NOTE: This article is Part 1 of 2. See Part 2 with Dodge's predictions for institutional, manufacturing & public works construction here.

Dodge Data & Analytics released its much-anticipated 2016 Dodge Construction Outlook on Friday during the firm's Outlook 2016 Executive Conference. Robert Murray, chief economist for Dodge Data & Analytics, explained the firm's predictions for 2015 and 2016 for residential, commercial, institutional, manufacturing, public works, and electric utilities/gas plants.

Overall, Murray said he believes the "expansion for construction is very much intact, but it's an evolving expansion" that still has obstacles. The main questions facing the industry include uncertainty over:

- the strength of the U.S. economy

- the impact of global headwinds

- political developments affecting funding

- financial conditions — such as lending and material prices

- the effect of emerging trends on construction demand

Murray noted that total 2015 construction activity, reflecting starts data, is on pace to reach the largest gain during the current expansion — since the crippling economic recession. Dodge predicts total construction activity this year will grow 13% to $675 billion, largely due to major gains in nonbuilding construction and residential building.

In 2016, construction starts are expected to grow 6% to $712 billion, with residential building leading the pack with a 16% gain. Dodge predicts the U.S. economy in 2016 will support continued growth in the construction sector. Although the Fed will soon raise short-term interest rates, long-term rate increases will likely remain on a gradual path. And with easing lending standards and an influx of funding support from state and local construction bond measures, 2016 will be a year of slow, but steady, expansion for the construction industry, according to Dodge.

The annual Outlook report from Dodge is seen as a reliable bellwether of future activity in the various construction sectors. While a few segments of the industry are expected to decline in 2016, Dodge Data offers a generally positive picture of future building performance.

Residential buildings

Single-family predictions

2015: +11% starts; 609,000 units

2016: +17% starts; 805,000 units

Murray has high hopes for single-family performance in 2016. He said the 17% rise in starts might even be a cautious estimate, as growth in the sector is expected to take off after a sluggish recovery. Improvements in access to home mortgage loans and employment growth will likely spur a surge of homebuyers in the coming year.

Multifamily predictions

2015: +13% starts; 455,000 units

2016: +5% starts; 480,000 units

Multifamily construction has dominated the residential sector in recent years. After the recession, the rental segment skyrocketed as potential buyers could no longer afford homes, and owners lost their properties. As the single-family market starts to see major improvement, the multifamily sector is expected to slow down next year and possibly plateau in 2017, according to Murray. "There's still room for more growth in 2016, but that might be the peak," he said. Still, low vacancy rates, rising rent prices and strong millennial demand will keep multifamily development riding high for at least another year.

Commercial buildings

Store and shopping center predictions:

2015: -5% starts; 110 million square feet

2016: +9%; 120 million square feet

Retail construction has experienced a disappointing 2015, as weak sales have been "a handicap for construction," Dodge reported. A significant number of store closings as well as a major loss in square footage from Wal-Mart construction contributed to this year's decline. However, 2016 is expected to be a better year for retail construction. An improving economy and housing market, as well as a recent spike in the number of large retail starts, will spur growth next year, according to Dodge.

Warehouse predictions:

2015: -7% starts; 163 million square feet

2016: +8% starts; 177 million square feet

After four consecutive years of growth, warehouse construction has seen a downturn in 2015, due to a dip in the number of large warehouse projects started during the year, according to Dodge. However, the blip on an otherwise positive trend upward is unlikely to continue into 2016, as warehouse construction hasn't yet reached its peak for the current cycle, Murray noted.

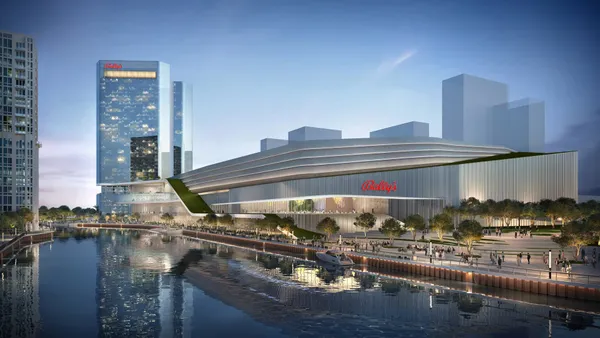

Office predictions:

2015: -8% starts; 100 million square feet

2016: +17% starts; 117 million square feet

Although office construction has slipped this year, Dodge emphasized the decline is not part of a cyclical downturn for the office market. A few major office projects in the tech sector, especially Apple's 2.8 million-square-foot headquarters, spurred a major rise in 2014 — which this year's construction level hasn't been able to reach. Dodge remains optimistic about next year's prospects for the office sector, as improving real estate fundamentals, a recent rise in the popularity of major corporate flagship properties, and increased development of technology and finance firm projects will lead to significant growth in 2016.

Hotel predictions:

2015: +18% starts; 68 million square feet

2016: +4% starts; 71 million square feet

Hotel construction has experienced a banner year in 2015, as increasing occupancy rates and room prices have spurred healthy growth since the start of the commercial recovery in 2011. "All cylinders have been firing for hotel construction," Dodge noted. Recent legislation legalizing gambling in more states has also led to a bump in casino resort construction, and the "resurgence of business travel" has resulted in higher demand for convention center and hotel construction. Although Dodge doesn't predict 2016 will see as significant a rise for the sector, the firm still expects consumer spending growth and an improving economy to contribute to steady gains in 2016. However, Dodge cautioned that "after five years of consecutive gains the hotel market may be nearing its peak for this business cycle."