Dive Brief:

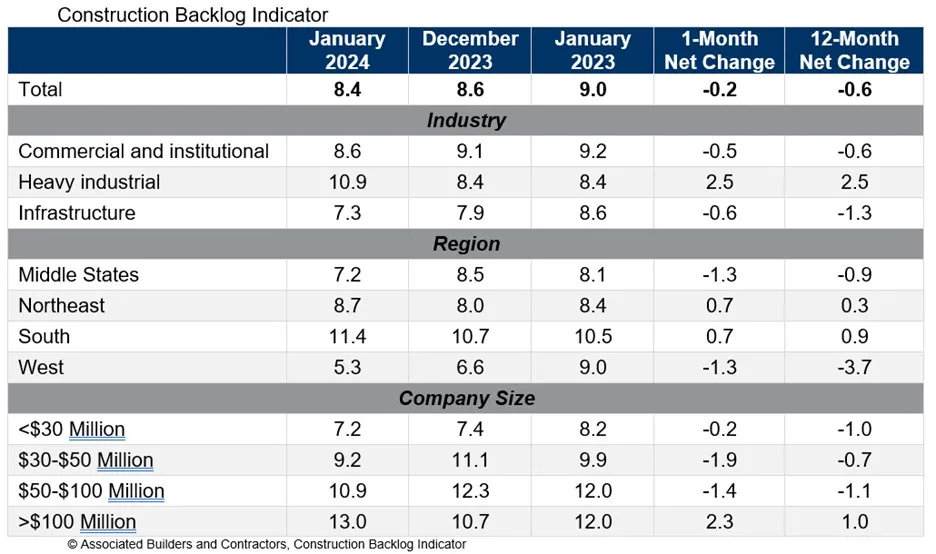

- Backlog dipped slightly to 8.4 months in January, according to a Feb. 13 release from Associated Builders and Contractors. This is the second consecutive decrease in the reading.

- Despite the industrywide drop, backlog increased to 10.9 months in the heavy industrial category, the highest on record for that sector. That figure is also 2.5 months higher than in January 2023, per the release. Backlog is down year over year in the commercial and institutional as well as infrastructure categories.

- Some slowing sectors were ones often sensitive to interest rate fluctuations, ABC Chief Economist Anirban Basu said in the release. In particular, Basu noted developer financing has become more expensive and difficult to obtain.

Dive Insight:

Financing and interest rates have been a hot topic in the industry, particularly as regulators pointed at commercial real estate as a leading risk to financial stability in 2024.

The largest gains in backlog came from the Northeast and the South, with growth to 8.7 from 8, and 11.7 from 10.4, respectively. Firms with over $100 million in revenue saw their pipeline grow to 13.0 from 10.7 months in December. All other brackets saw a shrink in future work.

“As predicted, performance in the nonresidential construction sector is becoming more disparate across segments,” Basu said in the release. “For much of the pandemic recovery period, contractors in virtually all segments were indicating stable to rising backlog. That remains the case for contractors most exposed to the nation’s industrial production. Reshoring and near-shoring continue to drive construction spending.”

While interest rates explain the drag in office work, Basu said that infrastructure slowdowns may be due to seasonality.

“There is every reason to believe that contractors specializing in public works will have a very busy year,” Basu said.