People need to eat. Unless they live on a self-sustaining farm, growing and raising what they need to survive — or dine out for every meal — an occasional visit to a grocery store is a necessary part of life.

The concept of the modern grocery store, which came to life in the early 1900s, saw the consolidation of a slew of specialty segments — butcher, milkman, baker, greengrocer, florist — under one roof. The days of stopping at several establishments on the way home just to gather ingredients for dinner were over. More household and convenience items were added little by little, and the current model for a grocery store was born — a one-stop shopping source.

Among those supermarkets, competition is fierce. "You need every store to be in a high-traffic area in order to succeed," said David Ostrow, partner at accounting and consultancy group Mazars. Older stores are constantly revamping their design in order to keep attracting customers, and staff must put on their friendliest faces to add a personal touch as de facto ambassadors of the brand.

However, even the strength of a million customer service smiles would find the newest grocery challenge difficult to overcome — the Internet. There’s no difference between the Brand A bathroom tissue that comes from a local grocery store versus that from an online retailer like Amazon. In addition, some online stores will have that Brand A item at someone's doorstep in one day. That convenience factor is hard for brick-and-mortar vendors to beat.

Some supermarkets have tried to capture shopper attention with heightened focus on the "fresh" aisles rather than their dry goods, according to Ostrow. Others have started concentrating on meeting the need for takeout meals and even provide a small in-store area for customers to eat.

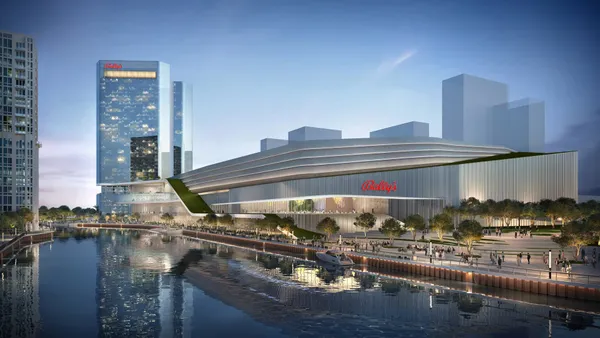

But there's a new contender on the scene: Enter the destination grocery store. Along with the influx of grocery retail options has been a recent movement toward using the space to anchor residential projects — with cities, grocery stores and construction firms taking advantage of the trend.

Grocery-anchored projects popping up across the US

Balfour Beatty is currently underway with a luxury residential mixed-use development in downtown Atlanta and signed a deal earlier this month with developer The Related Group to also build out a multi-story, 72,000-square-foot Whole Foods store as the complex’s anchor.

To say the project isn't an average supermarket is an understatement. In addition to the standard organic supermarket fare, the store will also offer a 5,000-square-foot pub, a 4,000-square-foot cooking school, a food delivery service, green walls and an outdoor dining area in an attempt to create a place that people want to visit socially.

"People hang out in areas in the store. It’s a game changer in what the corner market looks like"

Kyle Peterson

Director of the Los Angeles office of Carrier Johnson + Culture

"In a lot of instances, these areas have been business districts, not where people live," said Mike Macon, vice president and business unit leader at Balfour Beatty US. "One thing that comes first is residential, but what lags is grocery." Whole Foods makes sense as an anchor to the millennial-driven urban development, he said, because the younger generation is a more health-conscious group who want organic grocer options as well as extra features.

The trend of grocery stores as mixed-use development anchors, Macon said, is part of the shift to deliver things people need in addition to the hallmark upscale retail and dining that has typically come with these developments. "It’s a big part of this reurbanization effort where you literally live, work and play," he said.

In Los Angeles and San Diego, Whole Foods is pulling out all the stops on two anchor stores at the Grand and Eighth and the 7th and Market mixed-use projects, respectively, said architect Kyle Peterson, director of the Los Angeles office of Carrier Johnson + Culture.

Similar to their Southern counterpart in Atlanta, both stores offer features that aim to make them gathering places, not just supermarkets. "People hang out in areas in the store," Peterson said of the already-operational Los Angeles store. There’s even terraced-style seating so that patrons can have a good view of the comings and goings of other shoppers. "It’s a game changer in what the corner market looks like," he said.

The irony isn’t lost on Peterson that grocery stores have almost come full circle back to the busy, social markets that spawned them, particularly with their indoor and outdoor spaces that allow foot traffic to flow in and out. These stores, he said, have become mixed-use properties themselves within the mixed-use projects they anchor.

Implications for underserved areas

Peterson emphasized that this latest evolution in the grocery store also makes good business sense in underserved areas.

Programs like New York City’s Food Retail Expansion to Support Health (FRESH) initiative have made city grocery store development more attractive via financial incentives and other rewards in attempt to tackle resident health and economic viability of communities, according to architect John Cetra, co-founder of CetraRuddy. "In 2008, New York City was faced with food deserts in some communities and a pandemic of obesity, heart disease and diabetes," he said.

"We see so many grocer-anchored urban infills that these guys are obviously onto something. There's a big appetite."

Mike Macon,

Vice president and business unit leader at Balfour Beatty US

The FRESH rollout added not only to the supply of healthy food, but it also became what Cetra called an instrument for social change. "It set the stage for a better economy and a better city, where a Whole Foods Market became a signal of livability — and often, the best place to get a takeout meal," he said.

This incentive zoning, he said, helps "attract businesses and amenities that matter for a diverse city with people at all income levels."

However, it’s not just downtown luxury mixed-use complexes that are seeing more grocery stores. Popular suburban areas are experiencing the same uptick in supermarket stock, according to Macon. "They might not be in the urban centers, but others [on a] much smaller in scale are just as effective and welcomed by the folks who have been living in the areas or just moved in," he said.

Nevertheless, the big news is still what’s happening in downtowns and city centers. "We see so many grocer-anchored urban infills that these guys are obviously onto something," Macon said. "There's a big appetite."