Construction startups are hot and getting hotter. In an industry notorious for late adoption of technology, apps and innovative devices abound — and there doesn’t seem to be any sign of retreat. So the question remains: What is it about the construction industry that is generating so much excitement in the startup world?

Recent startup news

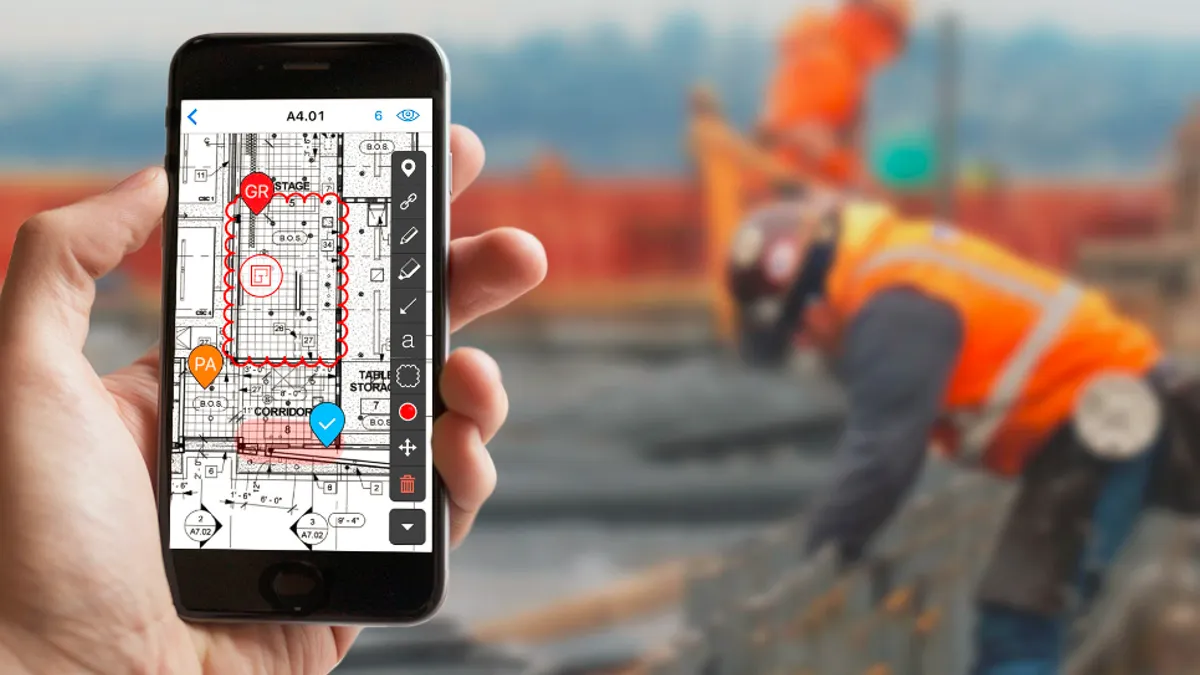

Just a few months ago, PlanGrid, which allows users to upload, track and sync changes to construction drawings in the field with a smartphone or tablet, scored a $40 million investment, bringing its total investment to $58 million.

Fieldwire also attracted interest from investors last year and announced $6.6 million in series A financing in October. The company offers mobile and web platform services for construction projects.

Startup drone company Identified Technologies, which features autonomous drones that can land and launch themselves, has seen a steady stream of investors since its launch in 2013 and this year moved to larger digs to accommodate its expansion plans. FieldLens, which boasts a mobile and web communication platform and a variety of project management tools, has also secured millions in investments since its launch in 2014.

Caterpillar-backed predictive data analytics startup Uptake also made a big splash in the startup world in December when Forbes named it the hottest startup of 2015. After raising $45 million from investors, the company reached a $1.1 billion valuation in October.

Factors behind new developments

It sounds pretty simple, but the ability to use all of the latest tools is one of the most significant — and obvious — developments. Internet connectivity has made its way to all but the most remote of construction sites, greatly increasing the likelihood of technology adoption.

"Until we had connectivity in the field for the folks that are actually getting stuff built, it would be really difficult to have that dramatic level of technology impact on the industry, but we're there now," FieldLens CEO Doug Chambers told Construction Dive.

Also a necessary part of the equation: Technology has finally developed to a point where it’s useful to the construction industry.

Fieldwire co-founder and CEO Yves Frinault said that unlike the highly automated manufacturing and agricultural industries, construction still has a very strong human element.

"Basically, all those very advanced human interfaces are getting to a point where it's becoming usable in construction," he told Construction Dive.

Personal adoption driving growth

The experts agree, however, that the most powerful influence on the adoption of technology in the construction industry is the fact that people are using it in their personal lives, and they want to use it at work as well.

"Technology has influenced enough of our customers in their personal lives that they're starting to realize it can have a serious impact in the workplace," Identified Technologies president and CEO Dick Zhang told Construction Dive. "I think that's probably one of the biggest drivers."

Frinault said that because customers are so familiar with mobile computing, they need very little training to use an app like Fieldwire.

"Construction is not the fastest industry to adopt technology," Frinault said, "but when that technology comes from the outside, it's just as fast as anybody else."

Brandon Young, marketing leader at PlanGrid, said that for years, construction field staff — including project managers, superintendents and foremen — were being force-fed cumbersome, unnecessarily complex solutions that really weren't solutions at all.

"They had laptops thrown at them, and it just didn't work for them," Young told Construction Dive. "They were being forced to do more work instead of being given solutions that save them time."

However, Young said mobile computing on a personal level has become so easy and so commonplace, construction workers — especially younger workers — are demanding that same functionality at work.

"As younger people come into the industry, they're going to demand it because their expectations are going to be even higher in terms of the way technology helps them to do a better job," Young said.

How best to engage young people and bring them into the industry has also been part of the discussion around the ongoing problem of skilled labor shortages in the construction industry.

Burgeoning investor interest

All of the factors driving the wave of construction startups are also making investors bullish toward the industry.

Young said PlanGrid has the benefit of geography when it comes to investors, as the startup is located in the San Francisco Bay Area, home to a large number of venture capitalists who invest in technology.

"I think a lot of investors are feeling that there's a huge opportunity in this space because it hasn't seen a lot of benefit (from available technology)," Young said. "And a lot of these investors know that if they find a product that has intrinsic value in it to customers, that it's a safe bet."

Chambers added, "Investors are fundamentally excited about the construction industry because it's a big industry... It's pretty difficult to ignore the impact that construction has, and it's always exciting to get potentially involved with an industry that is about to undergo significant efficiencies from technology."

However, Chambers said the one aspect of the construction industry that’s going to be difficult to overcome is the fact that no two jobs are alike, which makes automation of processes more difficult than in other industries.

"We don't have a consistent process from project to project," Chambers said. "You've got huge variances in what is a construction project, and every single project has a different set of players that comes together, forms and then disbands when the project’s over. Culturally, it's really hard to get a lot more efficient via technology or process improvement when things are constantly changing. That’s still a reality."

A crowded market?

So what about the competition? There are scores of companies coming online and going after the same potential customers. Chambers said there are other software companies that provide mobile solutions, access to plans, issue management and similar features that FieldLens provides. However, he’s not worried about them.

"Our biggest competitors are email, text messages and notebooks," Chambers said. "That’s our number one competitor."