Dive Brief:

- Fluor announced Friday it earned $22 million, or $0.08 per diluted share, in the third quarter of 2022, compared to a gain of $41 million in the same period last year. Excluding adjustments, analysts were expecting earnings of $0.42 per diluted share, according to stock analysis site Seeking Alpha.

- The Irving, Texas-based company reported its revenue rose to $3.6 billion from $3.5 billion a year ago, about a 3% increase, and slightly more than analysts' expectations of $3.58 billion.

- The company established its fourth quarter non-GAAP earnings guidance at $0.50-0.60 per diluted share, above the $0.42 consensus estimate from analysts, based on higher contributions from its Energy Solutions and Urban Solutions business segments.

Dive Insight:

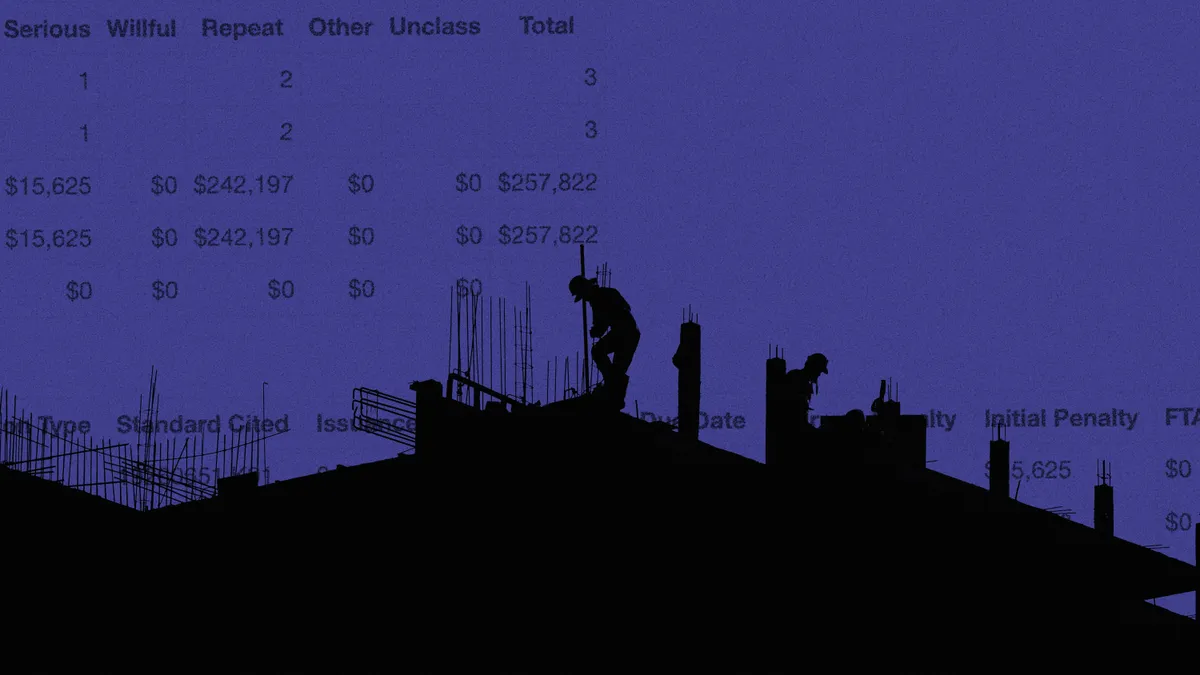

Infrastructure charges on three legacy projects impacted results, namely costing $64 million for additional rework and schedule delays on the I-635 LBJ East Freeway project, $22 million for cost growth and delay mitigation costs on the Gordie Howe project and $21 million for subcontractor cost escalation and productivity estimate on the LAX Automated People Mover project, according to the report.

Andrew Wittmann, senior research analyst at Milwaukee-based financial services company Baird, pegged Fluor’s results as “another what could have been” quarter if not for the $107 million in project charges. Still, Wittmann noted new awards won by Fluor “were tremendous and above our already high expectations.”

Fluor’s backlog jumped to $25.42 billion from $20.8 billion, about a 22% increase from a year ago, due to gains in its three major segments: Energy Solutions, Urban Solutions and Mission Solutions.

New awards in Energy Solutions totaled $3.6 billion, compared to $644 million a year ago, and included two chemicals projects in China, a refinery upgrade project in Mexico and a mid-scale liquefied natural gas project offshore the U.S. Gulf Coast.

New awards in Urban Solutions totaled $929 million, up from $781 million 12 months earlier, and included a large-scale biologics manufacturing facility in Scandinavia.

New awards in Mission Solutions totaled $4.9 billion, compared to $1.6 billion in the year-ago period.

For all segments, new awards totaled $9.7 billion compared to $3.4 billion a year ago.

“Our near record new awards in the quarter, 91% of which were reimbursable contracts, shows that there is considerable demand for the services we provide,” said David Constable, CEO of Fluor, following the third quarter results. “However, our legacy projects in infrastructure weighed heavily on our otherwise great results.”

Takeaways from earnings

The Energy and Mission solution segments drove the $9.7 billion in new awards, noted Wittmann. With 91% of the quarter’s bookings being reimbursable – versus fixed cost contracts, which are capped – 58% of Fluor's backlog now carries low to no risk, he added.

“The [infrastructure] charges are a setback to gaining back credibility,” said Wittmann in the research note. “But the near record awards are a powerful offset. Together, our first take is that our [outperform] thesis holds.”