Editor’s note: To kick off 2023, Construction Dive is taking a look at the outlook for the country’s top construction verticals. Click here for the second story in the series.

The Infrastructure Investment and Jobs Act will boost activity in the civil construction space in 2023, according to Dodge Construction Network.

Dodge expects civil construction starts, such as public transit, roads, bridges, EV charging stations, water-related projects and power plants, to total $281 billion in 2023, a 16% jump from last year. That’s because infrastructure funds will steadily flow into the market in 2023. As of July 2022, only a small fraction of IIJA dollars had entered the market, according to Dodge.

Out of all the IIJA dollars already allocated for projects, 19% has made its way to road and bridge projects, 21% to public transit projects, 15% to EV charging stations and 14% to water infrastructure, said Branch.

“There’s a lot of money still on the table waiting to be spent,” said Branch. “We continue to think 2023 and 2024 are the best years for infrastructure construction," he said, though it's possible that timeline could get pushed out by a year.

Dodge's forecast assumes that 85% of infrastructure money will be spent by 2027.

For that reason, there remains much runway for construction activity in the civil space, said Branch. Still, questions remain whether the bulk of that activity will begin in 2023, or get pushed out to 2024.

Below are the 2023 outlooks for highway and bridge construction, water-related infrastructure and power plants.

Big year ahead for highway and bridge construction

Public funding will continue to support construction activity in the highway and bridge sector, said Branch.

Over the past year, that money started stretching across the U.S., said Branch. For example, road and bridge construction in Texas jumped 40% in 2022 and accounted for 12% of all highway and bridge construction activity in the country. Other states, like Florida and South Carolina, have also seen surges in activity over the last year, said Branch.

Dodge pegs highway and bridge construction starts both to jump 20% in 2023 to reach $94.4 billion and $26.6 billion, respectively. Together, that’s $121 billion worth of activity in the highway and bridge sector in 2023, eclipsing 2022’s level of $100.8 billion.

No recession concerns for environmental public work activity

The infrastructure boost will boil over to environmental public works in 2023 as well, said Branch. That includes water-related infrastructure, such as dams, reservoirs and sewage.

Dodge expects starts in the sector to total $68.8 billion in 2023, more than a 14% jump from 2022.

Water supply systems will lead work in the sector, with a projected $23.8 billion worth of activity in 2023, a 12% jump from a year ago. Reservoirs and sewage systems closely follow, with about $22.8 billion and $22.2 billion worth of activity in 2023, a 15% and 17% increase from last year, respectively, according to Dodge.

“If we think about infrastructure and the influence of the federal dollars, we’re not expecting much change here [due to] a recession,” said Branch. “A recession would lower the demand for construction workers and put more downward pressure on prices. So, if we were to go into recession in 2023, it could mean here for infrastructure that more real work actually gets done for the dollars allocated.”

More demand for domestic power and gas plant projects

The Inflation Reduction Act will continue to boost the renewable energy market in 2023, a boon for the power and gas plant sector, according to Dodge.

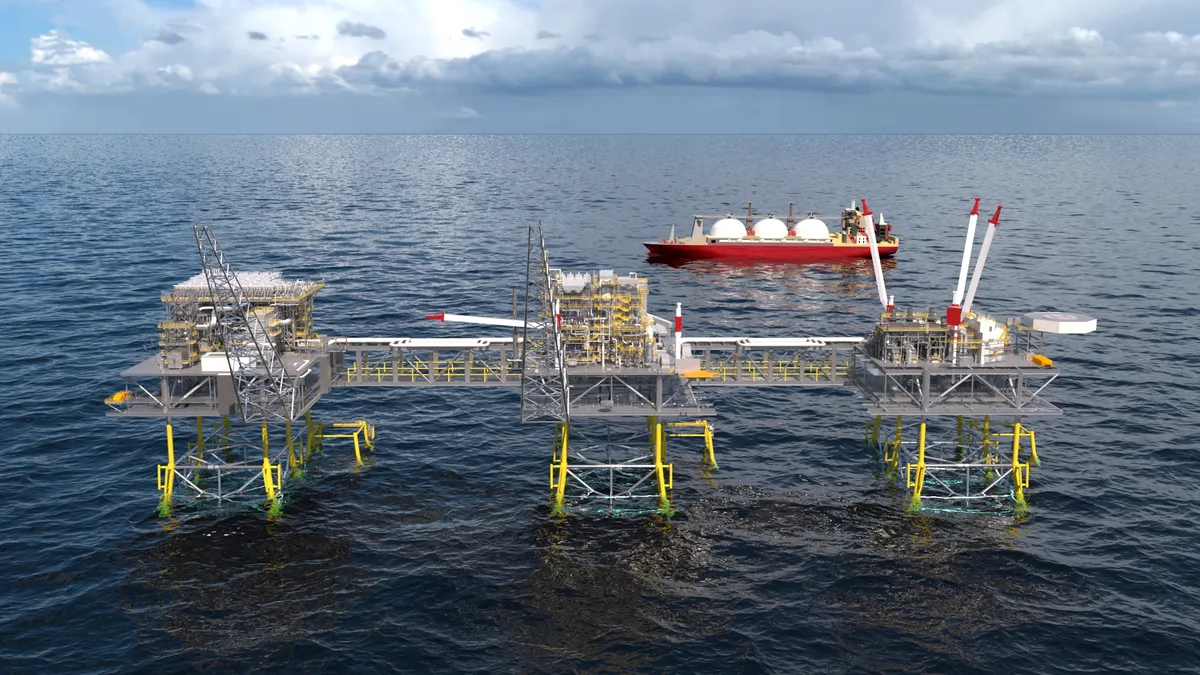

Dodge pegs the power and gas plants category, which includes local utilities, wind plants, solar plants and LNG export facilities, to reach $56.4 billion in 2023, a 7% increase from 2022’s level of $52.5 billion.

Additionally, as more European countries push to wean themselves off Russian natural gas, those companies would turn to U.S.-based LNG projects. For example, LNG production off the coast of Louisiana can support the European Union’s goal to end its dependence on Russian fossil fuels, said Jim Breuer, Fluor’s Energy Solutions Group president, in a company release.

That should continue to boost activity in the power and gas plant sector well beyond 2023.

“There’s already been a bigger buildout to [LNG] capacity, but there could be even more,” said Branch. “But the process to get those approved is pretty long, so I’d view that more as a 2024 element, rather than a 2023.”