Dive Brief:

-

California is working with municipal bond market startup Neighborly in the hopes of increasing local investment in state infrastructure projects, according to TechCrunch. New York, Massachusetts and Vermont are among the other states using the platform.

-

Potential backers can use Neighborly to search municipal bond offerings, along with project information, issuance details and investment options for each.

-

Current bond investment opportunities on offer range from $5,100 to $6,300. Neighborly users can explore investments by issuance, state, city and market sector.

Dive Insight:

Bonds are a popular means of financing infrastructure and other community-oriented projects, such as schools. Some are mammoth.

Earlier this month, the Los Angeles Unified School District wrapped up a $10 billion, 20-year construction program — the largest such initiative in the country — financed by a $27 billion bond measure. The $160 million Maywood Center for Enriched Studies is one of 131 new schools financed by bonds.

While small in comparison, Charlotte-Mecklenburg Schools, in Charlotte, NC, is also looking to use bonds to pay for school construction. The district is counting on voters approving a five-year, $922 million bond measure to help fund 29 school projects. In November, Austin, TX, voters will also decide whether to authorize a $1.05 billion bond measure to help pay for school construction.

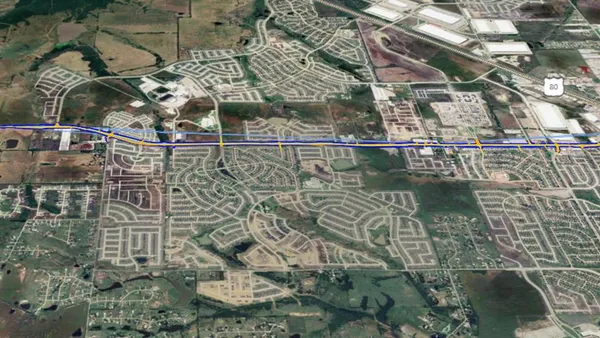

West Virginia is looking to bonds to help finance $2.8 billion of turnpike-related projects. Earlier this month, the West Virginia Parkways Authority approved a resolution that allows the agency to start preparing for a $500 million bond sale. An upcoming vote on the Roads to Prosperity 2017 amendment to the state's constitution would let the legislature issue $1.6 billion in bonds to help pay for road projects as well.

Last year, New York's Metropolitan Transportation Authority made history by selling its first-ever real estate–backed bonds. The MTA raised $1.06 billion and will pay off the debt with the lease payments it receives from the 26-acre Hudson Yards development. The MTA values the land on which Related Cos. is building the megaproject between $3.2 billion and $3.7 billion.