For the year, however, the prices for products that go into nonresidential structures and other construction projects are still up 16.7%, ABC said.

Dive Insight:

The news built on muted optimism that the sector may be able to avoid the full brunt of a recession, even if the broader economy experiences further contraction in the third quarter.

“Today's Producer Price Index report supplies additional evidence that wholesale inflation is edging lower from the highs observed earlier this year,” said Anirban Basu, ABC’s chief economist.

Earlier this week, the ABC’s Construction Confidence Index, which measures the outlook of commercial construction pros over the next six months, rebounded from recent pessimism. Contractors reported steady backlog, meaning the amount of work they’ve won but haven’t yet started has remained stable.

But in his most recent PPI analysis, Basu pointed to additional economic headwinds and cautioned contractors not to become complacent in the current environment.

“With COVID-19 lockdowns persisting in China, the world's leading manufacturer, and Europe facing severe energy crises, supply chain disruptions will persist,” said Basu. “That suggests that construction materials and equipment prices are likely to remain elevated even if year-over-year price increases moderate.”

Saying that now was not the time to declare victory, Basu emphasized that construction workers are still in short supply, and that inflation could remain stubbornly high. “Estimators and others in the construction industry should be on guard for occasional surges in inflation during the months ahead,” he said.

He connected those comments back to this week’s somewhat surprising confidence reading, when contractors indicated they expected profit margins to expand going forward. Previously, contractors said wage pressures were eating into their profits. But Basu indicated that reversal may not be complete.

“Many contractors expect to pass along their cost increases to project owners during the months ahead,” said Basu. “Some contractors may be in for a rude surprise. With borrowing costs rising and risk of recession elevated, it is perfectly conceivable that project owners will become increasingly resistant to elevated charges for the delivery of construction services.”

Instead, contractors should stay “laser-focused on cashflow and weeding out costs as opportunities arise,” Basu advised.