Dive Brief:

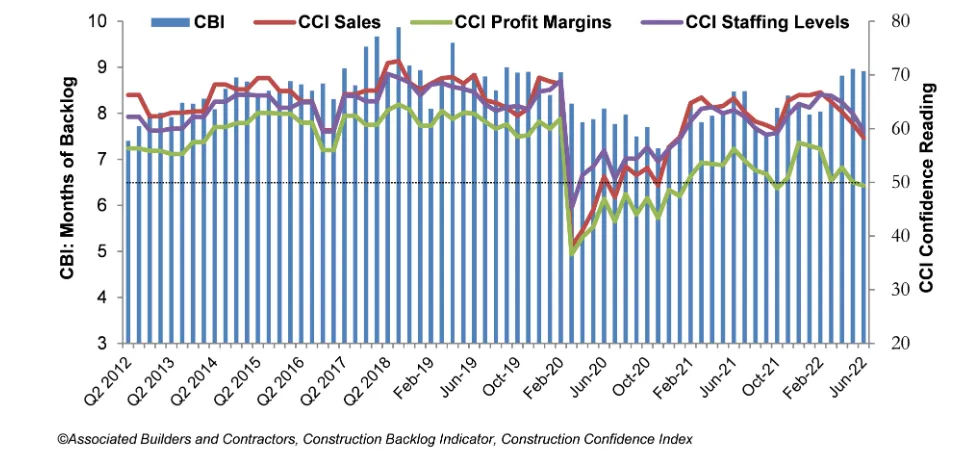

- Contractor confidence took another dive in June as backlogs, the lifeblood of future work in the construction industry, dipped into negative territory for the first time since January, according to Associated Builders and Contractors.

- Contractors extended their pessimistic outlook to a fourth straight month, with expectations for profit margins falling below a score of 50, indicating construction pros now think profits will shrink over the next 6 months, for the first time since October 2021. The outlook for sales and staffing levels also declined in June from a month before, though those metrics remained in positive, or growing, territory.

- Backlog, which tracks projects contractors have won, but haven’t yet started, dipped slightly, by 0.1 to 8.9 months. But that was higher than the year-ago number of 8.5 months, meaning contractors still have more work booked now than in June 2021.

Dive Insight:

The somewhat glum outlook from contractors about the profitability of their companies going forward, despite having a longer runway of work now than last summer, reflects a stark change from early 2022. “Several months ago, there was conjecture that contractors were generally too upbeat regarding their collective future,” said ABC Chief Economist Anirban Basu in a release. “Increasingly, the data suggest that they were.”

He said previously, many contractors reported surging backlog and an ability to pass along hefty cost increases to project owners. Subsequently, they expected sales, employment and profits to grow, not contract. But now, as inflation has spurred material prices upward, supply chain issues have delayed deliveries and surging wages have impacted profitability, the pendulum has swung the other way.

ABC Construction Confidence Index

| June 2022 | May 2022 | June 2021 | |

|---|---|---|---|

| Sales | 58.3 | 60.9 | 65.7 |

| Profit Margins | 49.4 | 50.0 | 56.3 |

| Staffing | 59.6 | 62.8 | 63.5 |

SOURCE: Associated Builders and Contractors

“The most recent ABC survey indicates that, to secure work and to induce project starts, a growing fraction of contractors is having to trim margins,” Basu said, noting that market may not prove as robust as previously anticipated due to delayed project start dates as public agencies wait for the right moment to purchase construction services. “While circumstances are hardly catastrophic, the nonresidential construction marketplace is not as strong as it was expected to be.”