Dive Brief:

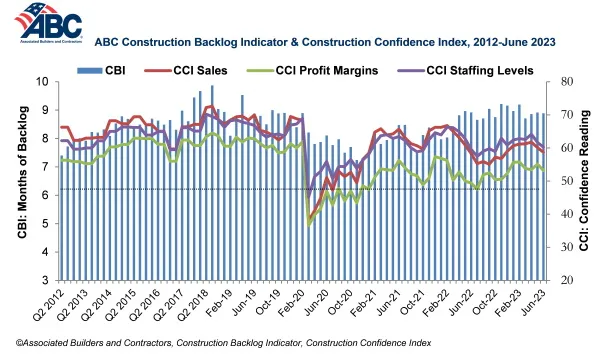

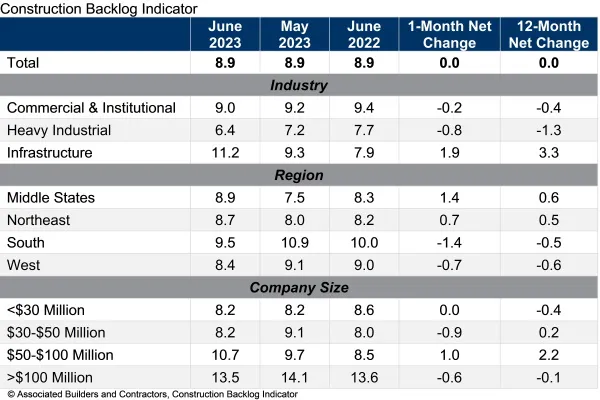

- Construction backlog remained flat in June at 8.9 months, the third consecutive month outstanding projects that contractors have booked, but haven’t yet started, notched that level. The number was also exactly the same as results from a year ago, according to a report from Associated Builders and Contractors.

- But just one sector is doing all of the heavy lifting. Infrastructure backlog increased for the third straight month and, more than 18 months after the passage of the $1.2 trillion Infrastructure Investment and Jobs Act, is now at its highest level in two years.

- That means new infrastructure jobs booked today won’t start for another 11.2 months. That contrasts to overall drops for backlog in the commercial and heavy industrial sectors for June, which came in at 9 and 6.4 months, respectively.

Dive Insight:

In short, it looks like construction is holding its head above water, at least for now.

“Many aspects of the economy, including consumer spending and the labor market, held up better than expected in the second quarter,” said Anirban Basu, chief economist for ABC, in a news release. “That bodes well for economic growth over the summer, but also suggests that the Federal Reserve may raise rates higher and keep them there longer in their ongoing efforts to suppress inflation.”

The infrastructure numbers support the theory that construction could be spared the worst impacts of an expected recession as the Fed continues to slow the supply of money into the economy. It also aligns with comments from public construction company CEOs, who don’t expect overall infrastructure spending to peak for another four years.

That could also explain why construction executives’ outlook has remained positive overall, even as sectors that they rely on heavily for clients, such as technology, have felt the brunt of layoffs and slowing sales as economic activity begins to wane.

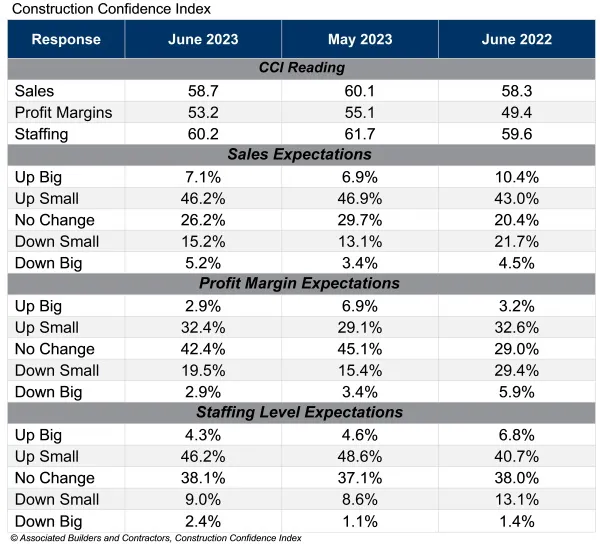

While posting an overall drop for the month, ABC’s Construction Confidence Index in June remained above 50, meaning that construction owners still expect growth overall for sales, profit margins and staffing.

Indeed, the last time the outlook for any of those metrics as negative was 11 months ago, in July of 2022, when profit expectations came in at just 47.5. That number is now 53.2 in June, well in positive territory, while staffing expectations were at 60.2 and sales hopes remained high at 58.7.

“Backlog once again remained stable in June despite tight credit conditions and high interest rates,” said Basu. “While those risk factors drove a decline in all three Construction Confidence Index series, contractors continue to signal an expectation that sales, profit margins and staffing will expand over the second half of 2023.”

At the same time, Basu remained committed to his long-held belief that the Feds campaign for raising interest rates in its war on inflation will eventually translate into less momentum in the building sector.

“All else equal, that will reduce construction activity in the quarters to come,” Basu said.