Dive Brief:

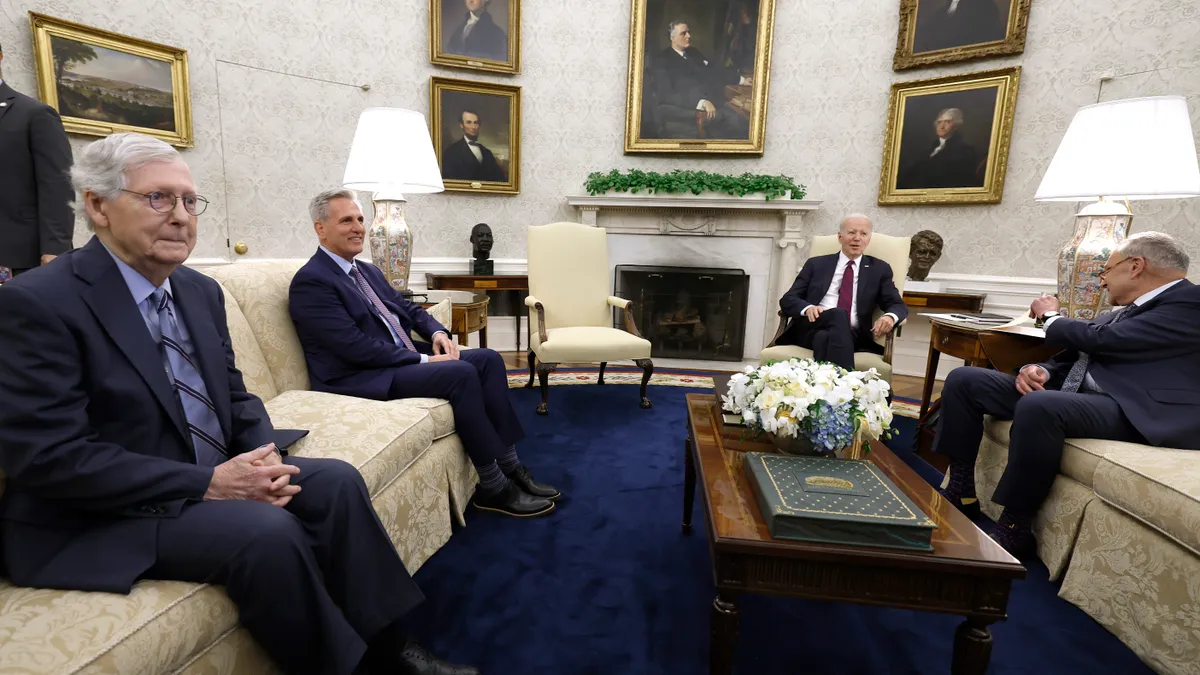

- As President Joe Biden and congressional leaders held discussions this week over the U.S. government’s potential debt default, construction and business groups called for a quick resolution to the issue.

- Kristen Swearingen, Associated Builders and Contractors’ vice president of legislative and political affairs said that a potential debt crisis must be avoided. “For the sake of all stakeholders who depend upon stable financial markets — including the construction industry — the debt ceiling debate should be resolved immediately in a way that avoids near-term calamity while ensuring financial stability over the long run,” she told Construction Dive.

- Treasury Department officials have said that a default on the $31.4 trillion national debt could come as soon as June 1 and would have a devastating effect on the U.S. economy, according to Reuters, triggering an “economic catastrophe” that would cause interest rates to soar.

Dive Insight:

Before agreeing to raise the debt ceiling, which the government needs in order to continue paying its bills, Republicans want an agreement to cut spending. Meanwhile, Democrats want a "clean increase” on the debt limit before addressing a framework for spending, according to AP News.

The U.S. Chamber of Commerce, the largest business group in the country, backed spending limits and process reform as part of a debt ceiling deal.

“The full faith and credit of the United States government should never be placed at risk, which is why it is essential that Congress and the administration quickly reach a bipartisan agreement to raise the debt ceiling,” Chief Policy Officer Neil Bradley said in a statement on Tuesday.

Recession proofing

The effect of a default would be devastating to the U.S. economy, including reduced public confidence and increased market volatility, according to a report from J.P. Morgan about the multifamily industry.

“An actual default will throw into question the entire creditworthiness of the United States and likely lead to further [interest] rate increases to justify increased risks that bondholders will now have to consider,” Victor Calanog, head of commercial real estate economics at Moody’s Analytics said in the report. “That will roil capital markets — not just for multifamily and commercial real estate, but every asset class.”

In light of the potential economic calamity, it’s important for owners and developers to try to recession-proof their properties as much as possible, the report said. But rising interest rates are already squeezing owners and lenders, making it difficult to set aside money or refinance existing debt, it noted.

Energy permitting

Negotiations over the debt ceiling include another issue of concern to contractors: permitting reform.

House Speaker Kevin McCarthy (R-Calif.) has pushed to include Republicans’ energy package — including provisions aimed at speeding up the permitting process for energy projects — in a deal to raise the government’s debt ceiling, according to the Washington Post, though its prospects are slim.

On March 30, the House passed legislation designed to expedite federal review and permitting decisions, deter unwarranted lawsuits and ensure federal agencies are more transparent and accountable. The Lower Energy Costs Act includes changes aimed at addressing bureaucratic hurdles, mitigating permitting delays and providing more transparency and accountability at federal agencies, according to the Associated General Contractors of America. It would:

- Reducing redundancy and duplication in the permitting and review process.

- Shorten the statute of limitations for case filings to 120 days after completion of the environmental review.

- Require prospective plaintiffs to participate in the National Environmental Policy Act review process as a pre-requisite for filing a lawsuit after permitting decisions are final.

While the bill faces hurdles in the Senate because of its provisions to spur more fossil fuels development, the permitting reform provisions lay the groundwork for more discussions in Congress that would move the issue forward, AGC said.

This week, AGC and the U.S. Chamber of Commerce said that political leaders should take the opportunity to further the conversation over permitting reforms during debt crisis talks.

“These reforms will expedite vital infrastructure and development projects without relaxing strict environmental protections that are already in place,” AGC Vice President of Public Affairs & Strategic Initiatives Brian Turmail told Construction Dive.

Looking ahead

As both parties continue to haggle over the specifics, business and construction leaders must wait to see how the issue will play out and what impact it will have on their companies.

Nevertheless, Ginger Chambless, head of research for commercial banking at JPMorgan Chase, said the U.S is unlikely to default on its debt and that past showdowns have been resolved.

“While we have a highly polarized Congress negotiating, it isn’t in either party’s interest to let a default happen,” she said in the report.