Construction activity held steady in February as gains in commercial building offset a slowdown in multifamily and manufacturing starts, according to a report from Dodge Construction Network.

Total construction starts ticked up 0.5% in February to a seasonally adjusted annual rate of $1.1 trillion, according to the report. Nonresidential building starts, which include office, hotel and healthcare projects, grew 2% in February, while residential starts slipped 1%. Nonbuilding starts — such as highways, bridges and utility plants — remained about flat for the month, according to Dodge.

“While increased uncertainty over the trajectory of monetary and fiscal policies may be informing some of the flat month-to-month trends — the largest construction sectors still saw growth in activity throughout February,” said Sarah Martin, associate director of forecasting at Dodge Construction Network. “Steady growth in planning activity throughout 2024 should support stronger construction starts in future months.”

Nevertheless, Martin said developers should remain cautious in 2025, particularly around risks related to elevated material costs, supply chain volatility and labor constraints.

Here are the nine largest U.S. projects to break ground in February, according to Dodge’s latest report:

- The $1.8 billion terminal at John Glenn Columbus Airport in Columbus, Ohio.

- The $1.5 billion Lyndon B. Johnson Hospital replacement in Houston.

- The $1.45 billion renovation to Everbank Stadium in Jacksonville, Florida.

- The $1.4 billion in road work on the Westshore Interchange in Tampa, Florida.

- The $1.1 billion Kensico-Eastview Connection Tunnel and Shafts in Valhalla, New York.

- The $1 billion Aratina Solar Farm in Boron, California.

- The $478 million condominiums at The Residences at 1428 Brickell in Miami.

- The $335 million Highbridge Apartment Building in Highbridge, New York.

- The $265 million Tower 2 at The Standard Residences Brickell in Miami.

Starts growth

The commercial sector showed signs of life in February following a slow start to the year.

Commercial groundbreakings jumped 22% in February, driven by strong office, hotel and parking garage activity, according to the report. Institutional construction, which includes healthcare, cooled slightly during the previous month, declining 2% after a spike in hospital projects in January. Manufacturing starts, on the other hand, tumbled 48% in February.

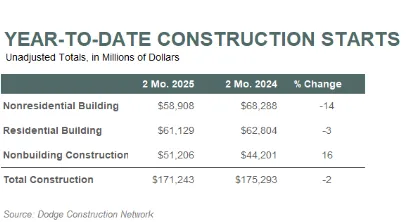

On a year-to-date basis through February, nonresidential starts declined 14% compared to February 2024, with commercial down 8% and institutional up 11% during that period, according to Dodge.

Nonbuilding construction, which includes infrastructure projects, posted mixed results. Highway and bridge groundbreakings increased 8% in February, as did environmental public works projects. However, utility and gas starts dropped 21% for the month.

On a year-to-date basis through February, however, overall nonbuilding construction remains up 16%, largely due to a strong 68% increase in utility and gas projects and a 20% jump in highway and bridge starts.

In the residential sector, multifamily starts dropped 6% in February, while single-family starts ticked up 1%, according to Dodge. Through the first two months of the year, single-family groundbreakings improved 2% compared to last year, while multifamily starts dropped 11%.